Question

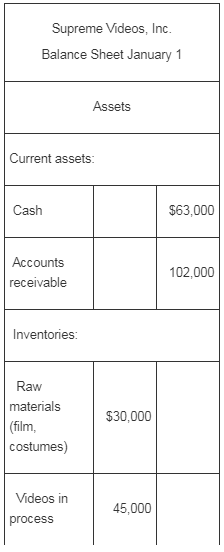

Supreme Videos, Inc., produces short musical videos for sale to retail outlets. The company?s balance sheet accounts as of January 1, the beginning of its

Supreme Videos, Inc., produces short musical videos for sale to retail outlets. The company?s balance sheet accounts as of January 1, the beginning of its fiscal year, are given on the following page.

Because the videos differ in length and in complexity of production, the company uses a job-order costing system to determine the cost of each video produced. Studio (manufacturing) overhead is charged to videos on the basis of camera-hours of activity. At the beginning of the year, the company estimated that it would work 7,000 camera-hours and incur $280,000 in studio overhead cost.

The following transactions were recorded for the year:

a. Film, costumes, and similar raw materials purchased on account, $185,000.

b. Film, costumes, and other raw materials issued to production, $200,000 (85% of this material was considered direct to the videos in production, and the other 15% was considered indirect).

c. Utility costs incurred in the production studio, $72,000.

d. Depreciation recorded on the studio, cameras, and other equipment, $84,000. Three-fourths of this depreciation related to actual production of the videos, and the remainder related to equipment used in marketing and administration.

e. Advertising expense incurred $130,000.

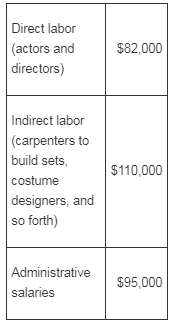

f. Costs for salaries and wages were incurred as follows:

g. Prepaid insurance expired during the year, $7,000 (80% related to production of videos, and 20% related to marketing and administrative activities).

h. Miscellaneous marketing and administrative expenses incurred, $8,600. i. Studio (manufacturing) overhead was applied to videos in production. The company recorded 7,250 camera-hours of activity during the year.

j. Videos that cost $550,000 to produce according to their job cost sheets were transferred to the finished videos warehouse to await sale and shipment.

k. Sales for the year totaled $925.000 and were all on account. The total cost to produce these videos according to their job cost sheets was $600,000.

I. Collections from customers during the year totaled $850,000.

m. Payments to suppliers on account during the year, $500,000: payments to employees for salaries and wages, $285,000.

Required:

1. Prepare a T-account for each account on the company's balance sheet and enter the beginning balances.

2. Record the transactions directly into the T-accounts. Prepare new T-accounts as needed. Key your entries to the letters (a) through (m) above. Compute the ending balance in each account.

3. Is the Studio (manufacturing) Overhead account underapplied or overapplied for the year? Make an entry in the T-accounts to close any balance in the Studio Overhead account to Cost of Goods Sold.

4. Prepare an income statement for the year. (Do not prepare a schedule of cost of goods manufactured: all of the information needed for the income statement is available in the T-accounts.)

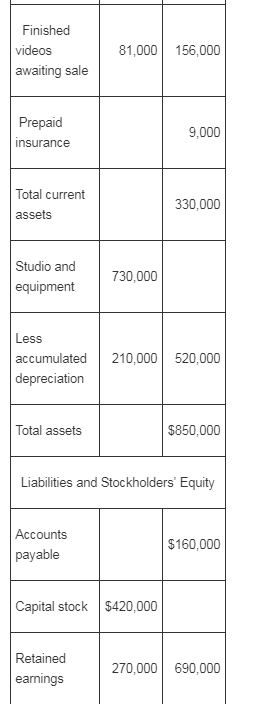

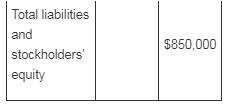

Supreme Videos, Inc. Balance Sheet January 1 Current assets: Cash Accounts receivable Inventories: Raw materials (film, costumes) Videos in Assets process $30,000 45,000 $63,000 102,000 Finished videos awaiting sale Prepaid insurance Total current assets Studio and equipment Less accumulated depreciation Total assets Accounts payable 81,000 156,000 730,000 Retained earnings 9,000 Capital stock $420,000 330,000 210,000 520,000 Liabilities and Stockholders' Equity $850,000 $160,000 270,000 690,000 Total liabilities and stockholders' equity $850,000 Direct labor (actors and directors) Indirect labor (carpenters to build sets, costume designers, and so forth) Administrative salaries $82,000 $110,000 $95,000

Step by Step Solution

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The financial records are prepared using the doubleentry book keeping system Under this system each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started