Question

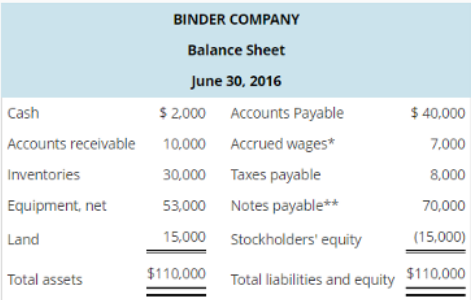

The balance sheet of the Binder Company immediately prior to entering bankruptcy proceedings and a balance sheet prepared during liquidation follows: BINDER COMPANY Balance Sheet

The balance sheet of the Binder Company immediately prior to entering bankruptcy proceedings and a balance sheet prepared during liquidation follows:

BINDER COMPANY Balance Sheet June 30, 2016

* Amounts due do not exceed statutory limits per employee.

** Of the notes payable, $25,000 are secured with inventory having a book value of $25,000. The remaining notes payable and the accounts payable are unsecured.

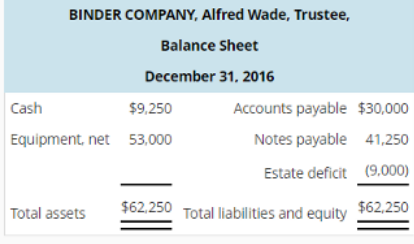

BINDER COMPANY, Alfred Wade, Trustee, Balance Sheet December 31, 2016

The inventory was sold at 60 percent of its book value. Eighty percent of the accounts receivable were collected; the rest were written off.

Required:

Reconstruct the journal entries made by Alfred Wade, Trustee for Binder Company, from June 30 to December 31, 2016.

To record sale of inventories.

To record payment to secured creditor.

To record payment of wages.

To record collection and write-off of accounts receivable

To record payment of taxes.

To record payments to unsecured creditors.

To record sale of land.

Closing entry: To close at December 31, 2016.

Cash Accounts receivable Inventories Equipment, net Land Total assets BINDER COMPANY Balance Sheet June 30, 2016 $2,000 Accounts Payable 10,000 Accrued wages* 30,000 Taxes payable 53,000 Notes payable** 15,000 Stockholders' equity $110,000 Total liabilities and equity $ 40,000 7,000 8,000 70,000 (15,000) $110.000 BINDER COMPANY, Alfred Wade, Trustee, Balance Sheet December 31, 2016 Cash $9,250 Equipment, net 53,000 Total assets Accounts payable $30,000 Notes payable 41,250 Estate deficit (9.000) $62,250 $62,250 Total liabilities and equity

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To record sale of inventions Cash 18000 Lass on realization 12000 Inventories 30000 To record sale o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60902cf22a0fe_21534.pdf

180 KBs PDF File

60902cf22a0fe_21534.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started