Question

The chief financial officer of Lost Weekend Ltd has asked you to calculate the taxable income and prepare the journal entry for the current tax

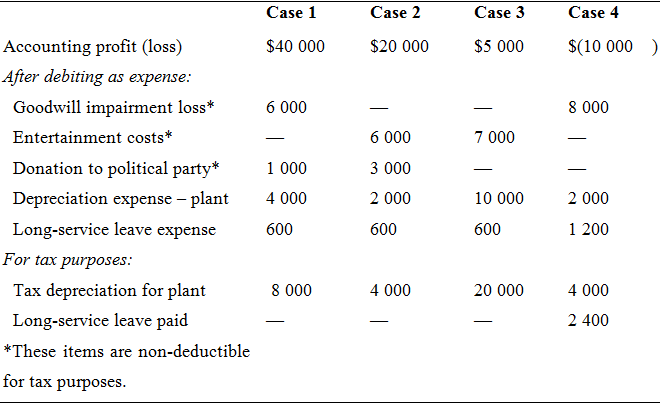

The chief financial officer of Lost Weekend Ltd has asked you to calculate the taxable income and prepare the journal entry for the current tax liability in each of the following four cases.

Assume a tax rate of 30%.

Accounting profit (loss) After debiting as expense: Goodwill impairment loss* Entertainment costs* Donation to political party* Depreciation expense - plant Long-service leave expense For tax purposes: Tax depreciation for plant Long-service leave paid *These items are non-deductible for tax purposes. Case 1 $40 000 6 000 1 000 4 000 600 8 000 Case 2 $20 000 - 6 000 3 000 2 000 600 4 000 Case 3 $5 000 - 7 000 - 10 000 600 20 000 Case 4 $(10 000) 8 000 2 000 1 200 4 000 2 400

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Case 1 Current Tax Worksheet Profit before income tax 40 000 Add Goodwill impairment loss 6 000 Dona...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Basic Finance An Introduction to Financial Institutions Investments and Management

Authors: Herbert B. Mayo

10th edition

1111820635, 978-1111820633

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App