Question

The Coletti Cleaning Brigade Company provides housecleaning services to its clients. The company uses an activity-based costing system for its overhead costs. The company has

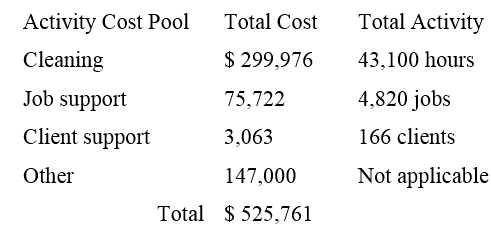

The Coletti Cleaning Brigade Company provides housecleaning services to its clients. The company uses an activity-based costing system for its overhead costs. The company has provided the following data from its activity-based costing system.

The ?Other? activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

One particular client, the Tubman family, requested 21 jobs during the year that required a total of 84 hours of housecleaning. For this service, the client was charged $1,490.

Required:

a. Using the activity-based costing system, compute the customer margin for the Tubman family.

b. Assume the company decides instead to use a traditional costing system in which ALL costs are allocated to customers on the basis of cleaning hours. Compute the margin for the Tubman family.

Activity Cost Pool Cleaning Job support Client support Other Total Cost $299,976 75,722 3,063 147,000 Total $525,761 Total Activity 43,100 hours 4,820 jobs 166 clients Not applicable

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Cleaning 299976 43100 hours 696 Job 75722 4820 jobs 1571 Client 306...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609376af7dc37_23833.pdf

180 KBs PDF File

609376af7dc37_23833.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started