Question

The controller in your firm has put you in charge of preparing the Statement of Cash Flows for the year ended December 31, 2017. You

The controller in your firm has put you in charge of preparing the Statement of Cash Flows for the year ended December 31, 2017. You gather the following data. Your firm uses the indirect method.

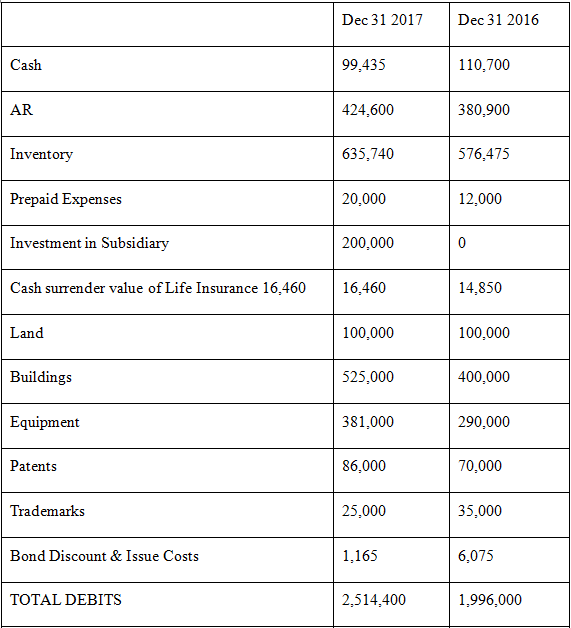

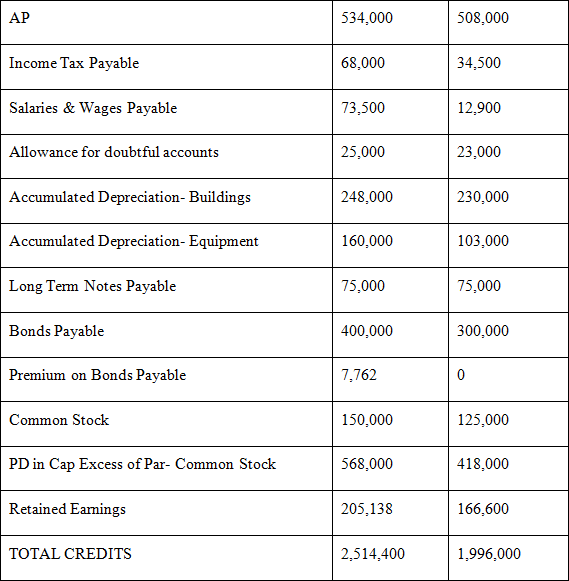

Your working papers from the audit contain the following information:

On November 1, 2017, 25,000 shares of $1 par stock were sold for $175,000

A patent was purchased for $31,000

During the year, equipment that had a cost basis of $26,400 and on which there was an accumulated depreciation of $5,800 was sold for $15,000. No other plant assets were sold during the year

The 10%, $300,000 40 year bonds were dated and issued on Jan 2, 2004. Interest was payable on June 30, and December 31. They were sold originally at 97. These bonds were retired at 101 plus accrued interest on May 31, 2017

The 6%, $400,000 20 year bonds were dated January 1, 2017 and were sold on may 31 at 102 plus accrued interest. Interest is payable semiannually on June 30 and Dec 31. Expense of Issuance was $1,200

You acquired 60% control in another company on Jan 2, 2017 for $146,000. The Income statement of that company for 2017 shows a net income of $90,000

Extraordinary repairs to buildings of $12,600 were charged to Accumulated Depreciation- Buildings

Interest paid in 2017 was $31,000 and Income taxes paid were $38,000

Net Income for the year totaled $76,538

Cash AR Inventory Prepaid Expenses Investment in Subsidiary Cash surrender value of Life Insurance 16,460 Land Buildings Equipment Patents Trademarks Bond Discount & Issue Costs TOTAL DEBITS Dec 31 2017 99,435 424,600 635,740 20,000 200,000 16,460 100,000 525,000 381,000 86,000 25,000 1,165 2,514,400 Dec 31 2016 110,700 380,900 576,475 12,000 0 14,850 100,000 400,000 290,000 70,000 35,000 6,075 1,996,000 AP Income Tax Payable Salaries & Wages Payable Allowance for doubtful accounts Accumulated Depreciation- Buildings Accumulated Depreciation- Equipment Long Term Notes Payable Bonds Payable Premium on Bonds Payable Common Stock PD in Cap Excess of Par- Common Stock Retained Earnings TOTAL CREDITS 534,000 68,000 73,500 25,000 248,000 160,000 75,000 400,000 7,762 150,000 568,000 205,138 2,514,400 508,000 34,500 12,900 23,000 230,000 103,000 75,000 300,000 0 125,000 418,000 166,600 1,996,000

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Details Amount Working Cash flow from Operating Activities 153945 Net income 76538 Depreciation on Building WN 4 30600 Working note no 4 Depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6092396b5345d_22858.pdf

180 KBs PDF File

6092396b5345d_22858.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started