Question

The cost of attending your college has once again gone up. Although you have been told that education is investment in human capital, which carries

The cost of attending your college has once again gone up. Although you have been told that education is investment in human capital, which carries a return of roughly 10% a year, you (and your parents) are not pleased. One of the administrators at your university/college does not make the situation better by telling you that you pay more because the reputation of your institution is better than that of others. To investigate this hypothesis, you collect data randomly for 100 national universities and liberal arts colleges from the 2000-2001 U.S. News and World Report annual ranking. Next you perform the following regression

You want to test simultaneously the hypotheses that ? size = 0 and ? dilibart = 0. Your regression package returns the F-statistic of 1.23. Can you reject the null hypothesis?

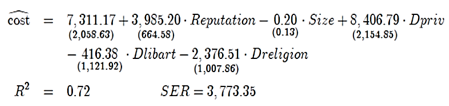

cost = = 7,311.17 +3,985.20 Reputation - 0.20 Size +8,406.79 Dpriv (2,154.85) (2,058.63) (664.58) (0.13) - 416.38 Dlibart-2,376.51 Dreligion (1,121.92) R = 0.72 (1,007.86) SER = 3,773.35

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The value of f statistic 123 The degrees of free...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started