Question

The financial statements of Forest Fire Ltd for the year ended 30 June 2017 showed a profit before tax of $480 000. The profit includes

The financial statements of Forest Fire Ltd for the year ended 30 June 2017 showed a profit before tax of $480 000. The profit includes non-deductible expenses of $20 000.

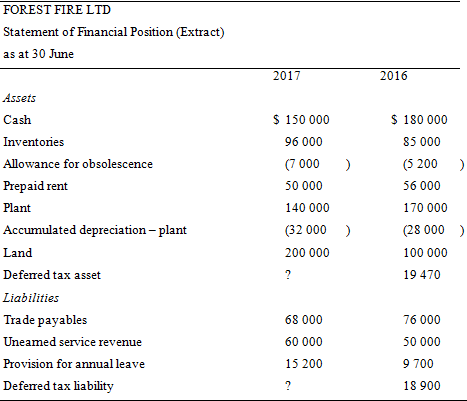

Extracts from the statements of financial position of the company as at 30 June 2017 and 30 June 2016 are as follows:

Additional information

? The accumulated depreciation on plant for tax purposes was $47 000 at 30 June 2017 (2016: $35 000).

? On 30 June 2017, the company?s land was revalued from the historical cost of $100 000 to its fair value of $200 000.

? The corporate tax rate is 30%.

A. Prepare the condensed current tax worksheet for the year to 30 June 2017 and the current tax entries for the year.

B. Prepare the deferred tax worksheet at 30 June 2016 to prove that the deferred tax liability and asset balances are $18 900 and $19 470 respectively.

C. Prepare the deferred tax worksheet at 30 June 2017 and the deferred tax entries for the year.

FOREST FIRE LTD Statement of Financial Position (Extract) as at 30 June Assets Cash Inventories Allowance for obsolescence Prepaid rent Plant Accumulated depreciation - plant Land Deferred tax asset Liabilities Trade payables Uneamed service revenue Provision for annual leave Deferred tax liability 2017 $ 150 000 96 000 (7000) 50 000 140 000 (32 000 ) 200 000 ? 68 000 60 000 15 200 ? 2016 $ 180 000 85 000 (5 200 ) 56 000 170 000 (28000) 100 000 19 470 76 000 50 000 9 700 18 900

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A Current Tax Worksheet Condensed For the year ended 30 June 2017 Accounting profit 480000 Add Nondeductible expenses 20 000 Depreciation expense plan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started