The following events affected the company during the 2016 accounting period: 1. Purchased merchandise on account that cost 615,000. 2. The goods in Event 1

The following events affected the company during the 2016 accounting period:

1. Purchased merchandise on account that cost 615,000.

2. The goods in Event 1 were purchased FOB shipping point with freight cost of 5800 cash.

3. Returned 52.600 of damaged merchandise for credit on account.

4. Agreed to keep other damaged merchandise for which the company received an $1,100 allowance.

5. Sold merchandise that cost $15.000 for $31,000 cash.

6. Delivered merchandise to customers in Event 5 under terms FOB destination with freight costs amounting to $500 cash

7. Paid 58,000 on the merchandise purchased in Event 1.

Required

a. Record the events in general joumal format.

b. Open general ledger T-accounts with the appropriate beginning balances, and post the journal entries to the T-accounts.

c. Prepare an income statement, balance sheet, and statement of cash flows. (Assume that closing entries have been made.)

d. Explain why a difference does or does not exist between net income and net cash flow from operating activities

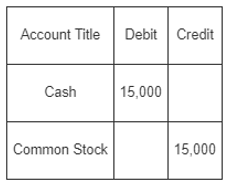

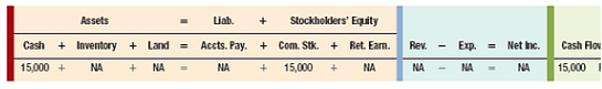

EVENT 1 JPS acquired S15,000 cash by issuing common stock. This event is an asset source transaction. It increases both assets (cash) and stockholders' equity (common stock). The income statement is not affected. The statement of cash flows reflects an inflow from financing activities The journal entry and its effects on the financial statements are shown here:

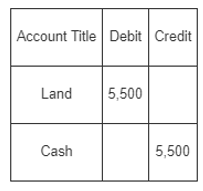

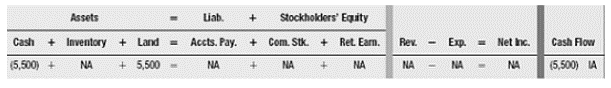

EVENT 5 JPS paid 55,500 cash to purchase land for a place to locate a future store. Buying the land increases the Land account and decreases the Cash account on the balance sheet. This is an asset exchange transaction. The income statement is not affected. The statement of cash flows shows a cash outflow to purchase land in the investing activities section of the statement of cash flows. The journal entry and its effects on the financial statements are shown here:

EVENT 5 JPS paid 55,500 cash to purchase land for a place to locate a future store. Buying the land increases the Land account and decreases the Cash account on the balance sheet. This is an asset exchange transaction. The income statement is not affected. The statement of cash flows shows a cash outflow to purchase land in the investing activities section of the statement of cash flows. The journal entry and its effects on the financial statements are shown here:

Account Title Debit Credit Cash Common Stock 15,000 15,000 Assets Cash + Inventory+Land= 15,000+NA+NA - Liab. Stockholders' Equity Accts. Pay. + Com. Stk. + Ret. Earn. NA + 15,000 + NA Rev. NA - Exp. = Net Inc. NA NA Cash Flow 15,000 Account Title Debit Credit Land Cash 5,500 5,500 Stockholders' Equity Cash + Inventory + Land = Accts. Pay. + Com. Stk. + Ret. Earn. (5,500) + NA NA NA + NA Assets +5,500- Liab. + Rev. NA - Exp. NA Net Inc. NA Cash Flow (5,500) IA

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Sales and Purchases Perpetual inventory system Sales The act of selling merchandise inventory in exchange for money is called sale of inventory Purchases The business event or activity of acquiring th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started