Question

The following financial statement data is available for the Winston Salem Company for Dec. 31, 2015. (30 pts) Instruction ? Prepare a statement of cash

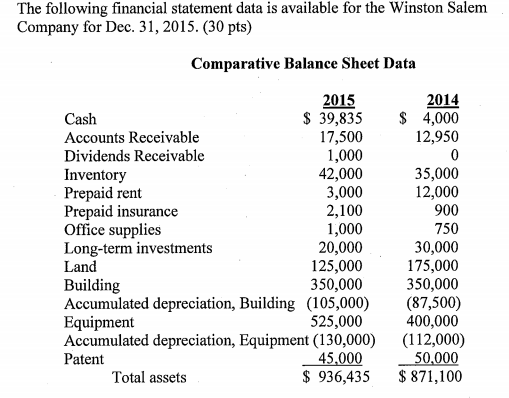

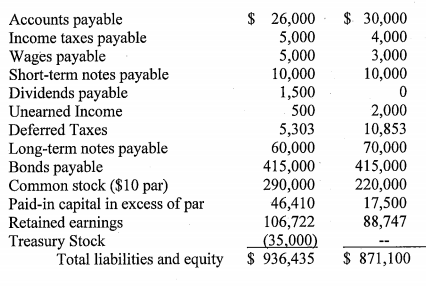

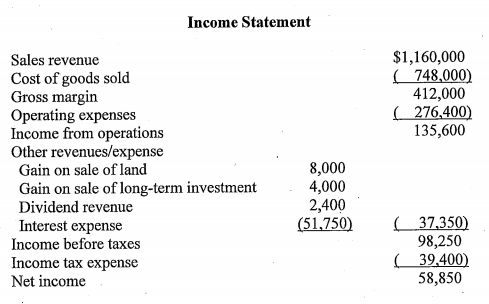

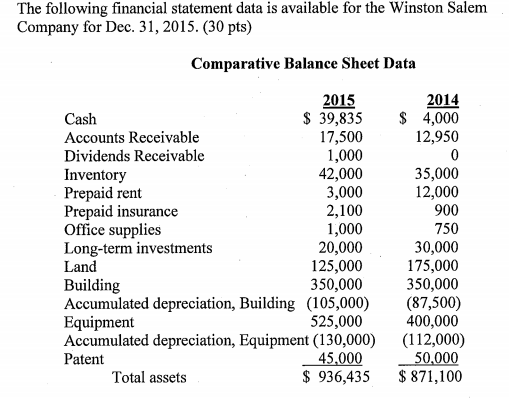

The following financial statement data is available for the Winston Salem Company for Dec. 31, 2015. (30 pts)

Instruction

? Prepare a statement of cash flows in proper form for 2015 using the Indirect method. Then, redo the Operating Section only using the Direct method.

? In this exercise, make sure to account for all changes in the balance sheet and reconcile those to the appropriate section of the cash flow statement.

? There are no non-cash transactions affecting investing activities.

? The only sales of assets are the ones reflected in the income statement.

? On April 1, 2015, the company paid $14 per share for Treasury Shares.

? On Sept. 1, 2015, the company declared and issued a 5% stock dividend on outstanding shares when the market price of the stock was $17.

? All other transactions affecting Contributed Capital and Retained Earnings occurred after Sept. 1, 2015.

? There were no stock retirements.

? To think through the effect on cash flows, it is helpful to use t-accounts, journal entries, and/or the accounting equation to see how transactions affected cash, especially for the treasury stock transaction and the stock dividends transaction.

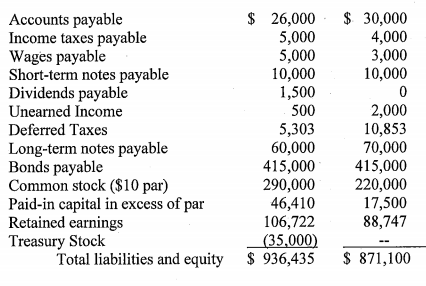

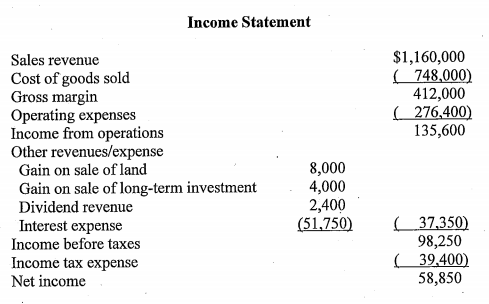

The following financial statement data is available for the Winston Salem Company for Dec. 31, 2015. (30 pts) Comparative Balance Sheet Data Cash Accounts Receivable Dividends Receivable Inventory Prepaid rent Prepaid insurance Office supplies Long-term investments 2015 $ 39,835 17,500 1,000 42,000 3,000 2,100 1,000 20,000 125,000 Land Building 350,000 Accumulated depreciation, Building (105,000) Equipment 525,000 Accumulated depreciation, Equipment (130,000) Patent 45,000 $936,435 Total assets 2014 $ 4,000 12,950 0 35,000 12,000 900 750 30,000 175,000 350,000 (87,500) 400,000 (112,000) 50,000 $ 871,100 Accounts payable Income taxes payable Wages payable Short-term notes payable Dividends payable Unearned Income Deferred Taxes Long-term notes payable $ 26,000 5,000 5,000 10,000 1,500 500 Bonds payable Common stock ($10 par) Paid-in capital in excess of par Retained earnings Treasury Stock $ 30,000 4,000 3,000 10,000 0 2,000 10,853 70,000 5,303 60,000 415,000 415,000 290,000 220,000 46,410 17,500 106,722 88,747 (35,000) Total liabilities and equity $936,435 $ 871,100 Income Statement Sales revenue Cost of goods sold Gross margin Operating expenses Income from operations Other revenues/expense Gain on sale of land Gain on sale of long-term investment Dividend revenue Interest expense Income before taxes Income tax expense Net income 8,000 4,000 2,400 (51,750) $1,160,000 ( 748,000) 412,000 ( 276,400) 135,600 (37,350) 98,250 (39,400) 58,850 The following financial statement data is available for the Winston Salem Company for Dec. 31, 2015. (30 pts) Comparative Balance Sheet Data Cash Accounts Receivable Dividends Receivable Inventory Prepaid rent Prepaid insurance Office supplies Long-term investments 2015 $ 39,835 17,500 1,000 42,000 3,000 2,100 1,000 20,000 125,000 Land Building 350,000 Accumulated depreciation, Building (105,000) Equipment 525,000 Accumulated depreciation, Equipment (130,000) Patent 45,000 $936,435 Total assets 2014 $ 4,000 12,950 0 35,000 12,000 900 750 30,000 175,000 350,000 (87,500) 400,000 (112,000) 50,000 $ 871,100 Accounts payable Income taxes payable Wages payable Short-term notes payable Dividends payable Unearned Income Deferred Taxes Long-term notes payable $ 26,000 5,000 5,000 10,000 1,500 500 Bonds payable Common stock ($10 par) Paid-in capital in excess of par Retained earnings Treasury Stock $ 30,000 4,000 3,000 10,000 0 2,000 10,853 70,000 5,303 60,000 415,000 415,000 290,000 220,000 46,410 17,500 106,722 88,747 (35,000) Total liabilities and equity $936,435 $ 871,100 Income Statement Sales revenue Cost of goods sold Gross margin Operating expenses Income from operations Other revenues/expense Gain on sale of land Gain on sale of long-term investment Dividend revenue Interest expense Income before taxes Income tax expense Net income 8,000 4,000 2,400 (51,750) $1,160,000 ( 748,000) 412,000 ( 276,400) 135,600 (37,350) 98,250 (39,400) 58,850

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Winston Salem Company Cash flow Statement Dec 31 2015 Particulars Amount Amount Particulars Amount Amount Cash flows from operating activities Net inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started