The Jackson independent School District began the year with the following accounts on its Balance Sheet related to property taxes (all amounts are in thousands

The Jackson independent School District began the year with the following accounts on its Balance Sheet related to property taxes (all amounts are in thousands of dollars). All accounts have normal balances:

Taxes Receivable ? Delinquent????????????.................$2,000

Allowance for Uncollectable Taxes ? Delinquent???..........??..400

Penalties and Interest Receivable???????????....................200

Allowance for Uncollectable Penalties and Interest????.....?..?15

Deferred Revenues ($300 Taxes, $55 Penalties and Interest)??.355

Prepare the necessary journal entries. Dates and explanations should bet omitted.

Part 1

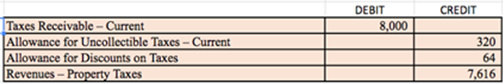

1. On January 1, the school district levied property taxes of $8,000. The due date for the taxes is March 31. Taxes are considered delinquent after that date. The school district expects to collect all but 4% of the levy. In addition the district offers a 2% discount if the taxes are paid by February 28. The district expects 40% of the tax to qualify for the discount.

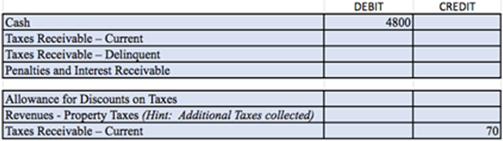

2. Between January 2 and February 28, the district collected $4,800 of the taxed due. Of this amount, $1,300 was due in the preceding fiscal year. The district also collected $130 of penalties and interest during the same time period.

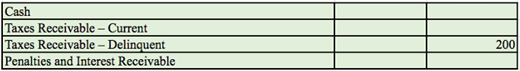

3. During March, an additional $3,500 of receivables were collected. Of this amount, $200 were for the preceding fiscal year. Also during March, $7 of penalties and interest were collected.

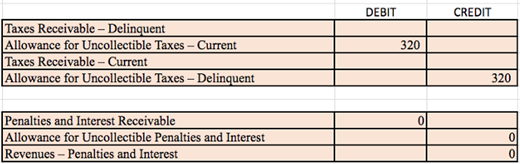

4. On April 1, the balance of the current year taxes is past due. A 10% penalty and 2% in interest was immediately assessed on the delinquent debt. It is estimated that $30 of the total interest and penalties will prove uncollectible.

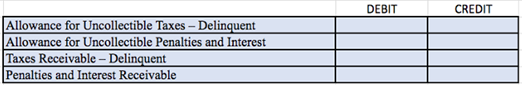

5. On June 12, the school district wrote off $100 property taxes, $10 in penalties, and $2 in interest as uncollectible.

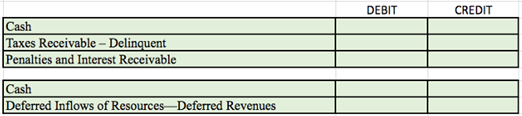

6. From March 31 to January 20 of the next year, the school district collected $300 of the property taxes that were levied on January 1, $86 in penalties, and $20 in interest. Also, the school district collected $200 of property taxes prepaid for the following year.

Part 2

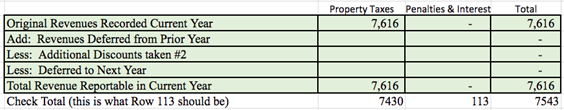

Compute total revenue reportable in current year

Taxes Receivable - Current Allowance for Uncollectible Taxes - Current Allowance for Discounts on Taxes Revenues - Property Taxes DEBIT 8,000 CREDIT 320 64 7,616 Cash Taxes Receivable - Current Taxes Receivable - Delinquent Penalties and Interest Receivable Allowance for Discounts on Taxes Revenues - Property Taxes (Hint: Additional Taxes collected) Taxes Receivable - Current DEBIT 4800 CREDIT 70 Cash Taxes Receivable - Current Taxes Receivable - Delinquent Penalties and Interest Receivable 200 Taxes Receivable - Delinquent Allowance for Uncollectible Taxes - Current Taxes Receivable - Current Allowance for Uncollectible Taxes - Delinquent Penalties and Interest Receivable Allowance for Uncollectible Penalties and Interest Revenues - Penalties and Interest DEBIT 320 0 CREDIT 320 Allowance for Uncollectible Taxes - Delinquent Allowance for Uncollectible Penalties and Interest Taxes Receivable - Delinquent Penalties and Interest Receivable DEBIT CREDIT Cash Taxes Receivable - Delinquent Penalties and Interest Receivable Cash Deferred Inflows of Resources Deferred Revenues DEBIT CREDIT Original Revenues Recorded Current Year Add: Revenues Deferred from Prior Year Less: Additional Discounts taken #2 Less: Deferred to Next Year Total Revenue Reportable in Current Year Check Total (this is what Row 113 should be) Property Taxes Penalties & Interest 7,616 7,616 7430 113 Total 7,616 7,616 7543

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 1 Taxes ReceivaleCurrent 8000 Allowaance for Uncollectible Taxes 320 Allowances for discounts ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609533bdf05b6_25641.pdf

180 KBs PDF File

609533bdf05b6_25641.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started