Question

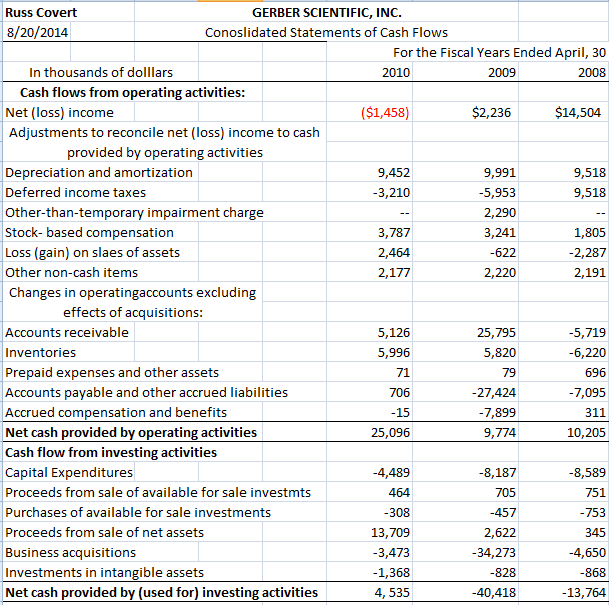

'Using the consolidated statements of cash flows for Gerber, prepare a summary analysis for the years ended April 30, 2010, 2009, and 2008. 1. Using

'Using the consolidated statements of cash flows for Gerber, prepare a summary analysis for the years ended April 30, 2010, 2009, and 2008.

1. Using the Consolidated Statements of Cash Flows for Gerber, prepare a summary analysis for the years ended April 30, 2010, 2009, 2008.

2. Write and analysis and interpretation of the cash flows for Gerber for all three years. Be sure to analyze the cash flows from operating activities, as well as the overall cash inflows and outflows for the firm.

3. Evaluate the creditworthiness of Gerber based on only the cash flow statements.

4. What Information from the balance sheets would be useful to a creditor in determining whether to loan Gerber money?

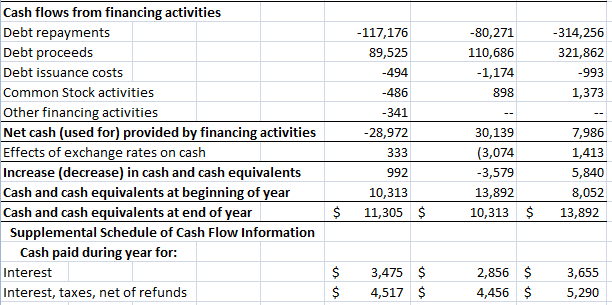

Russ Covert 8/20/2014 GERBER SCIENTIFIC, INC. Conoslidated Statements of Cash Flows In thousands of dolllars Cash flows from operating activities: Net (loss) income Adjustments to reconcile net (loss) income to cash provided by operating activities Depreciation and amortization Deferred income taxes Other-than-temporary impairment charge Stock-based compensation Loss (gain) on slaes of assets Other non-cash items Changes in operatingaccounts excluding effects of acquisitions: Accounts receivable Inventories Prepaid expenses and other assets Accounts payable and other accrued liabilities Accrued compensation and benefits Net cash provided by operating activities Cash flow from investing activities Capital Expenditures Proceeds from sale of available for sale investmts Purchases of available for sale investments Proceeds from sale of net assets Business acquisitions Investments in intangible assets Net cash provided by (used for) investing activities For the Fiscal Years Ended April, 30 2010 2009 2008 ($1,458) 9,452 -3,210 - 3,787 2,464 2,177 5,126 5,996 71 706 -15 25,096 -4,489 464 -308 13,709 -3,473 -1,368 4, 535 $2,236 9,991 -5,953 2,290 3,241 -622 2,220 25,795 5,820 79 -27,424 -7,899 9,774 -8,187 705 -457 2,622 -34,273 -828 -40,418 $14,504 9,518 9,518 1,805 -2,287 2,191 -5,719 -6,220 696 -7,095 311 10,205 -8,589 751 -753 345 -4,650 -868 -13,764 Cash flows from financing activities Debt repayments Debt proceeds Debt issuance costs Common Stock activities Other financing activities Net cash (used for) provided by financing activities Effects of exchange rates on cash Increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental Schedule of Cash Flow Information Cash paid during year for: Interest Interest, taxes, net of refunds $ $ $ -117,176 89,525 -494 -486 -341 -28,972 333 992 10,313 11,305 $ 3,475 $ 4,517 $ -80,271 110,686 -1,174 898 30,139 (3,074 -3,579 13,892 10,313 $ 2,856 $ 4,456 $ -314,256 321,862 -993 1,373 7,986 1,413 5,840 8,052 13,892 3,655 5,290

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Gerber Inc Summary analysis of cash flow statement For the year ended 30 April 20080910 2008 Over all cash position is positive ie 13892 Operating activities also yield a positive amount owing to a go...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started