Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the financial information that you prepared in Question 1 compare your calculations to the industry averages provided below: In Question 1 ? What is

Using the financial information that you prepared in Question 1 compare your calculations to the industry averages provided below:

In Question 1

? What is your overall assessment of the comparison of the ratios in 2001 as compared with the industry average?

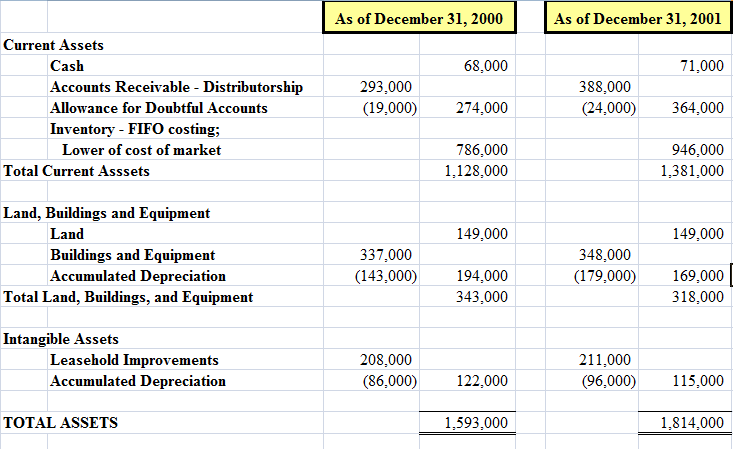

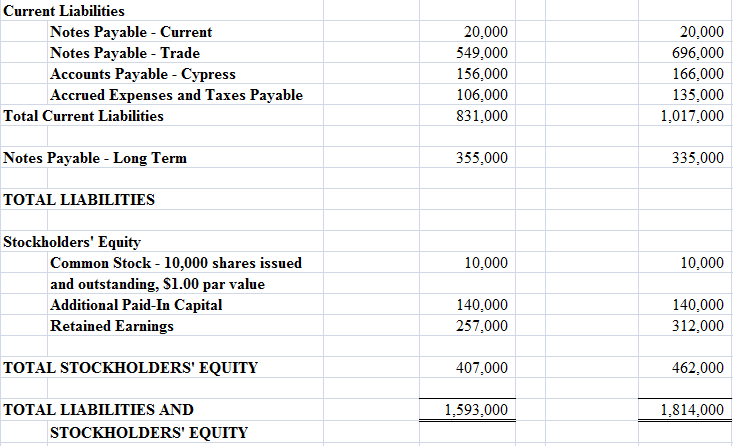

Current Assets Cash Accounts Receivable - Distributorship Allowance for Doubtful Accounts Inventory - FIFO costing; Lower of cost of market Total Current Asssets Land, Buildings and Equipment Land Buildings and Equipment Accumulated Depreciation Total Land, Buildings, and Equipment Intangible Assets Leasehold Improvements Accumulated Depreciation TOTAL ASSETS As of December 31, 2000 293,000 (19,000) 337,000 (143,000) 68,000 274,000 786,000 1,128,000 149,000 194,000 343,000 208,000 (86,000) 122,000 1,593,000 As of December 31, 2001 388,000 (24,000) 348,000 (179,000) 211,000 (96,000) 71,000 364,000 946,000 1,381,000 149,000 169,000 318,000 115,000 1,814,000 Current Liabilities Notes Payable - Current Notes Payable - Trade Accounts Payable - Cypress Accrued Expenses and Taxes Payable Total Current Liabilities Notes Payable - Long Term TOTAL LIABILITIES Stockholders' Equity Common Stock - 10,000 shares issued and outstanding, $1.00 par value Additional Paid-In Capital Retained Earnings TOTAL STOCKHOLDERS' EQUITY TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 20,000 549,000 156,000 106,000 831,000 355,000 10,000 140,000 257,000 407,000 1,593,000 20,000 696,000 166,000 135,000 1,017,000 335,000 10,000 140,000 312,000 462,000 1,814,000

Step by Step Solution

★★★★★

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Ratio Industry Average 2000 Company 2001 Current 173 135 Days inventory on hand 65 4 Recei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started