Using the information in the Budget Assumptions and budgets below, enter the correct values for each line item using numerical characters only without a dollar

Using the information in the Budget Assumptions and budgets below, enter the correct values for each line item using numerical characters only without a dollar sign or comma.

a. Operating & Financial Budgets for Ribs on the Run

b. Awesome sauces Budget Assumptions

| Balance Sheet | 20X5 |

| Assets: | |

| Cash | |

| Accounts Receivable | |

| Finished Goods Inventory | |

| Raw Materials Invention | |

| Property Plant and Equipment | |

| Accumulated Depreciation | |

| Property Plant and Equipment, Net | |

| Total Assets | |

| Liabilities and Equity: | |

| Accounts Payable | |

| Contributed Capital |

Operating & Financial Budgets

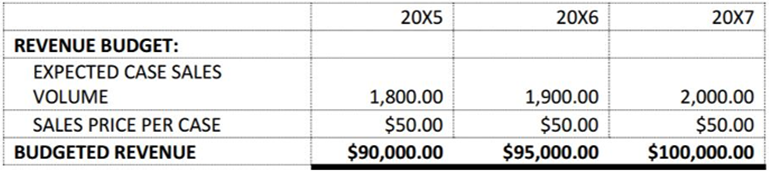

Revenue Budget

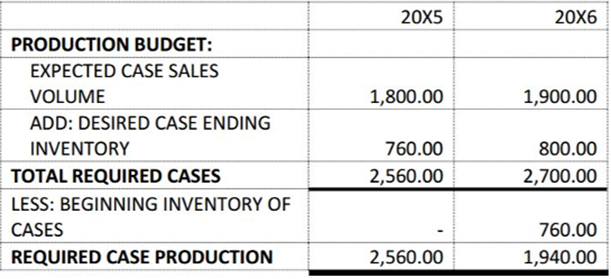

Production Budget

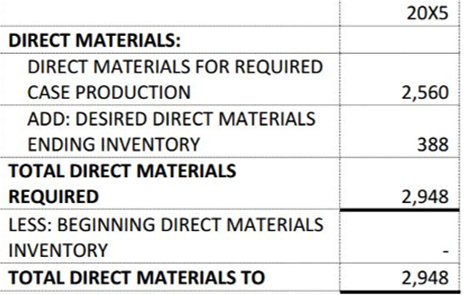

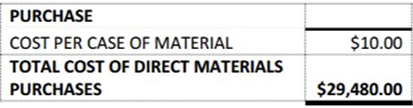

Direct Material

Direct Labor

Manufacturing Overhead

Selling & Administration

Unit Product Cost

Income statement

Cash Budget

Awesome Sauces

Budget Assumptions

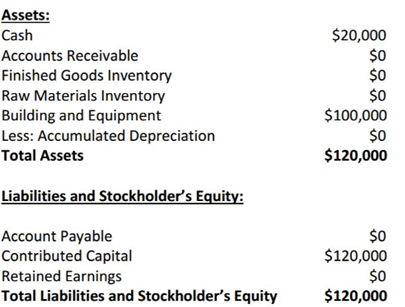

Balance Sheet as of January 1, 20X5

Moreover, Elena estimates that she will sell the following number of barbeque sauce cases in the coming year:

Year Sales in Cases

20X5 1,800

20X6 1,900

20X7 2,000

Elena provides you with the following additional information:

Sales price: Each case of barbeque sauce will sell for $50.

Inventory policy for finished goods: Elena will desire to have an ending finished goods inventory of 40% of the next year's forecasted demand.

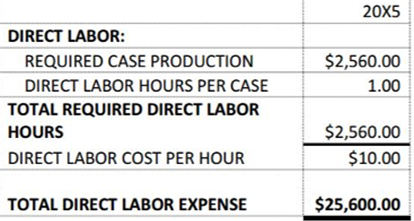

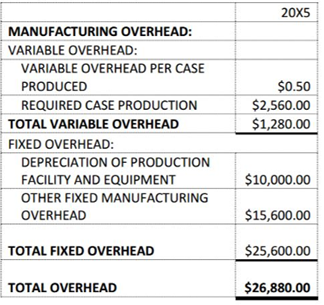

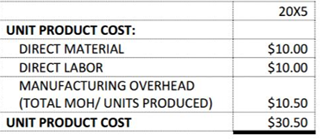

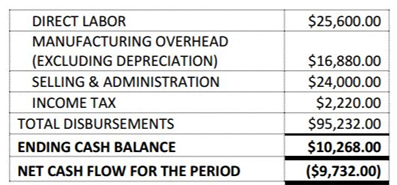

Production requirements: The cost of direct materials to produce each case of barbeque sauce will be $10 (including ingredients, bottles, labels, and packaging). When creating the direct materials budget, assume each case of sauce requires one unit of raw material that costs $10. Additionally, 1 hour of direct labor (cooking, bottling, and packaging) will be required to produce each case at a cost of $10 per direct labor hour. Elena will pay all wages in cash in the year worked. Fixed manufacturing overhead is expected to be $25,600 per year. Of this amount, $10,000 represents depreciation. The remaining amount, which (including insurance on the production facility, a part-time administrator to manage paperwork at the production facility, and a monthly fee paid to have the equipment maintained) will be paid in cash the year it is incurred. Elena expects variable overhead, which includes the utilities to run the production machines to be $0.50 per unit.

Inventory policy?raw materials: With regard to the materials needed to produce each case of barbeque sauce, Elena will want to have 20% of next year's production needs in inventory at the end of each year.

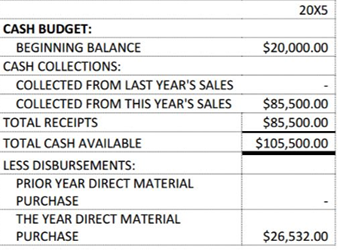

Payables policy: Elena will pay 90% of her material costs in the year of purchase and the remaining 10% in the following year.

Collection policy: Elena will receive 95% of her revenues in cash in the year of sale and the remaining 5% of revenues in the following year.

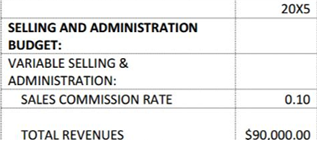

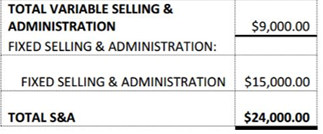

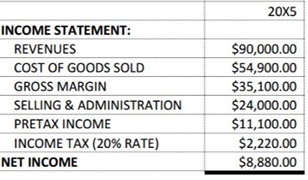

Selling and administration costs: Yearly non-manufacturing expenses consist of sales commissions of 10% of sales revenues and fixed selling and administration costs (which includes the lease payment for the sales/administrative office and equipment) of $15,000.

Taxes: Elena's tax rate is 20%. All taxes are paid in cash in the year of the expense.

REVENUE BUDGET: EXPECTED CASE SALES VOLUME SALES PRICE PER CASE BUDGETED REVENUE 20X5 1,800.00 $50.00 $90,000.00 20X6 1,900.00 $50.00 $95,000.00 20X7 2,000.00 $50.00 $100,000.00 PRODUCTION BUDGET: EXPECTED CASE SALES VOLUME ADD: DESIRED CASE ENDING INVENTORY TOTAL REQUIRED CASES LESS: BEGINNING INVENTORY OF CASES REQUIRED CASE PRODUCTION 20X5 1,800.00 760.00 2,560.00 2,560.00 20X6 1,900.00 800.00 2,700.00 760.00 1,940.00 DIRECT MATERIALS: DIRECT MATERIALS FOR REQUIRED CASE PRODUCTION ADD: DESIRED DIRECT MATERIALS ENDING INVENTORY TOTAL DIRECT MATERIALS REQUIRED LESS: BEGINNING DIRECT MATERIALS INVENTORY TOTAL DIRECT MATERIALS TO 20X5 2,560 388 2,948 I 2,948 PURCHASE COST PER CASE OF MATERIAL TOTAL COST OF DIRECT MATERIALS PURCHASES $10.00 $29,480.00 DIRECT LABOR: REQUIRED CASE PRODUCTION DIRECT LABOR HOURS PER CASE TOTAL REQUIRED DIRECT LABOR HOURS DIRECT LABOR COST PER HOUR TOTAL DIRECT LABOR EXPENSE 20X5 $2,560.00 1.00 $2,560.00 $10.00 $25,600.00 MANUFACTURING OVERHEAD: VARIABLE OVERHEAD: VARIABLE OVERHEAD PER CASE PRODUCED REQUIRED CASE PRODUCTION TOTAL VARIABLE OVERHEAD FIXED OVERHEAD: DEPRECIATION OF PRODUCTION FACILITY AND EQUIPMENT OTHER FIXED MANUFACTURING OVERHEAD TOTAL FIXED OVERHEAD TOTAL OVERHEAD 20X5 $0.50 $2,560.00 $1,280.00 $10,000.00 $15,600.00 $25,600.00 $26,880.00 SELLING AND ADMINISTRATION BUDGET: VARIABLE SELLING & ADMINISTRATION: SALES COMMISSION RATE TOTAL REVENUES 20X5 0.10 $90.000.00 TOTAL VARIABLE SELLING & ADMINISTRATION FIXED SELLING & ADMINISTRATION: $9,000.00 FIXED SELLING & ADMINISTRATION $15,000.00 $24,000.00 TOTAL S&A UNIT PRODUCT COST: DIRECT MATERIAL DIRECT LABOR MANUFACTURING OVERHEAD (TOTAL MOH/UNITS PRODUCED) UNIT PRODUCT COST 20X5 $10.00 $10.00 $10.50 $30.50 INCOME STATEMENT: REVENUES COST OF GOODS SOLD GROSS MARGIN SELLING & ADMINISTRATION PRETAX INCOME INCOME TAX (20% RATE) NET INCOME 20X5 $90,000.00 $54,900.00 $35,100.00 $24,000.00 $11,100.00 $2,220.00 $8,880.00 CASH BUDGET: BEGINNING BALANCE CASH COLLECTIONS: COLLECTED FROM LAST YEAR'S SALES COLLECTED FROM THIS YEAR'S SALES TOTAL RECEIPTS TOTAL CASH AVAILABLE LESS DISBURSEMENTS: PRIOR YEAR DIRECT MATERIAL PURCHASE THE YEAR DIRECT MATERIAL PURCHASE 20X5 $20,000.00 $85,500.00 $85,500.00 $105,500.00 $26,532.00 DIRECT LABOR MANUFACTURING OVERHEAD (EXCLUDING DEPRECIATION) SELLING & ADMINISTRATION INCOME TAX TOTAL DISBURSEMENTS ENDING CASH BALANCE NET CASH FLOW FOR THE PERIOD $25,600.00 $16,880.00 $24,000.00 $2,220.00 $95,232.00 $10,268.00 ($9,732.00) Assets: Cash Accounts Receivable Finished Goods Inventory Raw Materials Inventory Building and Equipment Less: Accumulated Depreciation Total Assets Liabilities and Stockholder's Equity: Account Payable Contributed Capital Retained Earnings Total Liabilities and Stockholder's Equity $20,000 $0 $0 $0 $100,000 $0 $120,000 $0 $120,000 $0 $120,000

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Prepared Balance Sheet Assets Cash 10268 Account Receivable 900005 4500 Raw ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6090cb2077c8a_21938.pdf

180 KBs PDF File

6090cb2077c8a_21938.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started