We project unit sales for a new household-use laser-guided cockroach search and destroy system as follows: The new system will be priced to sell at

We project unit sales for a new household-use laser-guided cockroach search and destroy system as follows:

The new system will be priced to sell at $380 each.

The cockroach eradicator project will require $1,800,000 in net working capital to start, and total net working capital will rise to 15 percent of the change in sales. The variable cost per unit is $265, and total fixed costs are $1,200,000 per year. The equipment necessary to begin production will cost a total of $24 million. This equipment is mostly industrial machinery and thus qualifies for CCA at a rate of 20 percent. In five years, this equipment will actually be worth about 20 percent of its cost.

The relevant tax rate is 35 percent, and the required return is 18 percent. Based on these preliminary estimates, what is the NPV of the project?

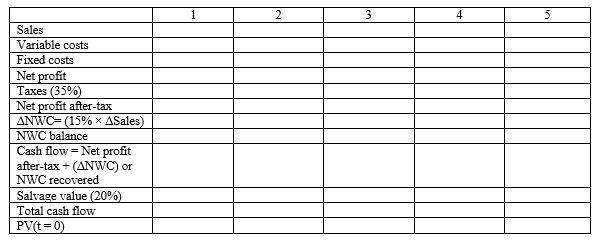

(use the spreadsheet template below and PVCCATS to answer this equation) NPV = CF year O + PVCCATS + discounted flow yr 1 + discounted flow yr 2?..+?.. discounted flow yr 5

Year 1 2 2345 Unit Sales 93,000 105,000 128,000 134,000 87,000 Sales Variable costs Fixed costs Net profit Taxes (35%) Net profit after-tax ANWC (15% ASales) NWC balance Cash flow Net profit after-tax + (ANWC) or NWC recovered Salvage value (20%) Total cash flow PV(t = 0) 1 2 3 4 5

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Yeart 0 1 2 3 4 5 Asset Book value 24000000 216000000 172800000 138240000 110592000 88473600 Depreci...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6096620fa5fd9_26838.pdf

180 KBs PDF File

6096620fa5fd9_26838.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started