Question

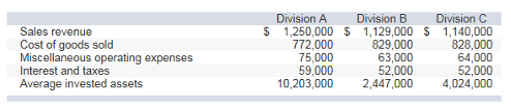

Wescott Company has three divisions: A, B, and C. The Company has a hurdle rate of 8 percent. Selected operating data for the three divisions

Wescott Company has three divisions: A, B, and C. The Company has a hurdle rate of 8 percent. Selected operating data for the three divisions are as follows:

Wescott is considering an expansion project in the upcoming year that will cost $7 million and return $565,000 per year. The project

Required

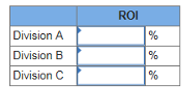

1. Compute the ROI for each division.

2. Compute the residual income for each division. (Loss amounts should be indicated by a minus sign.)

3. Rank the divisions according to the ROI and residual income of each.

4-b. Is this an acceptable project?

No

YesSales revenue Cost of goods sold Miscellaneous operating expenses Interest and taxes Average invested assets Division A Division B Division C $ 1,250,000 $ 1,129,000 $1,140,000 772,000 829,000 75,000 59,000 10,203,000 63,000 52,000 2,447,000 828,000 64,000 52,000 4,024,000 Division A Division B Division C ROI % % %

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 ROI Net Operating Income Average Invested Assets Division Net Operating Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609933318f911_29457.pdf

180 KBs PDF File

609933318f911_29457.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started