Question

Winsstonco is considering investing in three projects. If we fully invest in a project, the realized cash flows (in millions of dollars) will be as

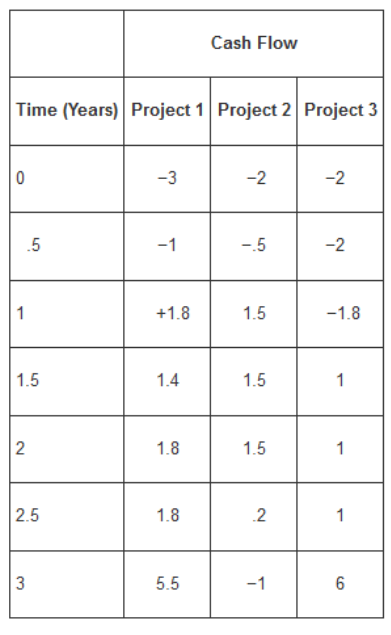

Winsstonco is considering investing in three projects. If we fully invest in a project, the realized cash flows (in millions of dollars) will be as shown it Table 44. For example, project 1 requires cash outflow of $3 million today and returns $5.5 million 3 years from now. Today we have $2 million in cash. At each time point (0, .5, 1, 1.5, 2. And 2.5 years from today) we may, if desired, borrow up to $2 million at 3.5% (per 6 months) interest. Leftover cash earns 3% (per 6 months) interest. Leftover cash earns 3% (per months) interest. For example, if after borrowing and investing at time 0 we have $1 million we would receive $30,000 in interest at time .5 years. Winstonco?s goal is to maximize cash on hand after it accounts for time 3 cash flows. What investment and borrowing strategy should be used? Remember that we may invest in a fraction of a project.

For example, if we invest in. 5 of project 3, then we have cash outflows of -$1 million at time 0 and .5.

Table 44

Time (Years) Project 1 Project 2 Project 3 0 1 1.5 .5 2 2.5 3 -3 -1 +1.8 1.4 1.8 1.8 Cash Flow 5.5 -2 -.5 1.5 1.5 1.5 2 -1 -2 -2 -1.8 1 1 1 6

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Let P i be the fraction of project I invested for i ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6095fefaa883b_26485.pdf

180 KBs PDF File

6095fefaa883b_26485.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started