Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Write a paper about your risk tolerance and your need to diversify, explain how the selected realized returns (1926-2009) and the effects of portfolio risk

Write a paper about your risk tolerance and your need to diversify, explain how the selected realized returns (1926-2009) and the effects of portfolio risk for average stocks will impact your future investment decisions and why post your work in the body of the posting.

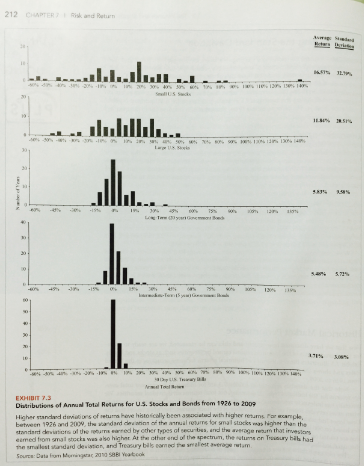

212 CHAPTER Risk and Return Neof 1 30 30 n 10 ................. 40% 43% 20% 20% 30% 40% 50% 0% 12 13 14 30 50 30- 40 40% 30- X e dulillah... 3 in -15% JL. 394 Twent Boch -Ter(5) G Tool Ty 12% IN 30% 13% 13 EXHIBIT 7.3 Distributions of Annual Total Returns for U.S. Stocks and Bends from 1926 to 2009 16% 85% 583% 5.4% 5,7% Higher standard deviations of returns have historically been associated with higher returns. For example, between 1926 and 2009, the standard deviation of the annual returns for smal stocks was higher than the standard deviations of the returns earned by other types of securities, and the average return that investors eamed from smal stocks was also higher. At the other end of the spectrum, the nature on Tussury bil had the smallest standard deviation, and Treasury bills earned the sellest average retu Source: Data from Morningstar 2010 ok

Step by Step Solution

★★★★★

3.39 Rating (137 Votes )

There are 3 Steps involved in it

Step: 1

Risk Tolerance and the Need for Diversification Risk tolerance is considered as how much risk an investor can comfortably take or the degree of uncert...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started