Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yasmin purchased two assets during the current year. Yasmin placed in service computer equipment (5-year property) on May 26 th with a basis of $29,000

Yasmin purchased two assets during the current year. Yasmin placed in service computer equipment (5-year property) on May 26 th with a basis of $29,000 and machinery (7-year property) on December 9 th with a basis of $29,000.

Required:

Using the above information, calculate the maximum depreciation expense

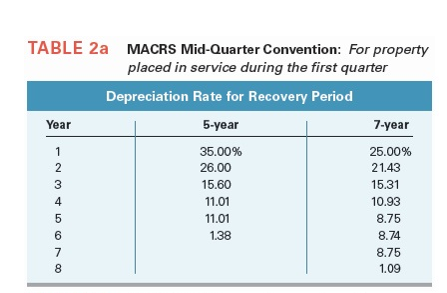

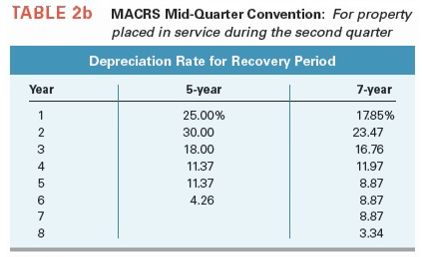

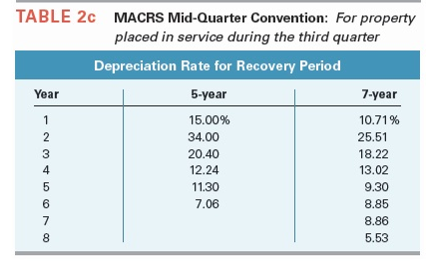

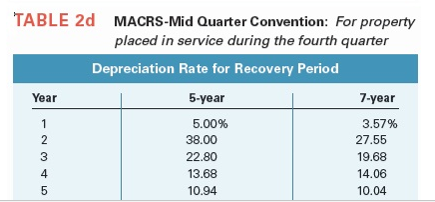

TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter Depreciation Rate for Recovery Period Year 1234 45678 5-year 35.00% 26.00 15.60 11.01 11.01 1.38 7-year 25.00% 21.43 15.31 10.93 8.75 8.74 8.75 1.09 TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter Depreciation Rate for Recovery Period Year 1 BLOG AWN 5-year 25.00% 30.00 18.00 11.37 11.37 4.26 7-year 17.85% 23.47 16.76 11.97 8.87 8.87 8.87 3.34 TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period Year 1234 45678 5-year 15.00% 34.00 20.40 12.24 11.30 7.06 7-year 10.71% 25.51 18.22 13.02 9.30 8.85 8.86 5.53 TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter Depreciation Rate for Recovery Period Year 12345 5-year 5.00% 38.00 22.80 13.68 10.94 7-year 3.57% 27.55 19.68 14.06 10.04

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Maximum Depreciation Expense is 8285 The midquarte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60963f750b0cc_26736.pdf

180 KBs PDF File

60963f750b0cc_26736.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started