Question

You have just been hired as controller for a growing company that manufactures green products. It is October 1 and time for creation of the

You have just been hired as controller for a growing company that manufactures green products. It is October 1 and time for creation of the budget for the next year. The budget will be created in quarters using each month as a period of sales/production.

Create the budget for the first quarter of 2016. This involves completing budgets for January, February, March and the first quarter in total for 2016. You seek out last year?s data, recent costing information and follow up on important assumptions.

The CFO wants to see the first quarter budget before you complete the rest of the year, as adjustments may be needed. You will need to create the following sub-budgets as part of the overall master budget.

Production Budget for the 1 st quarter

Materials Purchases Budget for the 1 st quarter

Direct Labor Budget for the 1 st quarter

Overhead Budget for the 1 st quarter

Cash Receipts of Sales Revenue for the 1 st quarter

Sales Budget for the 1 st quarter

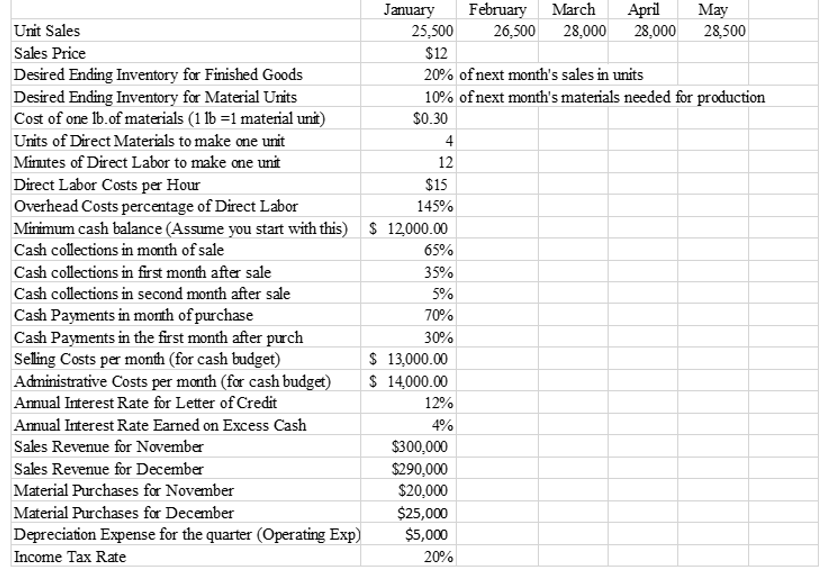

The following table illustrates all assumptions needed to create the master budget, income statement and statement of cash flows. These assumptions have been approved by the CFO. You will use them to create the master budget for January, February, March and in total for the first quarter.

Unit Sales Sales Price Desired Ending Inventory for Finished Goods Desired Ending Inventory for Material Units Cost of one lb. of materials (1 lb =1 material unit) Units of Direct Materials to make one unit Minutes of Direct Labor to make one unit Cash collections in first month after sale Cash collections in second month after sale Cash Payments in month of purchase Cash Payments in the first month after purch Selling Costs per month (for cash budget) Administrative Costs per month (for cash budget) Annual Interest Rate for Letter of Credit January February March April May 25,500 26,500 28,000 28,000 28,500 $12 20% of next month's sales in units 10% of next month's materials needed for production $0.30 Annual Interest Rate Earned on Excess Cash Sales Revenue for November Sales Revenue for December Material Purchases for November Material Purchases for December Depreciation Expense for the quarter (Operating Exp) Income Tax Rate 4 12 Direct Labor Costs per Hour Overhead Costs percentage of Direct Labor Minimum cash balance (Assume you start with this) $ 12,000.00 Cash collections in month of sale $15 145% 65% 35% 5% 70% 30% $ 13,000.00 $ 14,000.00 12% 4% $300,000 $290,000 $20,000 $25,000 $5,000 20%

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Production budget for 1st quarter Particular Jan Feb March units to be sold 25500 26500 28000 add ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

608fe39f7bca3_21347.pdf

180 KBs PDF File

608fe39f7bca3_21347.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started