Answered step by step

Verified Expert Solution

Question

1 Approved Answer

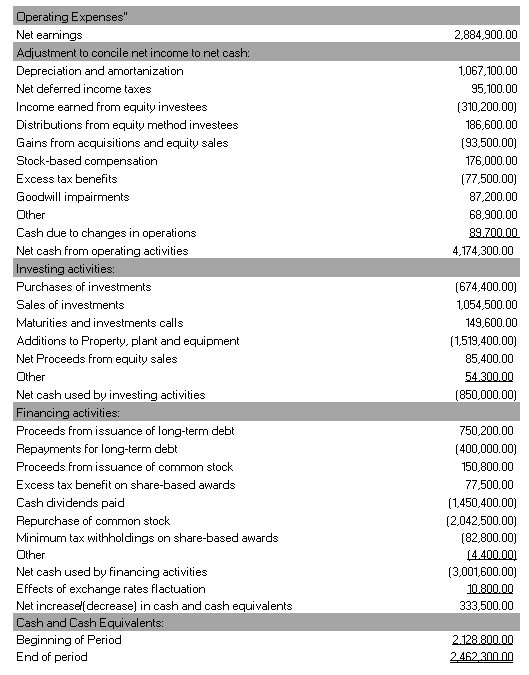

You need to do ratio analysis of Starbucks after reviewing its financial statement 2017: Operating Expenses Net earnings Adjustment to concile net income to net

You need to do ratio analysis of Starbucks after reviewing its financial statement 2017:

Operating Expenses" Net earnings Adjustment to concile net income to net cash: Depreciation and amortanization Net deferred income taxes Income earned from equity investees Distributions from equity method investees Gains from acquisitions and equity sales Stock-based compensation Excess tax benefits Goodwill impairments Other Cash due to changes in operations Net cash from operating activities Investing activities: Purchases of investments Sales of investments Maturities and investments calls Additions to Property, plant and equipment Net Proceeds from equity sales Other Net cash used by investing activities Financing activities: Proceeds from issuance of long-term debt Repayments for long-term debt Proceeds from issuance of common stock Excess tax benefit on share-based awards Cash dividends paid Repurchase of common stock Minimum tax withholdings on share-based awards Other Net cash used by financing activities Effects of exchange rates flactuation Net increasel( decrease) in cash and cash equivalents Cash and Cash Equivalents: Beginning of Period End of period 2,884,900.00 1,067,100.00 95,100.00 (310,200.00) 186,600.00 (93,500.00) 176,000.00 (77,500.00) 87,200.00 68,900.00 89.700.00 4,174,300.00 (674,400.00) 1,054,500.00 149,600.00 (1,519,400.00) 85,400.00 54.300.00 (850,000.00) 750,200.00 (400,000.00) 150,800.00 77,500.00 (1,450,400.00) (2,042,500.00) (82,800.00) (4.400.00) (3,001,600.00) 10.800.00 333,500.00 2.128.800.00 2.462.300.00

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

From the following table it can be seen that there is a change in the current ratio and quick ratio during the threeyear financial period During the three financial periods the current ratios have bee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started