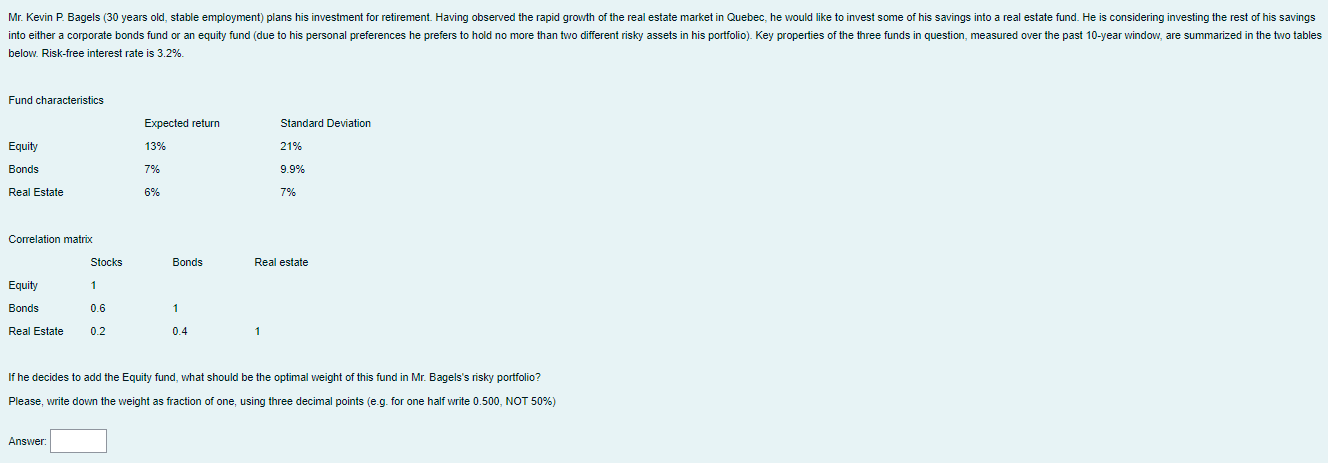

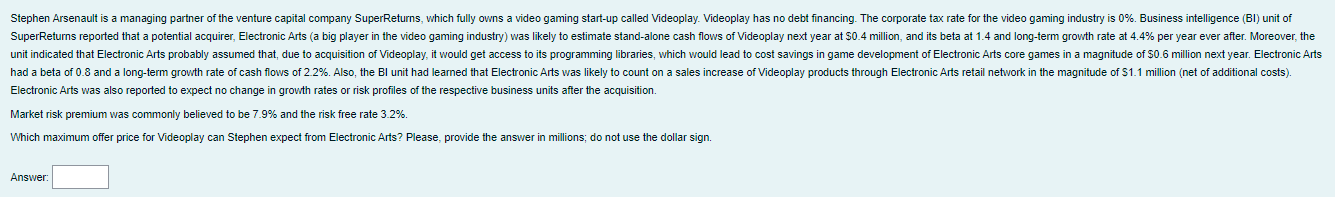

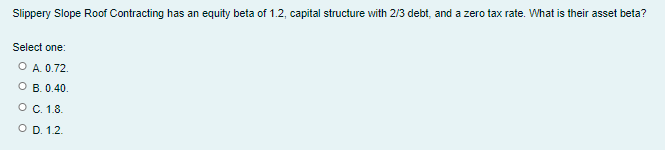

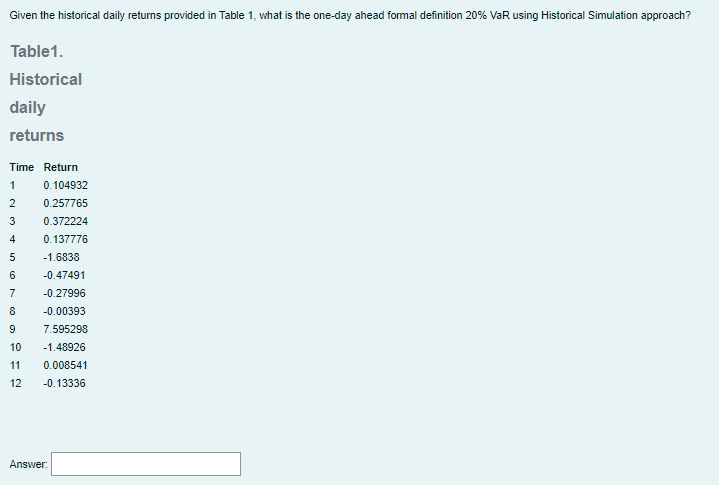

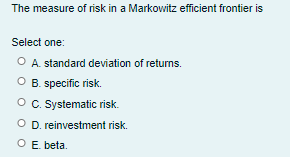

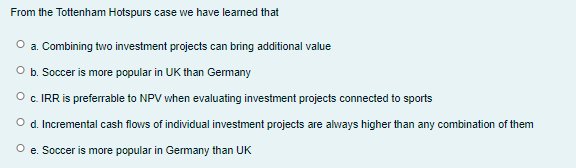

Mr. Kevin P. Bagels (30 years old, stable employment) plans his investment for retirement. Having observed the rapid growth of the real estate market in Quebec, he would like to invest some of his savings into a real estate fund. He is considering investing the rest of his savings into either a corporate bonds fund or an equity fund (due to his personal preferences he prefers to hold no more than two different risky assets in his portfolio). Key properties of the three funds in question, measured over the past 10-year window, are summarized in the two tables below. Risk-free interest rate is 3.2%. Fund characteristics Expected return Standard Deviation Equity 13% 21% Bonds 7% 9.9% Real Estate 6% 7% Correlation matrix Stocks Bonds Real estate Equity Bonds 0.6 1 Real Estate 0.2 0.4 If he decides to add the Equity fund, what should be the optimal weight of this fund in Mr. Bagels's risky portfolio? Please, write down the weight as fraction of one, using three decimal points (e.g. for one half write 0.500, NOT 50%) AnswerStephen Arsenault is a managing partner of the venture capital company SuperReturns, which fully owns a video gaming start-up called Videoplay. Videoplay has no debt financing. The corporate tax rate for the video gaming industry is 0%. Business intelligence (BI) unit of SuperReturns reported that a potential acquirer, Electronic Arts (a big player in the video gaming industry) was likely to estimate stand-alone cash flows of Videoplay next year at $0.4 million, and its beta at 1.4 and long-term growth rate at 4.4% per year ever after. Moreover, the unit indicated that Electronic Arts probably assumed that, due to acquisition of Videoplay, it would get access to its programming libraries, which would lead to cost savings in game development of Electronic Arts core games in a magnitude of $0.6 million next year. Electronic Arts had a beta of 0.8 and a long-term growth rate of cash flows of 2 2%. Also, the BI unit had learned that Electronic Arts was likely to count on a sales increase of Videoplay products through Electronic Arts retail network in the magnitude of $1.1 million (net of additional costs). Electronic Arts was also reported to expect no change in growth rates or risk profiles of the respective business units after the acquisition. Market risk premium was commonly believed to be 7.9% and the risk free rate 3.2%. Which maximum offer price for Videoplay can Stephen expect from Electronic Arts? Please, provide the answer in millions; do not use the dollar sign. Answer:Slippery Slope Roof Contracting has an equity beta of 1.2, capital structure with 2/3 debt, and a zero tax rate. What is their asset beta? Select one: O A. 0.72. O B. 0.40. O C. 1.8. O D. 1.2.Given the historical daily returns provided in Table 1, what is the one-day ahead formal definition 20% VaR using Historical Simulation approach? Table1. Historical daily returns Time Return 0.104932 0.257765 0.372224 0.137776 -1.6838 -0.47491 -0.27996 8 -0.00393 9 7.595298 10 -1.48926 11 0.008541 12 -0.13336 Answer:The measure of risk in a Markowitz efficient frontier is Select one: O A standard deviation of returns. O B. specific risk. O C. Systematic risk. O D. reinvestment risk. O E. beta.From the Tottenham Hotspurs case we have learned that a. Combining two investment projects can bring additional value b. Soccer is more popular in UK than Germany c. IRR is preferrable to NPV when evaluating investment projects connected to sports d. Incremental cash flows of individual investment projects are always higher than any combination of them O e. Soccer is more popular in Germany than UK