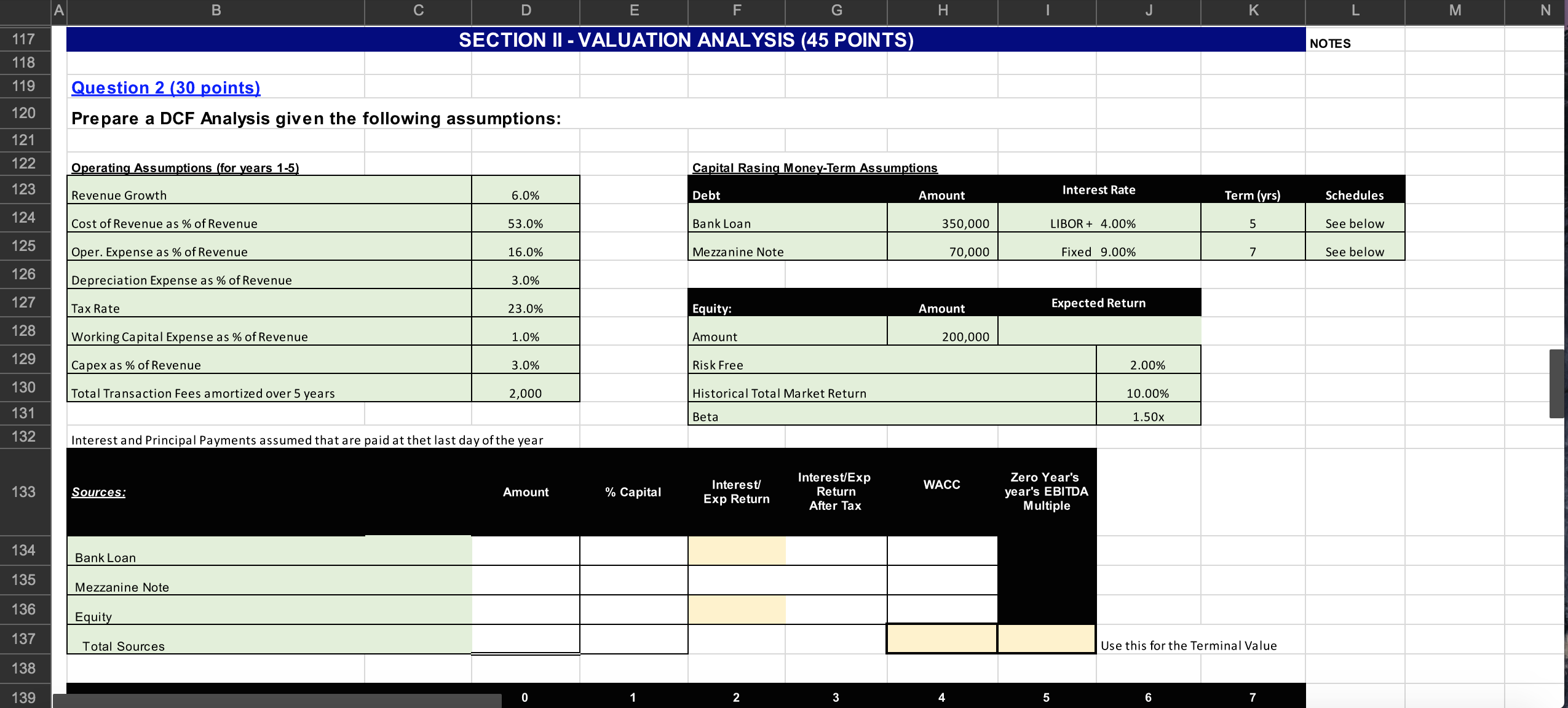

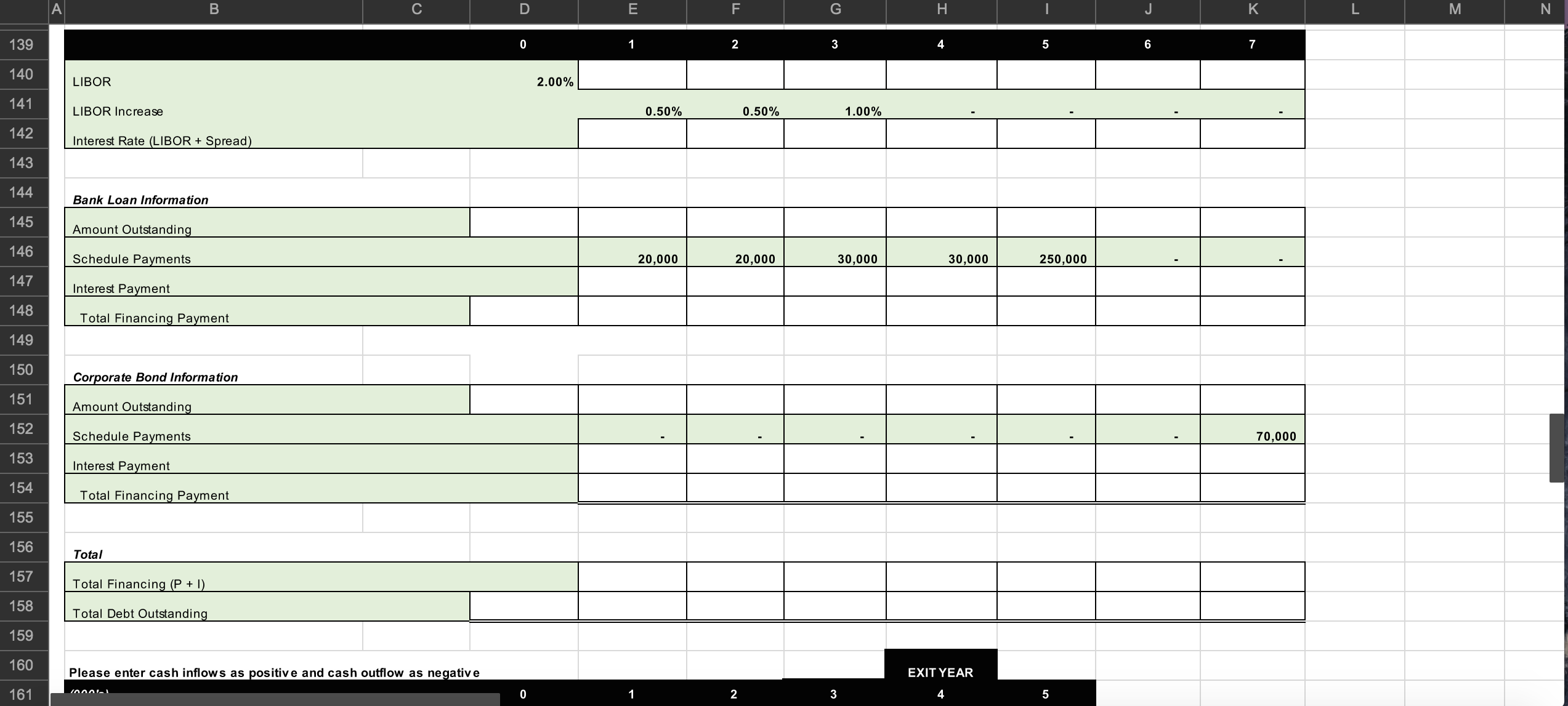

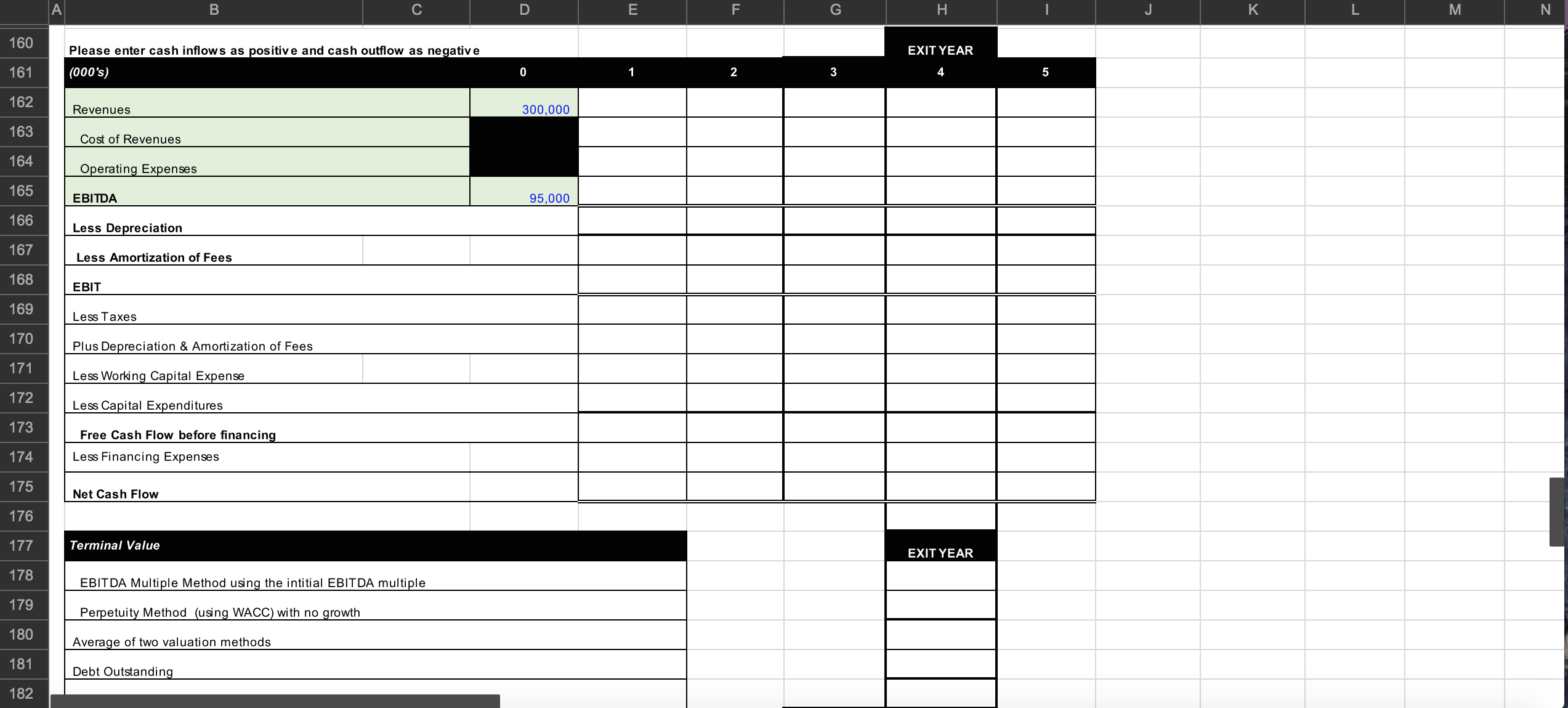

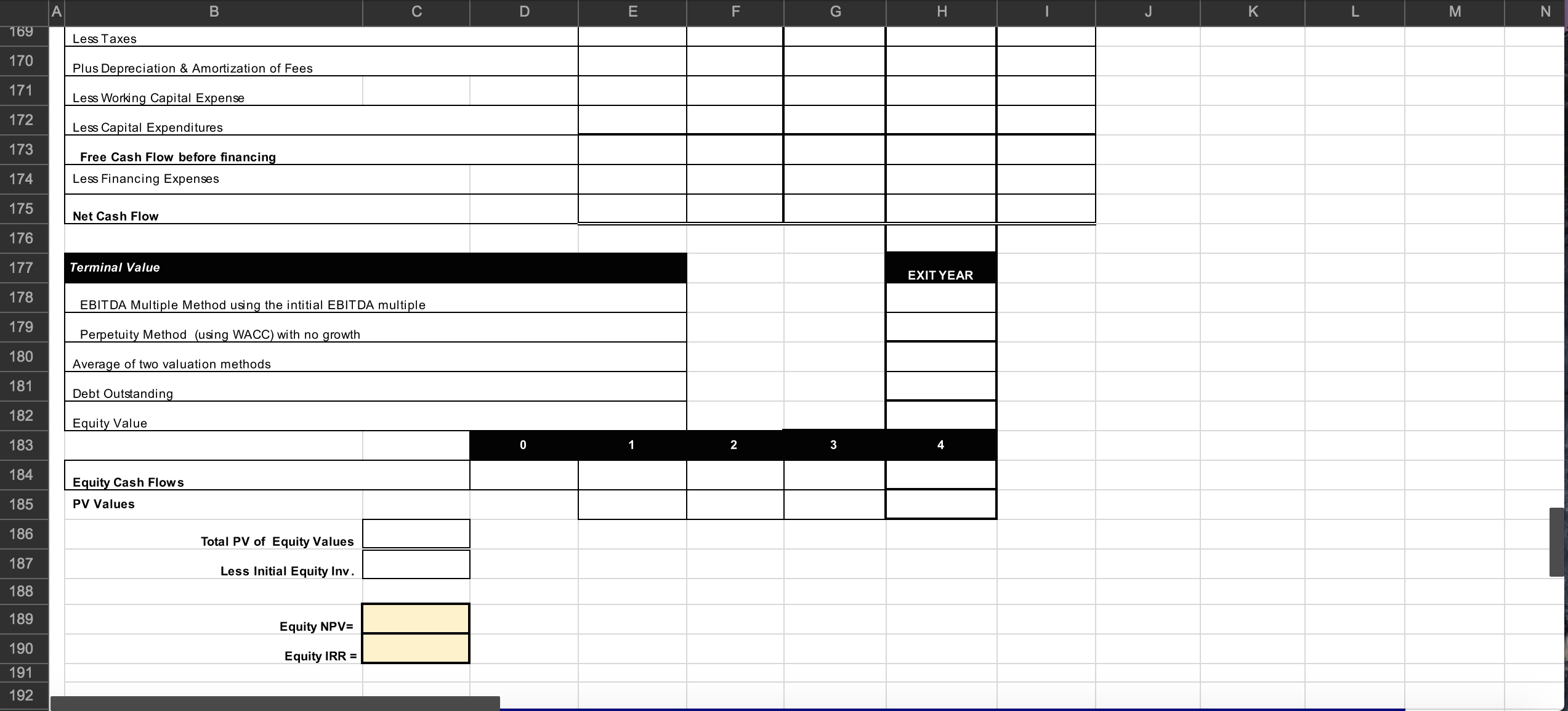

A B C D E F G H K M N 117 SECTION II - VALUATION ANALYSIS (45 POINTS) NOTES 118 119 Question 2 (30 points) 120 Prepare a DCF Analysis given the following assumptions: 121 122 Operating Assumptions (for years 1-5) Capital Rasing Money-Term Assumptions 123 Revenue Growth 6.0% Debt Amount Interest Rate Term (yrs) Schedules 124 Cost of Revenue as % of Revenue 53.0% Bank Loan 350,000 LIBOR + 4.00% 5 See below 125 Oper. Expense as % of Revenue 16.0% Mezzanine Note 70,000 Fixed 9.00% 7 See below 126 Depreciation Expense as % of Revenue 3.0% 127 Tax Rate 23.0% Equity: Amount Expected Return 128 Working Capital Expense as % of Revenue 1.0% Amount 200,000 129 Capex as % of Revenue 3.0% Risk Free 2.00% 130 Total Transaction Fees amortized over 5 years 2,000 Historical Total Market Return 10.00% 131 Beta 1.50x 132 Interest and Principal Payments assumed that are paid at thet last day of the year Interest/ Interest/Exp WACC Zero Year's 133 Sources: Amount % Capital Exp Return Return year's EBITDA After Tax Multiple 134 Bank Loan 135 Mezzanine Note 136 Equity 137 Total Sources Use this for the Terminal Value 138 139B C D E F G K M 139 0 1 2 3 4 5 6 7 140 LIBOR 2.00% 141 LIBOR Increase 0.50% 0.50% 1.00% 142 Interest Rate (LIBOR + Spread) 143 144 Bank Loan Information 145 Amount Outstanding 146 Schedule Payments 20,000 20,000 30,000 30,000 250,000 147 Interest Payment 148 Total Financing Payment 149 150 Corporate Bond Information 151 Amount Outstanding 152 Schedule Payments 70,000 153 Interest Payment 154 Total Financing Payment 155 156 Total 157 Total Financing (P + 1) 158 Total Debt Outstanding 159 160 Please enter cash inflows as positive and cash outflow as negative EXIT YEAR 161 5B C D E F G H K M N 160 Please enter cash inflows as positive and cash outflow as negative EXIT YEAR 161 (000's) 2 3 5 162 Revenues 300.000 163 Cost of Revenues 164 Operating Expenses 165 EBITDA 95,000 166 Less Depreciation 167 Less Amortization of Fees 168 EBIT 169 Less Taxes 170 Plus Depreciation & Amortization of Fees 171 Less Working Capital Expense 172 Less Capital Expenditures 173 Free Cash Flow before financing 174 Less Financing Expenses 175 Net Cash Flow 176 177 Terminal Value EXIT YEAR 178 EBITDA Multiple Method using the intitial EBITDA multiple 179 Perpetuity Method (using WACC) with no growth 180 Average of two valuation methods 181 Debt Outstanding 182B C D E F G H K M N 169 Less Taxes 170 Plus Depreciation & Amortization of Fees 171 Less Working Capital Expense 172 Less Capital Expenditures 173 Free Cash Flow before financing 174 Less Financing Expenses 175 Net Cash Flow 176 177 Terminal Value EXIT YEAR 178 EBITDA Multiple Method using the intitial EBITDA multiple 179 Perpetuity Method (using WACC) with no growth 180 Average of two valuation methods 181 Debt Outstanding 182 Equity Value 183 2 3 184 Equity Cash Flows 185 PV Values 186 Total PV of Equity Values 187 Less Initial Equity Inv. 188 189 Equity NPV= 190 Equity IRR = 191 192