Alice J. and Bruce M. Byrd are married taxpayers who file a joint return. Their Social Security numbers are 123-45-6784 and 111-11-1113, respectively. Alice's

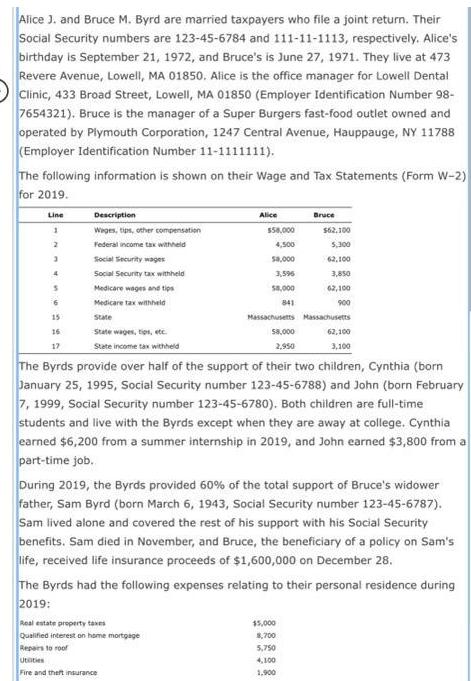

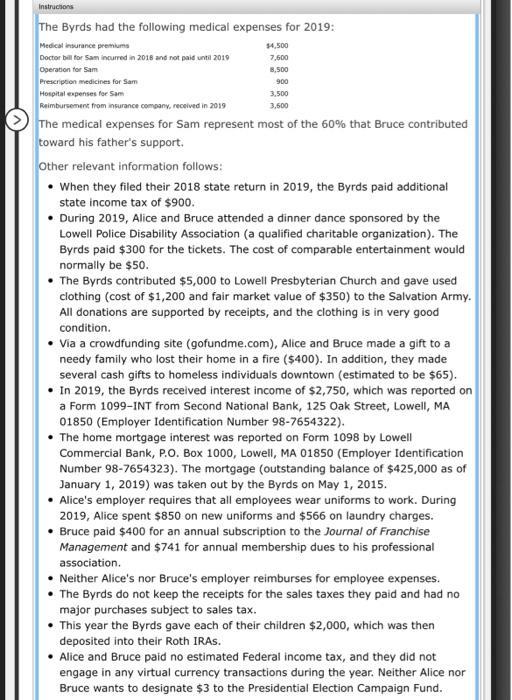

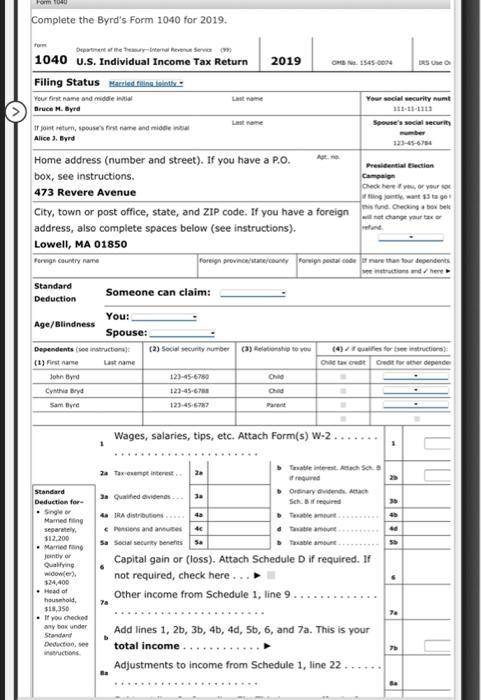

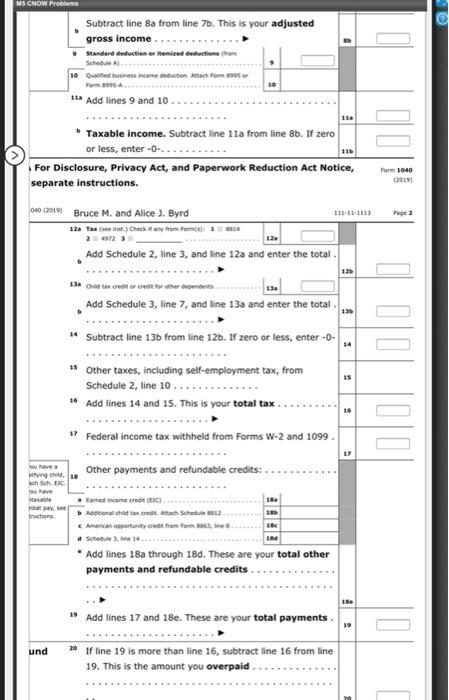

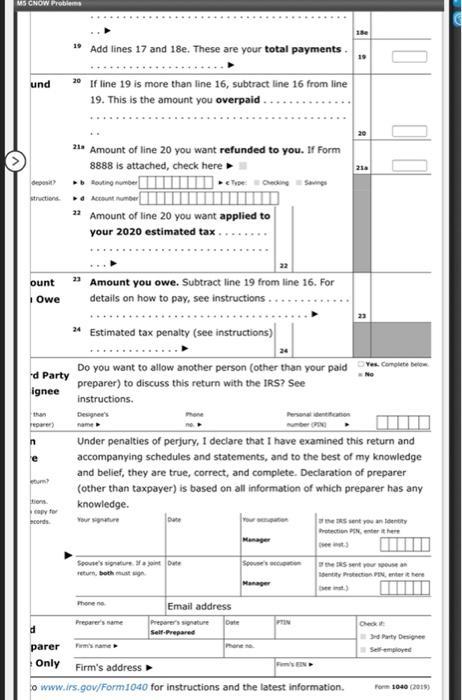

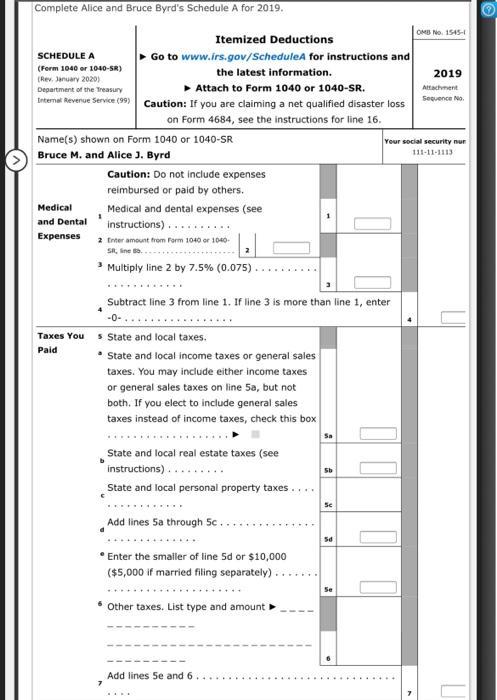

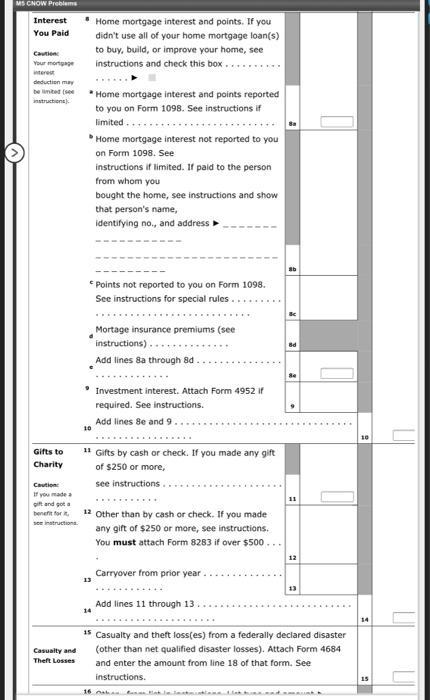

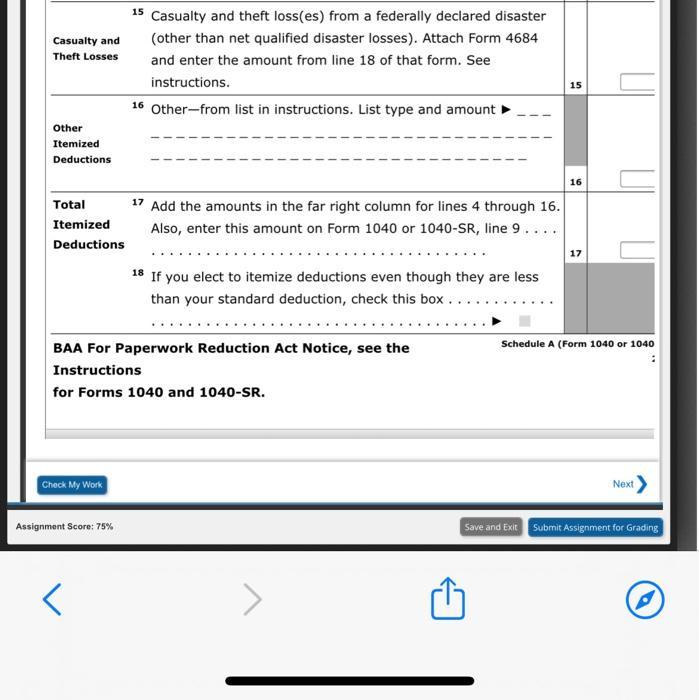

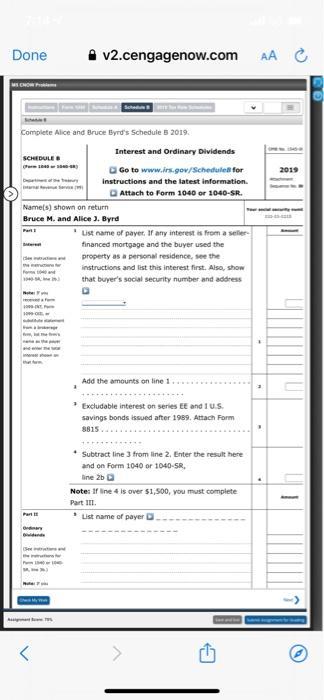

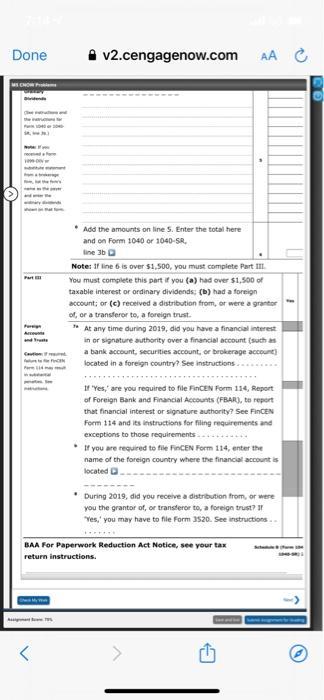

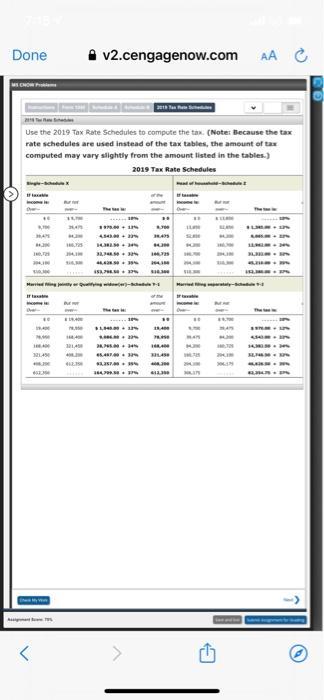

Alice J. and Bruce M. Byrd are married taxpayers who file a joint return. Their Social Security numbers are 123-45-6784 and 111-11-1113, respectively. Alice's birthday is September 21, 1972, and Bruce's is June 27, 1971. They live at 473 Revere Avenue, Lowell, MA 01850, Alice is the office manager for Lowell Dental Clinic, 433 Broad Street, Lowell, MA 01850 (Employer Identification Number 98- 7654321). Bruce is the manager of a Super Burgers fast-food outlet owned and operated by Plymouth Corporation, 1247 Central Avenue, Hauppauge, NY 11788 (Employer Identification Number 11-1111111). The following information is shown on their Wage and Tax Statements (Form W-2) for 2019. Line Description Alice Bruce Weges, tips, other compensation S58,000 S62.100 Federal income tax wahheld 4,500 5,300 Social Security wages sa,000 62,100 Social Security tax withheld 3,596 Medicare wages and tips sa,000 62,100 Medicare tax withheld 900 15 State Massachusetts Massachusetts 16 State wages, tips, etc. S8,000 62,100 17 State income tax withheld 2,950 3,100 The Byrds provide over half of the support of their two children, Cynthia (born January 25, 1995, Social Security number 123-45-6788) and John (born February 7, 1999, Social Security number 123-45-6780). Both children are full-time students and live with the Byrds except when they are away at college. Cynthia earned $6,200 from a summer internship in 2019, and John earned $3,800 from a part-time job. During 2019, the Byrds provided 60% of the total support of Bruce's widower father, Sam Byrd (born March 6, 1943, Social Security number 123-45-6787). Sam lived alone and covered the rest of his support with his Social Security benefits. Sam died in November, and Bruce, the beneficiary of a policy on Sam's life, received life insurance proceeds of $1,600,000 on December 28. The Byrds had the following expenses relating to their personal residence during 2019: Real estate preperty taves Qualified interest on home mortgage Repairs to roof 15,000 8,700 5,750 Utities 4,100 Fire and thert insurance 1,900 Instructions The Byrds had the following medical expenses for 2019: Medical insurance premiums $4,500 Doctor bill for Sam incurred in 2016 and not paid until 2019 7,600 Operation for Sam Prescription medicines for Sam Hospital expenses for Sam Reimbursement from insurance company, recelved in 2019 8,500 900 3,500 3,600 The medical expenses for Sam represent most of the 60% that Bruce contributed toward his father's support. Other relevant information follows: When they filed their 2018 state return in 2019, the Byrds paid additional state income tax of $900. During 2019, Alice and Bruce attended a dinner dance sponsored by the Lowell Police Disability Association (a qualified charitable organization). The Byrds paid $300 for the tickets. The cost of comparable entertainment would normally be $50. The Byrds contributed $5,000 to Lowell Presbyterian Church and gave used clothing (cost of $1,200 and fair market value of $350) to the Salvation Army. All donations are supported by receipts, and the clothing is in very good condition. Via a crowdfunding site (gofundme.com), Alice and Bruce made a gift to a needy family who lost their home in a fire ($400). In addition, they made several cash gifts to homeless individuals downtown (estimated to be $65). In 2019, the Byrds received interest income of $2,750, which was reported on a Form 1099-INT from Second National Bank, 125 Oak Street, Lowell, MA 01850 (Employer Identification Number 98-7654322). The home mortgage interest was reported on orm 1098 by Lowell Commercial Bank, P.O. Box 1000, Lowell, MA 01850 (Employer Identification Number 98-7654323). The mortgage (outstanding balance of $425,000 as of January 1, 2019) was taken out by the Byrds on May 1, 2015. Alice's employer requires that all employees wear uniforms to work. During 2019, Alice spent $850 on new uniforms and $566 on laundry charges. Bruce paid $400 for an annual subscription to the Journal of Franchise Management and $741 for annual membership dues to his professional association. Neither Alice's nor Bruce's employer reimburses for employee expenses. The Byrds do not keep the receipts for the sales taxes they paid and had no major purchases subject to sales tax. This year the Byrds gave each of their children $2,000, which was then deposited into their Roth IRAS. Alice and Bruce paid no estimated Federal income tax, and they did not engage in any virtual currency transactions during the year. Neither Alice nor Bruce wants to designate $3 to the Presidential Election Campaign Fund. Complete the Byrd's Form 1040 for 2019. form Orpatmentahe teay-tenal Reve Serve 1040 u.S. Individual Income Tax Return 2019 CHB Na. 1545-004 RS Ue O Filing Status Haczind. fitina koindby - Your first name and mdde nal Last name Your secial security numt Bruce H. Byrd Lat name Spouse's secial security If joint return, spouses fest name and midae inta Alice 3. Byrd 123-45474 Home address (number and street). If you have a P.O. Presidential Election Campaign Check here y, or yeur so box, see instructions. 473 Revere Avenue City, town or post office, state, and ZIP code. If you have a foreign set change yur ta or fund. Checking bo bel address, also complete spaces below (see instructions). tune Lowell, MA 01850 Foreign provincestane/county foreigh petai code mare than tour dependents e imstructions nd / here Foregn country nane Standard Someone can claim: Deduction You: Age/Blindness Spouse: Dependents (see instructions (2) Social security number (3) Relationship to vou (4)reuifes for tsee instructiora): (1) First name Last name Che ta redt Credt rther depende John Byrd 12345-6780 Ch Cyntha Bryd 123-45-4 Child Sam Byrd 123-45-6787 Parent Wages, salaries, tips, etc. Attach Form(s) W-2.. > Tesatte interest. Ah S 2a Taxesempt interest.. it requred 2 Standard Ordinary dvidend. Attach 3a Quaifed avdends. Deduction for Single or Marred ing separetely, $12,200 - Marned fng jeintly or Qualifying widower), $24,400 Head of household, $18,350 . If you checked any box under Sch. Bf reouired 4a IRA distributions... E Pensions and antutes 4 Sa Social security benefits s Taale amut. e Taate amune. 4a Taxable amune. Capital gain or (loss). Attach Schedule D if required. If not required, check here.. Other income from Schedule 1, line 9.. Add lines 1, 2b, 3b, 4b, 4d, Sb, 6, and 7a. This is your Standard Deducton, see total income inseructions Adjustments to income from Schedule 1, line 22 ..... MS CNOW Problems Subtract line 8a from line 7b. This is your adjusted gross income.. Standard deductien or temieed deductiona a Schede A. 10 Quated buine uton. Attac Form Form SA 11 Add lines 9 and 10. 11a * Taxable income. Subtract line 11a from line 8b. If zero or less, enter -0-. . 11 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, Form 1040 (2019) separate instructions. 040 (2019 Bruce M. and Alice J. Byrd Page 2 12a Tax (see inat. ) Checany trem Femc 2 4972 3 Add Schedule 2, line 3, and line 12a and enter the total 13. C ta oedt or redt fr ther pendets Add Schedule 3, line 7, and line 13a and enter the total. * Subtract line 136 from line 12b. If zero or less, enter-0- 14 " other taxes, including self-employment tax, from is Schedule 2, line 10. 16 Add lines 14 and 15. This is your total tax 7 Federal income tax withheld from Forms W-2 and 1099. u have a yng e. 18 ch Sch. EIC have Other payments and refundable credits: . Male tamed income credt (IC).. at pa see Astonal chid tan cedt Atach Schedule 2 iructions. e American opportunty credt fram Fam a, ne 4 Schedue 3, ine 14. * Add lines 18a through 18d. These are your total other payments and refundable credits. * Add lines 17 and 18e. These are your total payments. 19 und 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid. ..... MS CNOW Problems 19 Add lines 17 and 18e. These are your total payments. 19 * If line 19 is more than line 16, subtract line 16 from lir und line 19. This is the amount you overpaid. 21* Amount of line 20 you want refunded to you. If Form 8888 is attached, check here deposit Roting numbe eTypeCedins Sangs structions Account umber 22 Amount of line 20 you want applied to your 2020 estimated tax.. 2 Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions . ount i Owe 24 Estimated tax penalty (see instructions) Do you want to allow another person (other than your paid ves. Complete beon preparer) to discuss this return with the IRS? See d Party ignee instructions. than reparer) Designee's name Persana dentitaen ober PE Under penalties of perjury, 1 declare that I have examined this return and 'e accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any tiens capy for hcords knowledge. Date e RS sent you an teentity Protection PEN, enter here eet Manager Seoune's vignature a soint Dete Spoune's ecoen eRS sent your use an return, both must gn entity Protection PIN, enter t here Manager eeit) Email address hone ne Preperers sgnature Self-Prepared Date PTIN Check Preparer's name Party Designee parer hane ne Self-employed Only Firm's address Fems EN o www.irs.gov/Form1040 for instructions and the latest information. Form 1040 (2019) Complete Alice and Bruce Byrd's Schedule A for 2019. OMB No. 1545- Itemized Deductions > Go to www.irs.gov/ScheduleA for instructions and SCHEDULE A (Form 1040 or 1040-SR) the latest information. 2019 (Rev. January 2020) Attach to Form 1040 or 1040-SR. Attachment Department of the Treasury Internal Revenue Service (99) Sequence No. Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16. Name(s) shown on Form 1040 or 1040-SR Your social security nur 111-11-1113 Bruce M. and Alice J. Byrd Caution: Do not include expenses reimbursed or paid by others. Medical Medical and dental expenses (see and Dental instructions).......... Expenses 2 Enter amount from Form 1040 or 1040- SR, ine . Multiply line 2 by 7.5% (0.075). Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- Taxes You s State and local taxes. Paid State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box State and local real estate taxes (see instructions).... ... State and local personal property taxes Se Add lines Sa through Sc... * Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) Other taxes. List type and amount Add lines 5e and 6 ..... MS CNOW Preblems * Home mortgage interest and points. If you Interest You Paid didn't use all of your home mortgage loan(s) to buy, build, or improve your home, see Caution Your mortuage instructions and check this box. interest deduction may be lintet (se Home mortgage interest and points reported instructient). to you on Form 1098. See instructions if limited... * Home mortgage interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address > * Points not reported to you on Form 1098. See instructions for special rules.. Mortage insurance premiums (see instructions).. Add lines 8a through 8d Investment interest. Attach Form 4952 if required. See instructions. Add lines 8e and 9. 10 Gifts to " Gifts by cash or check. If you made any gift Charity of $250 or more, Caution see instructions If you made a 11 gift and got a benefit for 12 Other than by cash or check. If you made any gift of $250 or more, see instructions. You must attach Form 8283 if over $500 ... see instructiona 12 Carryover from prior year 13 13 Add lines 11 through 13 * Casualty and theft loss(es) from a federally declared disaster (other than net qualified disaster losses). Attach Form 4684 Casualty and Theft Losses and enter the amount from line 18 of that form. See instructions. 16 lak 15 Casualty and theft loss(es) from a federally declared disaster Casualty and (other than net qualified disaster losses). Attach Form 4684 Theft Losses and enter the amount from line 18 of that form. See instructions. 16 Other-from list in instructions. List type and amount Other Itemized Deductions 16 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Form 1040 or 1040-SR, line 9.... Itemized Deductions 17 18 If you elect to itemize deductions even though they are less than your standard deduction, check this box .. Schedule A (Form 1040 or 1040 BAA For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1040-SR. Check My Work Next Assignment Score: 75% Save and Exit Submit Assignment for Grading Done A v2.cengagenow.com AA Complete Alice and Bruce Byrd's Schedule 5 2019. Interest and Ordinary Dividends SCHEDULE O Go to www.irs.gov/Schedulea for 2019 Instructions and the latest information. Q Attach to Form 1040 or 1040-SR. Namels) shown on return Bruce M. and Alice J. Byrd Par 'List name of payer. If any interest is from a seller- financed mortgage and the buyer used the property as a personal residence, see the instructions and list this interest first. Also, show Fe that buyer's social security number and address imer Add the amounts on line 1 * Excludable interest on series EE and1uS. savings bonds issued after 1989. Attach Form 8815. Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR, ine 2ba Note: If line 4 is over $1,500, you must complete Part III. Part * List name of payer D nary dend Done A v2.cengagenow.com AA C Add the amounts on line S. Enter the total here and on Form 1040 or 1040-SR, ine 3bD Note: 1f line 6 is over $1,500, you must complete Part III. You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust. Fergn * At any time during 2019, did you have a financial interest in or signature authority over a financial account (such as te a bank account, securities account, or brokerage account) located in a foreign country? See instructions. Permam Ir Yes,' are you required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 and its instructions for filing requirements and exceptions to those requirements. . If you are required to file FinCEN Form 114, enter the name of the foreign country where the financial account is located a. During 2019, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? I Yes,' you may have to file Form 3520. See instructions. BAA For Paperwork Reduction Act Notice, see your tax return instructions. Done A v2.cengagenow.com AA C S CHOW Use the 2019 Tax Rate Schedules to compute the tax. (Note: Because the tax rate schedules are used instead of the tax tables, the amount of tax computed may vary silightly from the amount listed in the tables.) 2019 Tax Rate Schedules S s UR ISA Mai gy w- Itt ete SaS

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part I Tax Computation Bruces salary Alices salary Interest income Adjusted gross income Less ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started