Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are Susan Chandler, reporting to your boss Blanka Dobrynan. Blanka has charged you with assessing the potential added value to Wrigley as a

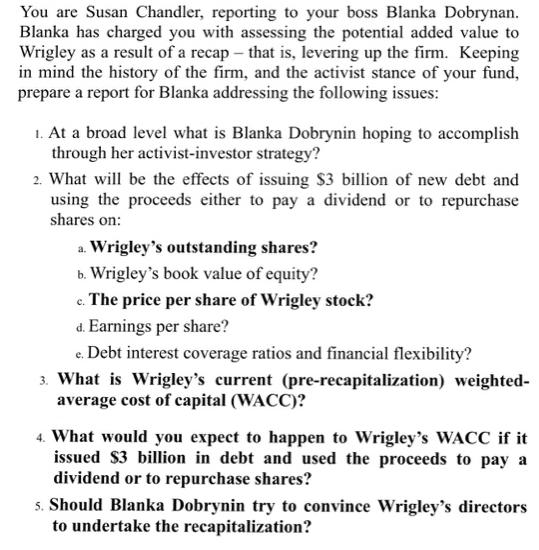

You are Susan Chandler, reporting to your boss Blanka Dobrynan. Blanka has charged you with assessing the potential added value to Wrigley as a result of a recap- that is, levering up the firm. Keeping in mind the history of the firm, and the activist stance of your fund, prepare a report for Blanka addressing the following issues: 1. At a broad level what is Blanka Dobrynin hoping to accomplish through her activist-investor strategy? 2. What will be the effects of issuing $3 billion of new debt and using the proceeds either to pay a dividend or to repurchase shares on: a. Wrigley's outstanding shares? b. Wrigley's book value of equity? e. The price per share of Wrigley stock? d. Earnings per share? e. Debt interest coverage ratios and financial flexibility? 3. What is Wrigley's current (pre-recapitalization) weighted- average cost of capital (WACC)? What would you expect to happen to Wrigley's WACC if it issued $3 billion in debt and used the proceeds to pay a dividend or to repurchase shares? 5. Should Blanka Dobrynin try to convince Wrigley's directors to undertake the recapitalization?

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Subject Assessment of Potential Added Value through Recapitalization at Wrigley Dear Blanka Dobrynin I have conducted a comprehensive analysis of the potential added value to Wrigley resulting from a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started