Answered step by step

Verified Expert Solution

Question

1 Approved Answer

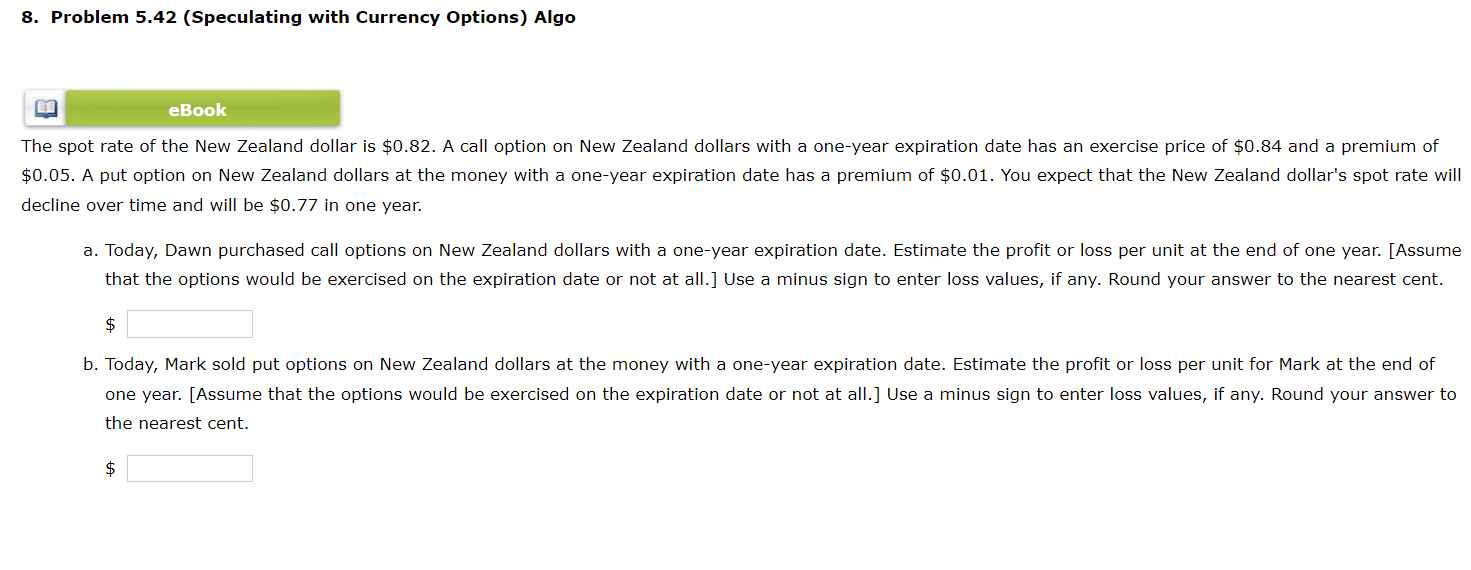

$ 0 . 0 5 . A put option on New Zealand dollars at the money with a one - year expiration date has a

$ A put option on New Zealand dollars at the money with a oneyear expiration date has a premium of $ You expect that the New

decline over time and will be $ in one year.

a Today, Dawn purchased call options on New Zealand dollars with a oneyear expiration date. Estimate the profit or loss per unit at the end of one year. Assume

that the options would be exercised on the expiration date or not at all. Use a minus sign to enter loss values, if any. Round your answer to the nearest cent.

$

b Today, Mark sold put options on New Zealand dollars at the money with a oneyear expiration date. Estimate the profit or loss per unit for Mark at the end of

one year. Assume that the options would be exercised on the expiration date or not at all. Use a minus sign to enter loss values, if any. Round your answer to

the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started