Answered step by step

Verified Expert Solution

Question

1 Approved Answer

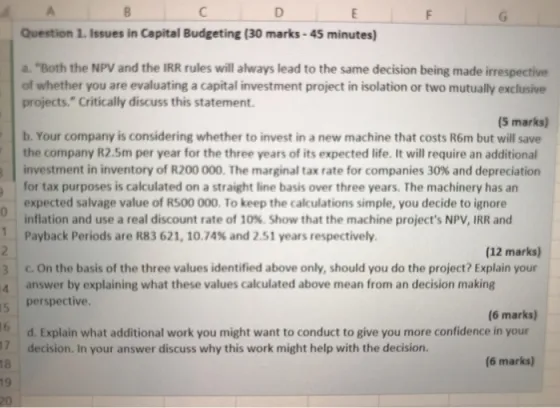

0 2 3 14 15 16 17 18 19 20 C E Question 1. Issues in Capital Budgeting (30 marks-45 minutes) a. Both the

0 2 3 14 15 16 17 18 19 20 C E Question 1. Issues in Capital Budgeting (30 marks-45 minutes) a. "Both the NPV and the IRR rules will always lead to the same decision being made irrespective of whether you are evaluating a capital investment project in isolation or two mutually exclusive projects." Critically discuss this statement. (5 marks) b. Your company is considering whether to invest in a new machine that costs R6m but will save the company R2.5m per year for the three years of its expected life. It will require an additional investment in inventory of R200 000. The marginal tax rate for companies 30% and depreciation for tax purposes is calculated on a straight line basis over three years. The machinery has an expected salvage value of R500 000. To keep the calculations simple, you decide to ignore inflation and use a real discount rate of 10%. Show that the machine project's NPV, IRR and Payback Periods are R83 621, 10.74% and 2.51 years respectively. (12 marks) c. On the basis of the three values identified above only, should you do the project? Explain your answer by explaining what these values calculated above mean from an decision making perspective. (6 marks) d. Explain what additional work you might want to conduct to give you more confidence in your decision. In your answer discuss why this work might help with the decision. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The statement that both the NPV and IRR rules will always lead to the same decision regardless of whether you are evaluating a capital investment project in isolation or two mutually exclusive proje...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started