Question

The property being appraised is a 10-year old warehouse containing 30,000 square feet of gross buildingarea and 3,000 square feet of finished office area. The

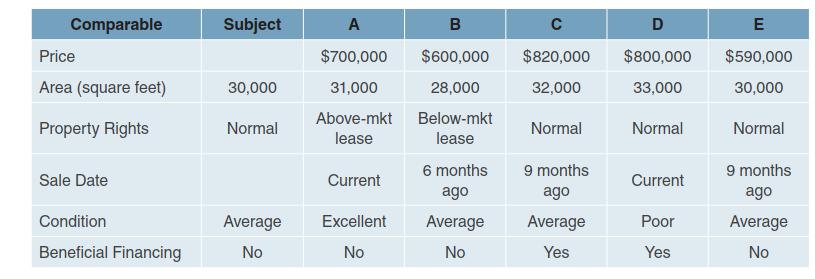

The property being appraised is a 10-year old warehouse containing 30,000 square feet of gross building area and 3,000 square feet of finished office area. The ceiling height is 18 feet. The quality of construction is good and the building's condition is average. The five comparables described in the table below were used in the analysis. All of the comparables are warehouses located in the subject property's market area.

Below is further information on the properties' attributes and the necessary quantitative adjustments:

Property Rights Conveyed:

Sales A and B were sold subject to long-term leases, so both require an adjustment for property rights conveyed. Sale A requires an adjustment of $29,000 because it is leased at an above-market contract rent. Sale B requires an adjustment of $30,000 because it is leased at a below-market contract rent. All comparables were arm's-length transactions.

Market Conditions:

The sales occurred over a 12-month period. Properties in this market have been appreciating at 6% annually or 0.5% per month (assume a simple, non-compounding rate). Sale B occurred six months ago, while Sales C and E occurred 9 months ago. Sales A and D are current sales.

Financing:

The vendor of Sale D provided advantageous financing that resulted in the buyer paying $45,000 more than the buyer would have paid in a cash transaction. The buyer of Sale C assumed an existing, below market loan and therefore paid a premium of $5,000 above the price that would have been paid under market terms. The other sales were paid in cash.

Condition of Improvements:

Sales B, C, and E all had building conditions that were average. Sale A had no deferred maintenance and was in excellent condition. An adjustment of $8,000 is required to bring it in line with the subject's average condition. Sale D suffered from excessive deferred maintenance. At the time of sale, the buyer anticipated spending $28,000 upgrading the building to average condition.

11. What is the property rights adjustment for Sale B?

(1) +$30,000

(2) -$29,000

(3) +$29,000

(4) -$30,000

Comparable Subject A B C D E Price $700,000 $600,000 $820,000 $800,000 $590,000 Area (square feet) 30,000 Property Rights Normal 31,000 Above-mkt lease 28,000 Below-mkt lease 32,000 33,000 30,000 Normal Normal Normal 6 months 9 months 9 months Sale Date Current Current ago ago ago Condition Average Excellent Average Average Poor Average Beneficial Financing No No No Yes Yes No

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The proper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started