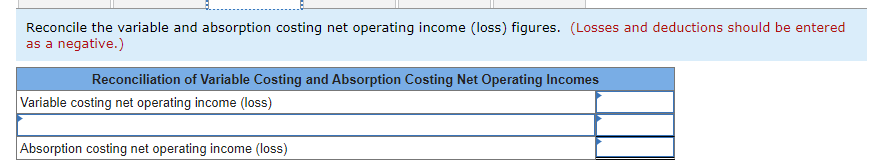

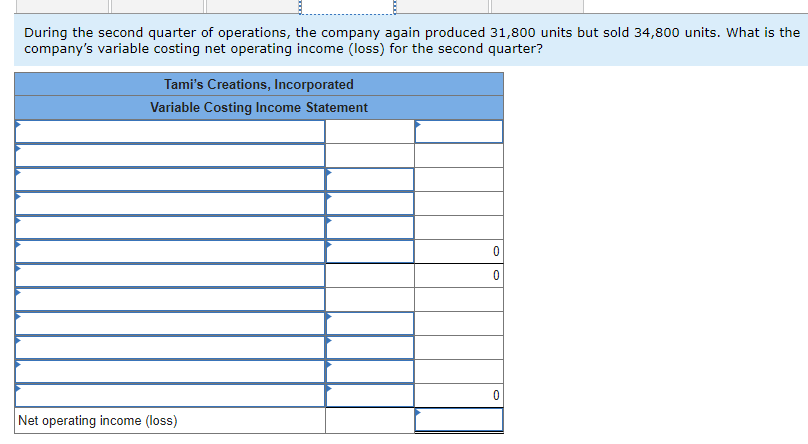

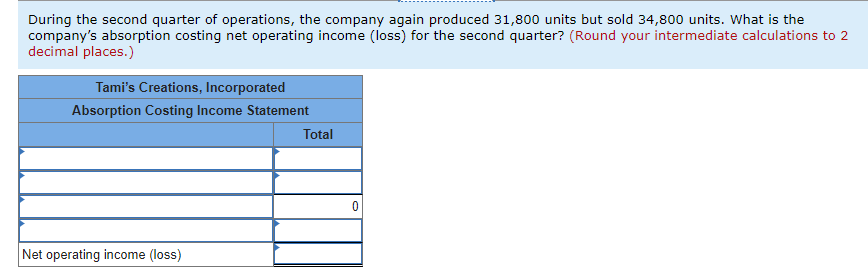

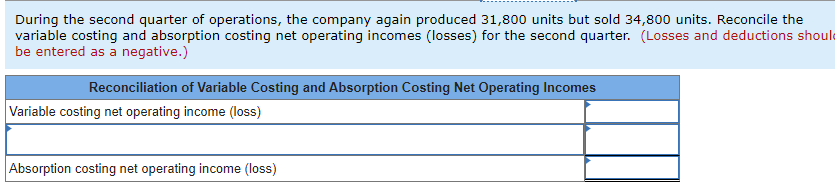

0

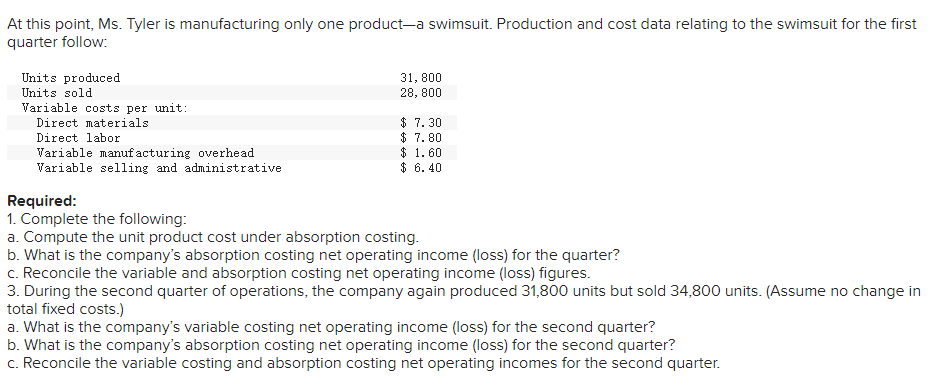

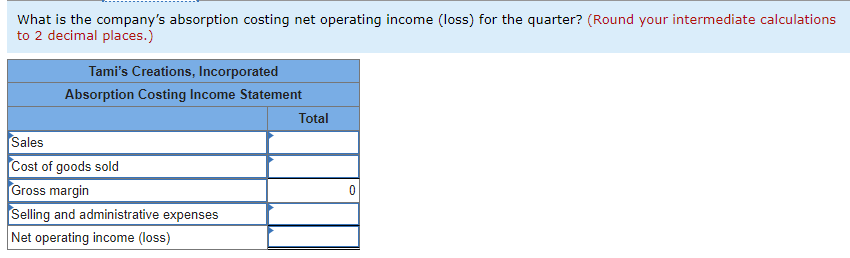

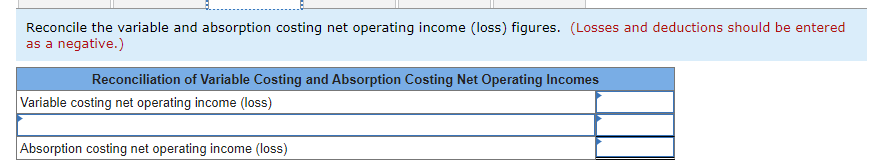

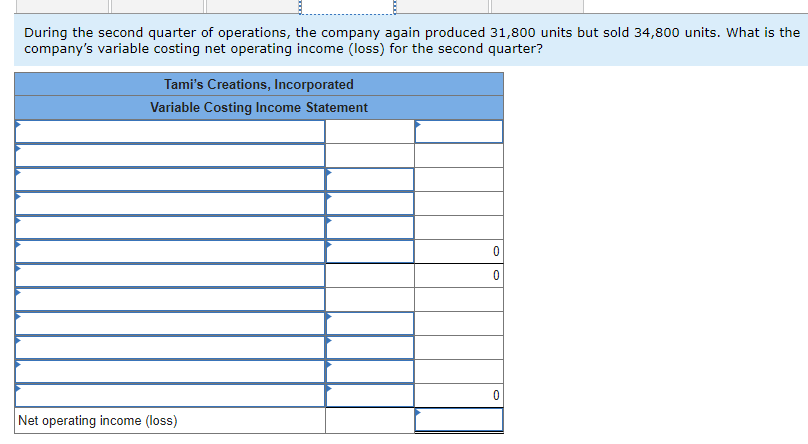

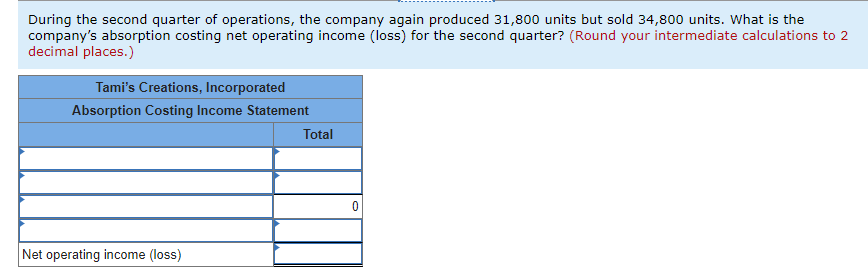

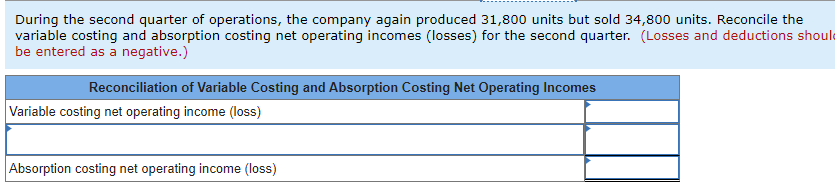

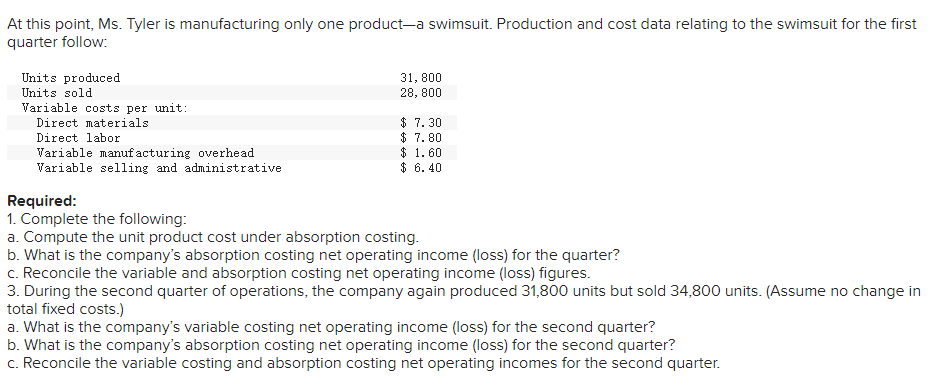

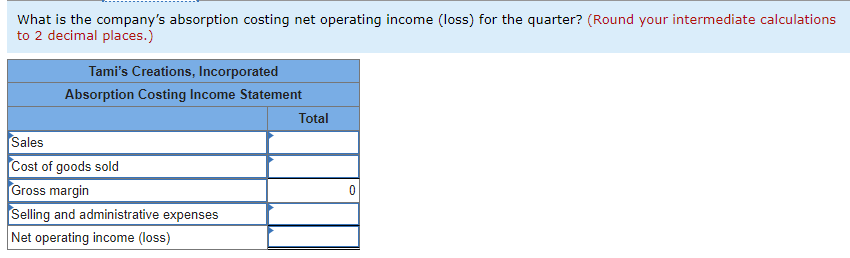

At this point, Ms. Tyler is manufacturing only one product-a swimsuit. Production and cost data relating to the swimsuit for the first quarter follow: 31, 800 28, 800 Units produced Units sold Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative $ 7.30 $ 7.80 $ 1.60 $ 6.40 Required: 1. Complete the following: a. Compute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile the variable and absorption costing net operating income (loss) figures. 3. During the second quarter of operations, the company again produced 31,800 units but sold 34,800 units. (Assume no change in total fixed costs.) a. What is the company's variable costing net operating income (loss) for the second quarter? b. What is the company's absorption costing net operating income (loss) for the second quarter? c. Reconcile the variable costing and absorption costing net operating incomes for the second quarter. What is the company's absorption costing net operating income (loss) for the quarter? (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Incorporated Absorption Costing Income Statement Total Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income (loss) 0 Reconcile the variable and absorption costing net operating income (loss) figures. (Losses and deductions should be entered as a negative.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Absorption costing net operating income (loss) During the second quarter of operations, the company again produced 31,800 units but sold 34,800 units. What is the company's variable costing net operating income (loss) for the second quarter? Tami's Creations, Incorporated Variable Costing Income Statement Net operating income (loss) During the second quarter of operations, the company again produced 31,800 units but sold 34,800 units. What is the company's absorption costing net operating income (loss) for the second quarter? (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Incorporated Absorption Costing Income Statement Total 0 Net operating income (loss) During the second quarter of operations, the company again produced 31,800 units but sold 34,800 units. Reconcile the variable costing and absorption costing net operating incomes (losses) for the second quarter. (Losses and deductions shoul be entered as a negative.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Absorption costing net operating income (loss) At this point, Ms. Tyler is manufacturing only one product-a swimsuit. Production and cost data relating to the swimsuit for the first quarter follow: 31, 800 28, 800 Units produced Units sold Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative $ 7.30 $ 7.80 $ 1.60 $ 6.40 Required: 1. Complete the following: a. Compute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile the variable and absorption costing net operating income (loss) figures. 3. During the second quarter of operations, the company again produced 31,800 units but sold 34,800 units. (Assume no change in total fixed costs.) a. What is the company's variable costing net operating income (loss) for the second quarter? b. What is the company's absorption costing net operating income (loss) for the second quarter? c. Reconcile the variable costing and absorption costing net operating incomes for the second quarter. What is the company's absorption costing net operating income (loss) for the quarter? (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Incorporated Absorption Costing Income Statement Total Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income (loss) 0 Reconcile the variable and absorption costing net operating income (loss) figures. (Losses and deductions should be entered as a negative.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Absorption costing net operating income (loss) During the second quarter of operations, the company again produced 31,800 units but sold 34,800 units. What is the company's variable costing net operating income (loss) for the second quarter? Tami's Creations, Incorporated Variable Costing Income Statement Net operating income (loss) During the second quarter of operations, the company again produced 31,800 units but sold 34,800 units. What is the company's absorption costing net operating income (loss) for the second quarter? (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Incorporated Absorption Costing Income Statement Total 0 Net operating income (loss) During the second quarter of operations, the company again produced 31,800 units but sold 34,800 units. Reconcile the variable costing and absorption costing net operating incomes (losses) for the second quarter. (Losses and deductions shoul be entered as a negative.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Absorption costing net operating income (loss)