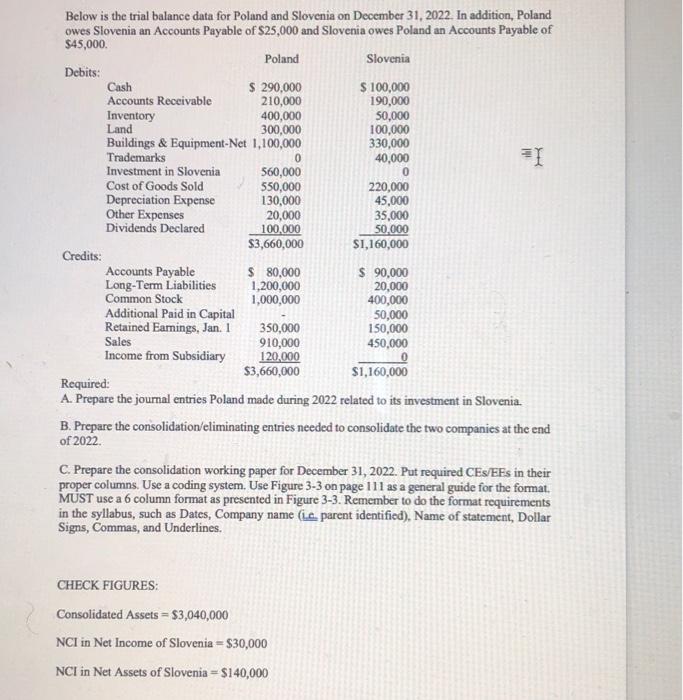

0 Below is the trial balance data for Poland and Slovenia on December 31, 2022. In addition, Poland owes Slovenia an Accounts Payable of $25,000 and Slovenia owes Poland an Accounts Payable of $45,000 Poland Slovenia Debits: Cash $ 290,000 $ 100,000 Accounts Receivable 210,000 190,000 Inventory 400,000 50,000 Land 300,000 100,000 Buildings & Equipment-Net 1,100,000 330,000 Trademarks 40,000 1 Investment in Slovenia 560,000 Cost of Goods Sold 550,000 220,000 Depreciation Expense 130,000 45,000 Other Expenses 20,000 35,000 Dividends Declared 100,000 50.000 $3,660,000 $1,160,000 Credits: Accounts Payable $ 80,000 $ 90,000 Long-Term Liabilities 1,200,000 20,000 Common Stock 1,000,000 400,000 Additional Paid in Capital 50,000 Retained Earings, Jan. I 350,000 150,000 910,000 450,000 Income from Subsidiary 120,000 $3,660,000 $1,160,000 Required: A. Prepare the journal entries Poland made during 2022 related to its investment in Slovenia. B. Prepare the consolidation/eliminating entries needed to consolidate the two companies at the end of 2022 C. Prepare the consolidation working paper for December 31, 2022. Put required CEs/EEs in their proper columns. Use a coding system. Use Figure 3-3 on page 111 as a general guide for the format. MUST use a 6 column format as presented in Figure 3-3. Remember to do the format requirements in the syllabus, such as Dates, Company name (1.4.parent identified), Name of statement, Dollar Signs, Commas, and Underlines. Sales CHECK FIGURES: Consolidated Assets = $3,040,000 NCI in Net Income of Slovenia = $30,000 NCI in Net Assets of Slovenia = $140,000 0 Below is the trial balance data for Poland and Slovenia on December 31, 2022. In addition, Poland owes Slovenia an Accounts Payable of $25,000 and Slovenia owes Poland an Accounts Payable of $45,000 Poland Slovenia Debits: Cash $ 290,000 $ 100,000 Accounts Receivable 210,000 190,000 Inventory 400,000 50,000 Land 300,000 100,000 Buildings & Equipment-Net 1,100,000 330,000 Trademarks 40,000 1 Investment in Slovenia 560,000 Cost of Goods Sold 550,000 220,000 Depreciation Expense 130,000 45,000 Other Expenses 20,000 35,000 Dividends Declared 100,000 50.000 $3,660,000 $1,160,000 Credits: Accounts Payable $ 80,000 $ 90,000 Long-Term Liabilities 1,200,000 20,000 Common Stock 1,000,000 400,000 Additional Paid in Capital 50,000 Retained Earings, Jan. I 350,000 150,000 910,000 450,000 Income from Subsidiary 120,000 $3,660,000 $1,160,000 Required: A. Prepare the journal entries Poland made during 2022 related to its investment in Slovenia. B. Prepare the consolidation/eliminating entries needed to consolidate the two companies at the end of 2022 C. Prepare the consolidation working paper for December 31, 2022. Put required CEs/EEs in their proper columns. Use a coding system. Use Figure 3-3 on page 111 as a general guide for the format. MUST use a 6 column format as presented in Figure 3-3. Remember to do the format requirements in the syllabus, such as Dates, Company name (1.4.parent identified), Name of statement, Dollar Signs, Commas, and Underlines. Sales CHECK FIGURES: Consolidated Assets = $3,040,000 NCI in Net Income of Slovenia = $30,000 NCI in Net Assets of Slovenia = $140,000