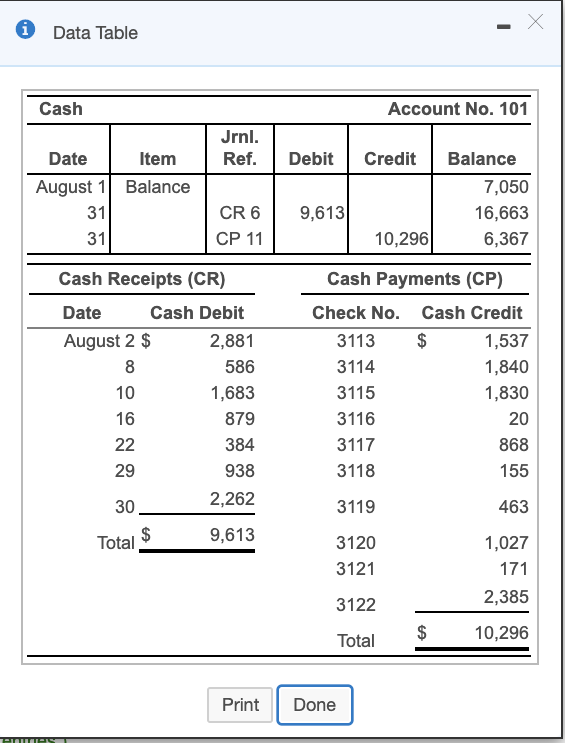

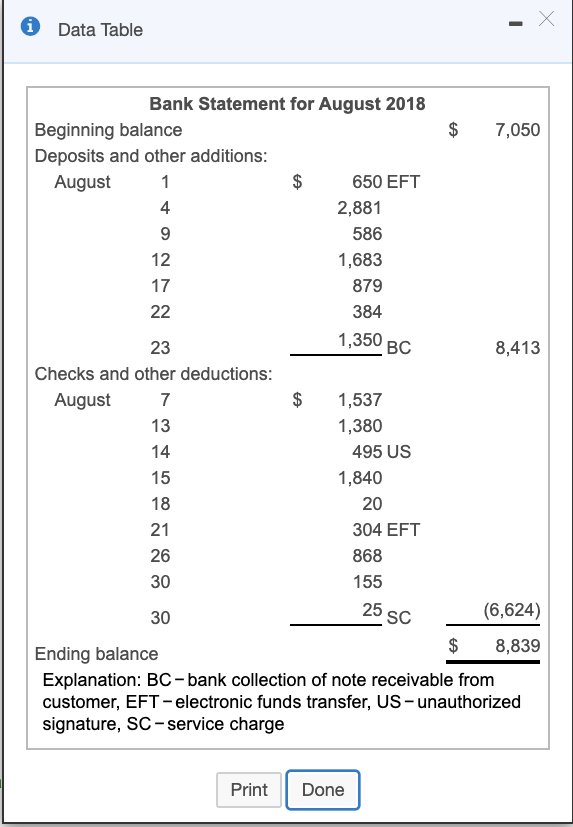

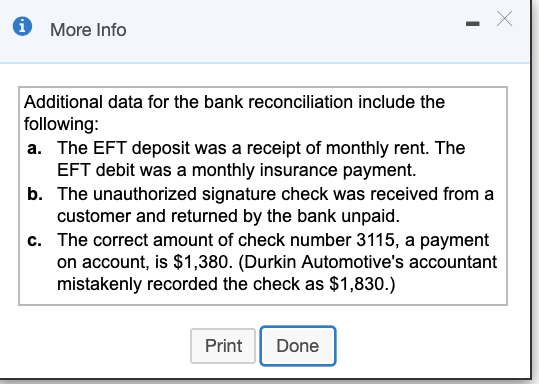

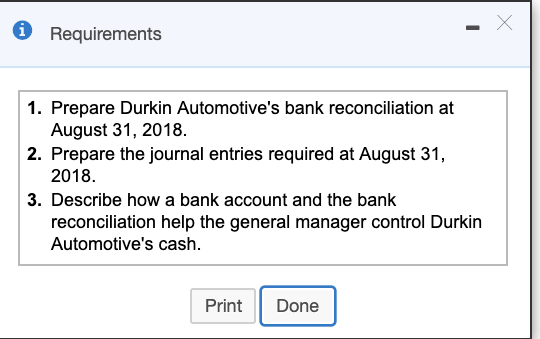

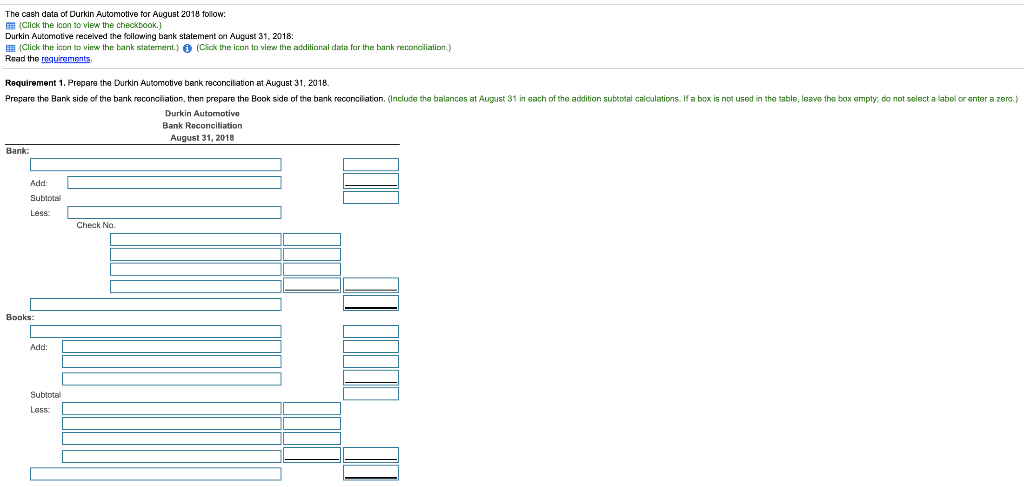

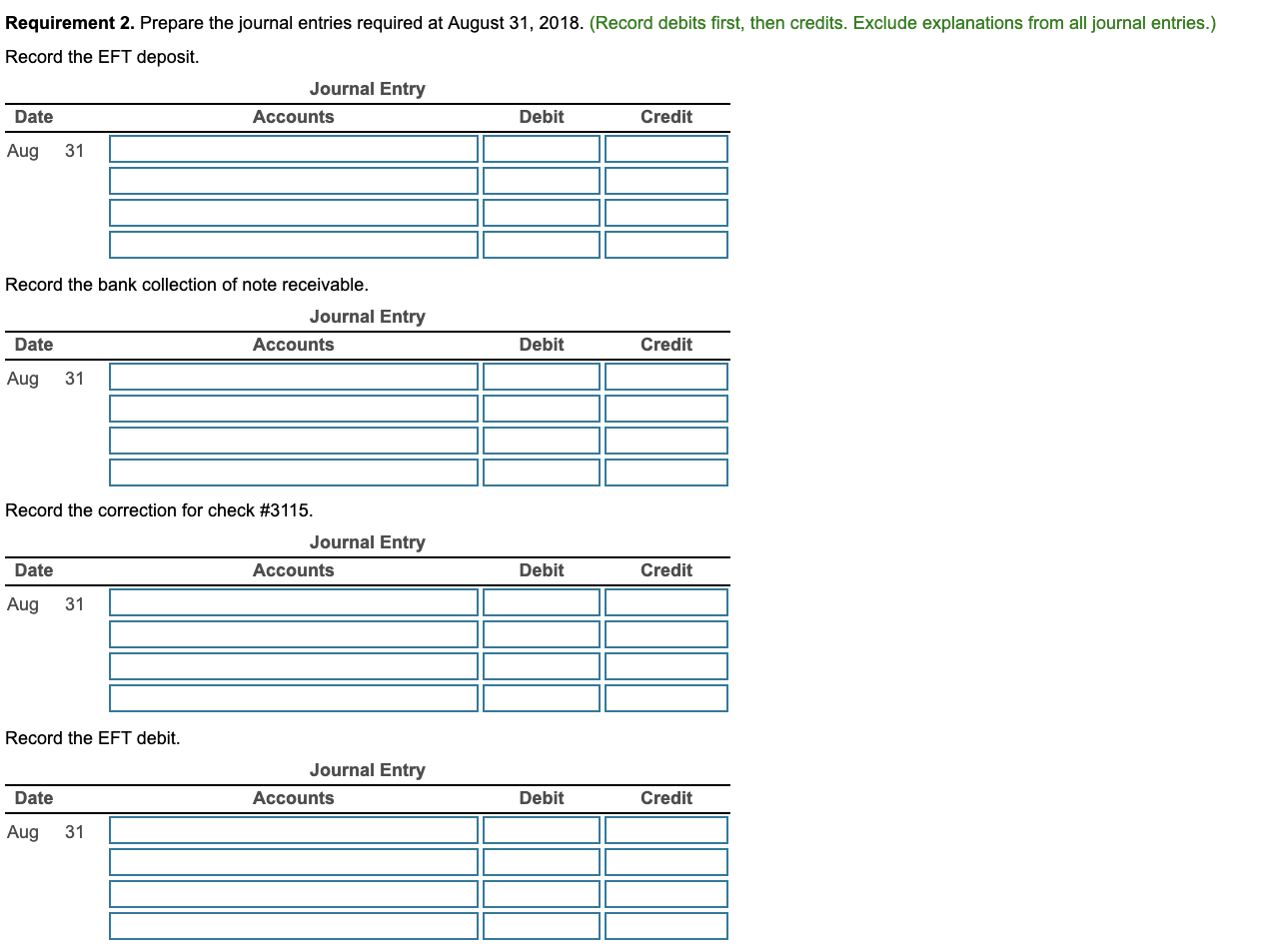

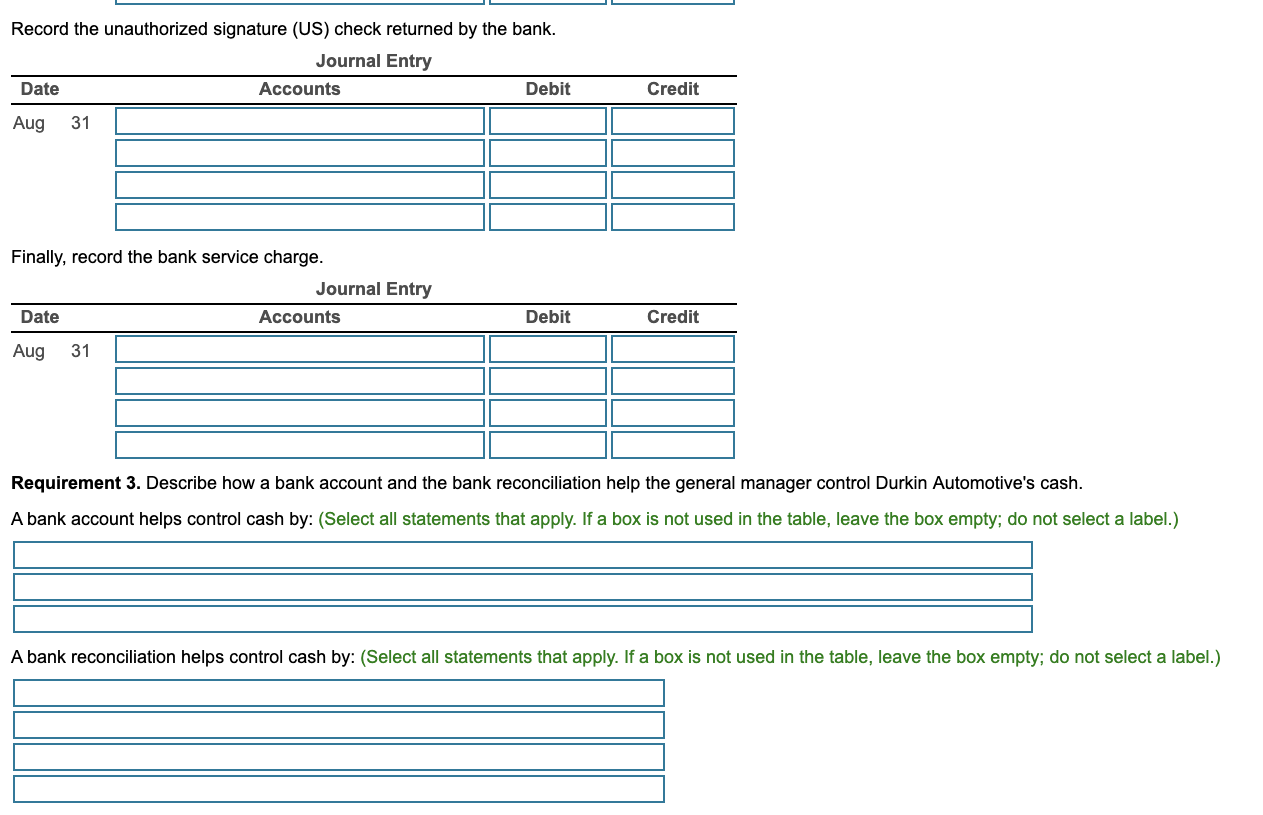

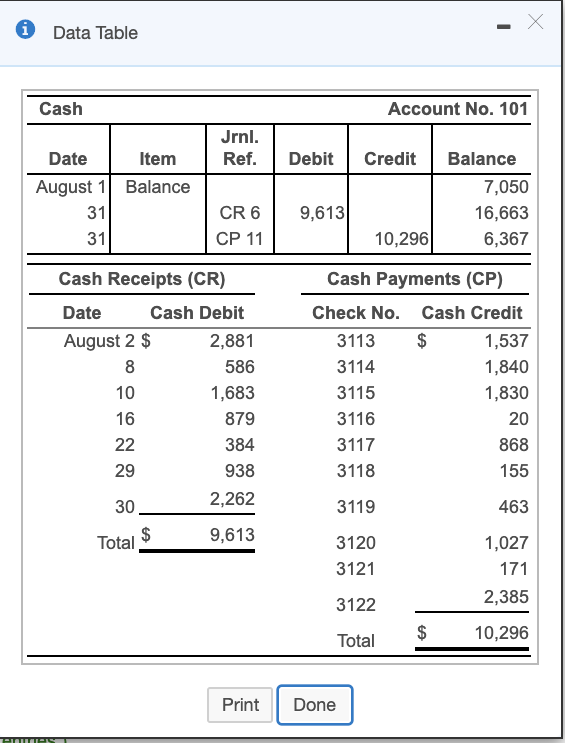

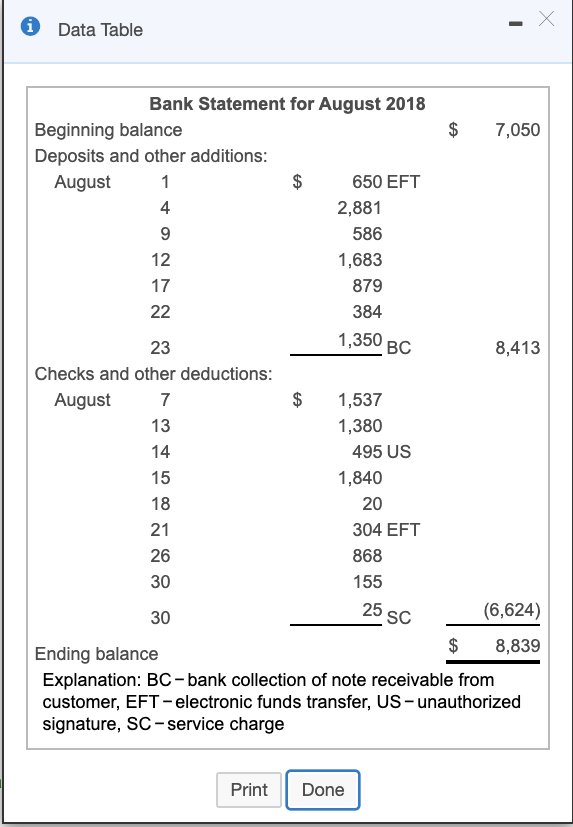

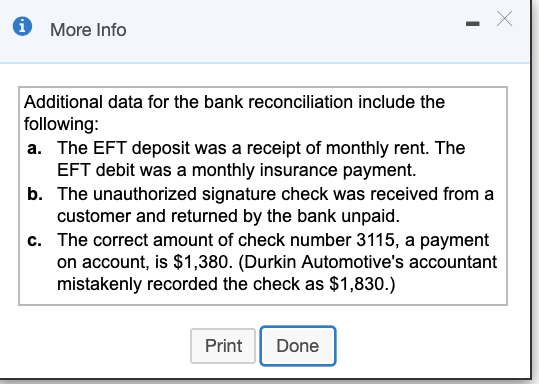

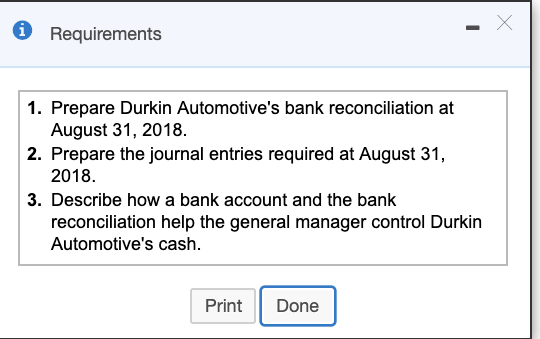

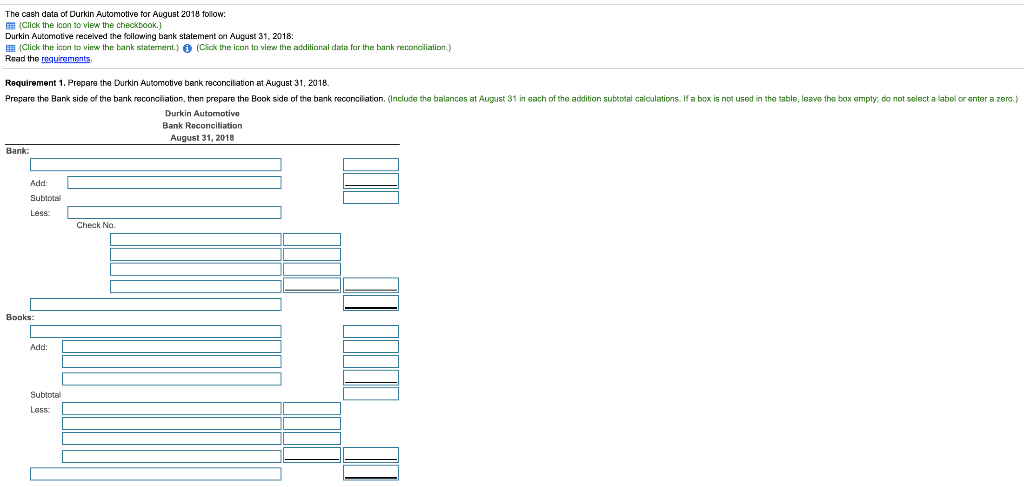

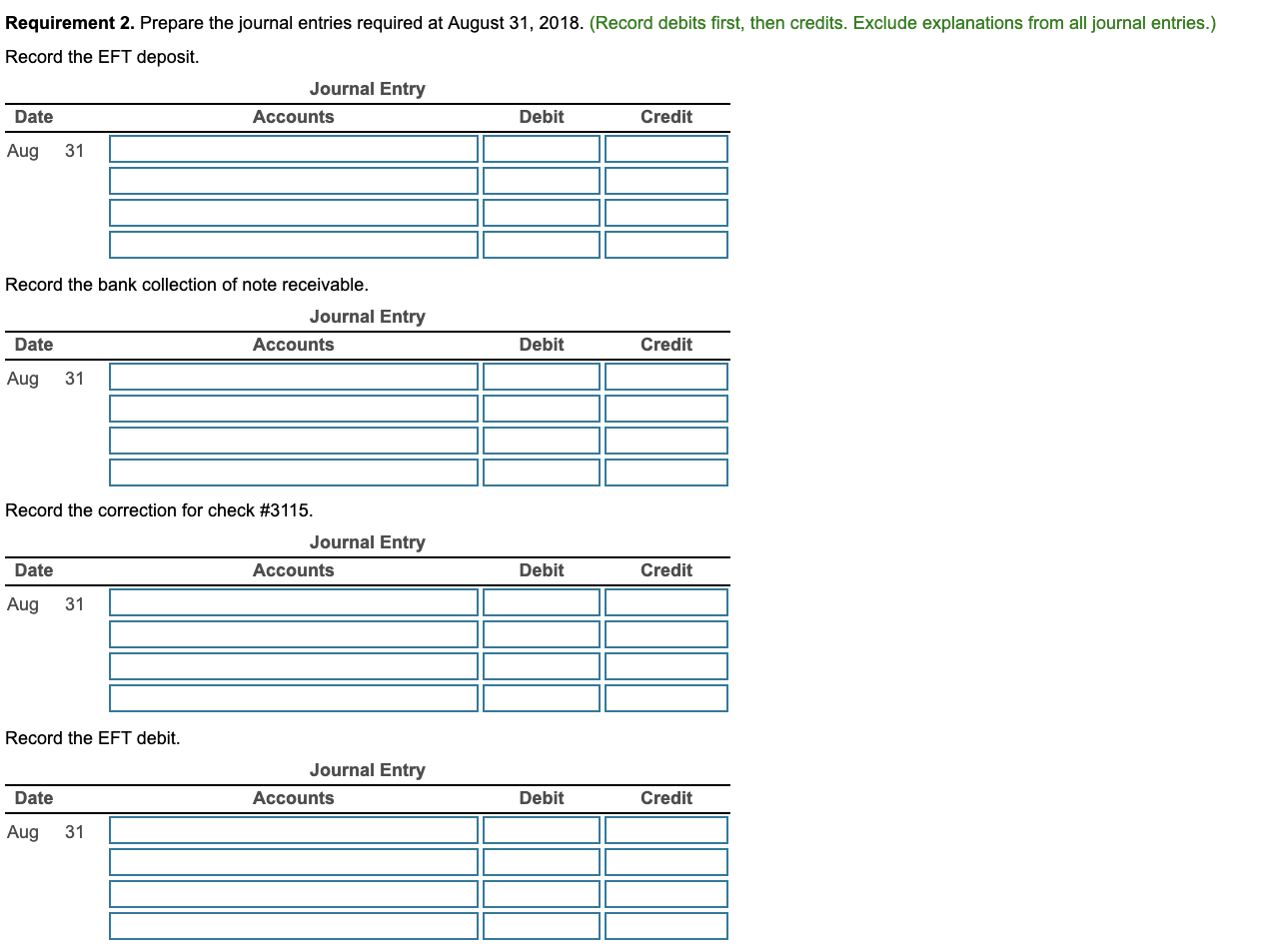

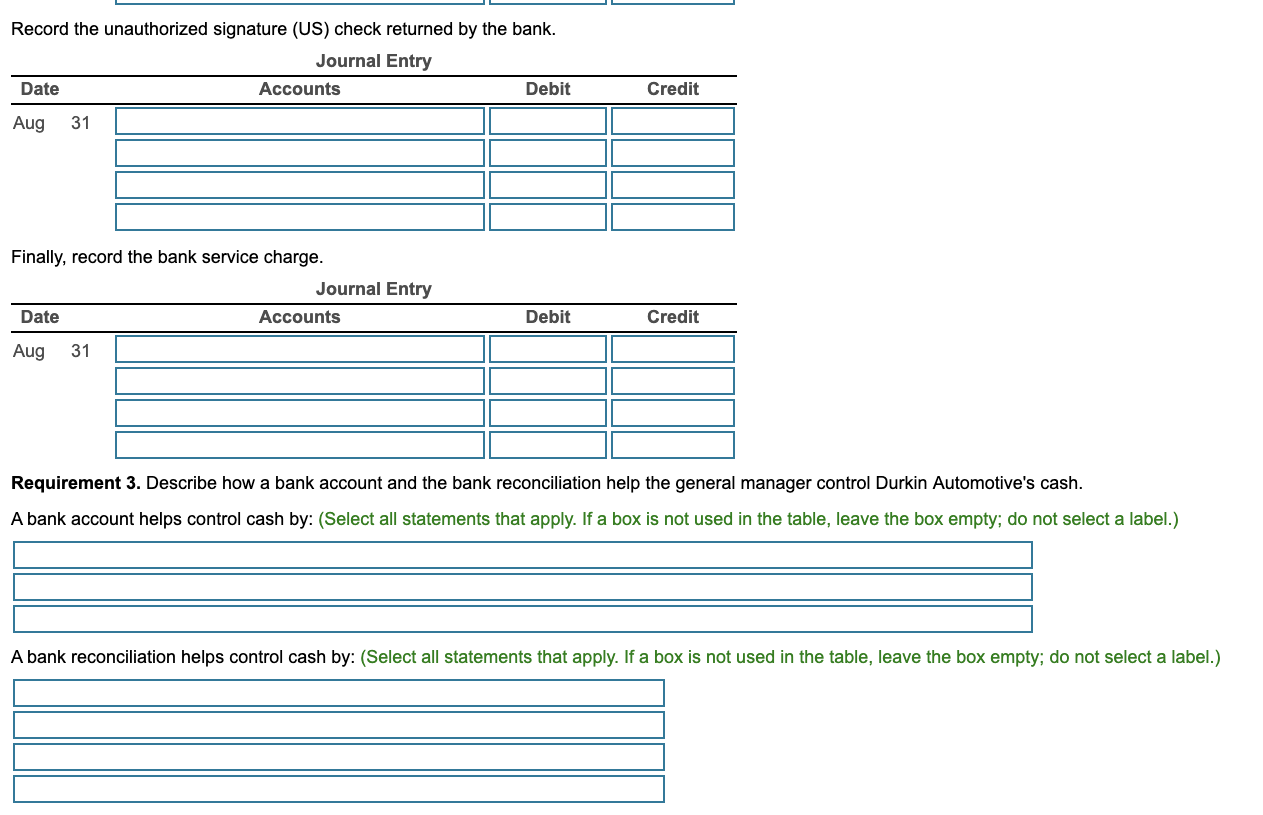

0 Data Table Cash Account No. 101 Jrnl. Ref. Debit Credit Date Item August 1 Balance 31 31 Balance 7,050 16,663 6,367 9,613 CR 6 CP 11 10,296 Cash Receipts (CR) Date Cash Debit August 2$ 2,881 8 586 10 1,683 879 384 29 938 30 2,262 Total $ 9,613 Cash Payments (CP) Check No. Cash Credit 3113 $ 1,537 3114 1,840 3115 1,830 3116 3117 868 3118 155 20 16 22 3119 463 3120 3121 1,027 171 2,385 3122 Total $ 10,296 Print Done DITTO i Data Table $ 7,050 1 Bank Statement for August 2018 Beginning balance Deposits and other additions: August 650 EFT 4 2,881 9 586 12 1,683 879 22 384 17 1,350 BC 23 8,413 Checks and other deductions: August 7 $ 1,537 13 1,380 14 495 US 15 1,840 18 20 21 304 EFT 26 868 30 155 30 25 (6,624) Ending balance $ 8,839 Explanation: BC-bank collection of note receivable from customer, EFT - electronic funds transfer, US - unauthorized signature, SC-service charge SC Print Done i More Info Additional data for the bank reconciliation include the following: a. The EFT deposit was a receipt of monthly rent. The EFT debit was a monthly insurance payment. b. The unauthorized signature check was received from a customer and returned by the bank unpaid. c. The correct amount of check number 3115, a payment on account, is $1,380. (Durkin Automotive's accountant mistakenly recorded the check as $1,830.) Print Done The cash data of Durkin Automotive for August 2018 follow: (Click the icon to view the checkbook.) Durkin Automotive received the following bank statement on August 31, 2018 (Click the icon to view the bank statement.) (Click the icon to view the additional data for the bank reconciliation) Read the requirements Requirement 1. Prepare the Durkin Automotive bank reconciliation at August 31, 2018 Prepare the Bank side of the bank reconciliation, then prepare the Book side of the bank reconciliation. (Include the balances at August 31 in each of the addition subtotal calculations. If a box is not used in the table, leave the box empty, do not select a label or enter a zero. Durkin Automotive Bank Reconciliation August 31, 2018 Bank Add Subtotal Less: Check No. Books: Add Subtota Less: Requirement 2. Prepare the journal entries required at August 31, 2018. (Record debits first, then credits. Exclude explanations from all journal entries.) Record the EFT deposit. Journal Entry Date Accounts Debit Credit Aug 31 Record the bank collection of note receivable. Journal Entry Date Accounts Debit Credit Aug 31 Record the correction for check #3115. Journal Entry Date Accounts Debit Credit Aug 31 Record the EFT debit. Journal Entry Accounts Date Debit Credit Aug 31 Record the unauthorized signature (US) check returned by the bank. Journal Entry Date Accounts Debit Credit Aug 31 Finally, record the bank service charge. Journal Entry Date Accounts Debit Credit Aug 31 Requirement 3. Describe how a bank account and the bank reconciliation help the general manager control Durkin Automotive's cash. A bank account helps control cash by: (Select all statements that apply. If a box is not used in the table, leave the box empty; do not select a label.) A bank reconciliation helps control cash by: (Select all statements that apply. If a box is not used in the table, leave the box empty; do not select a label.)