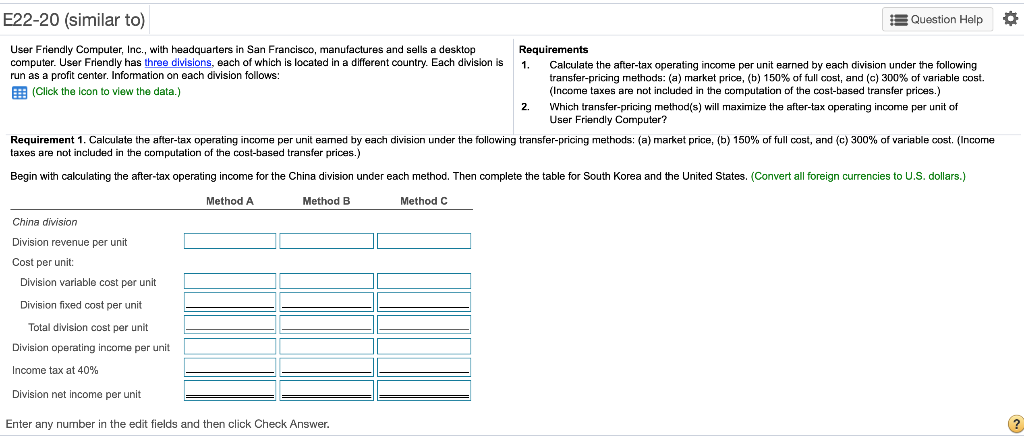

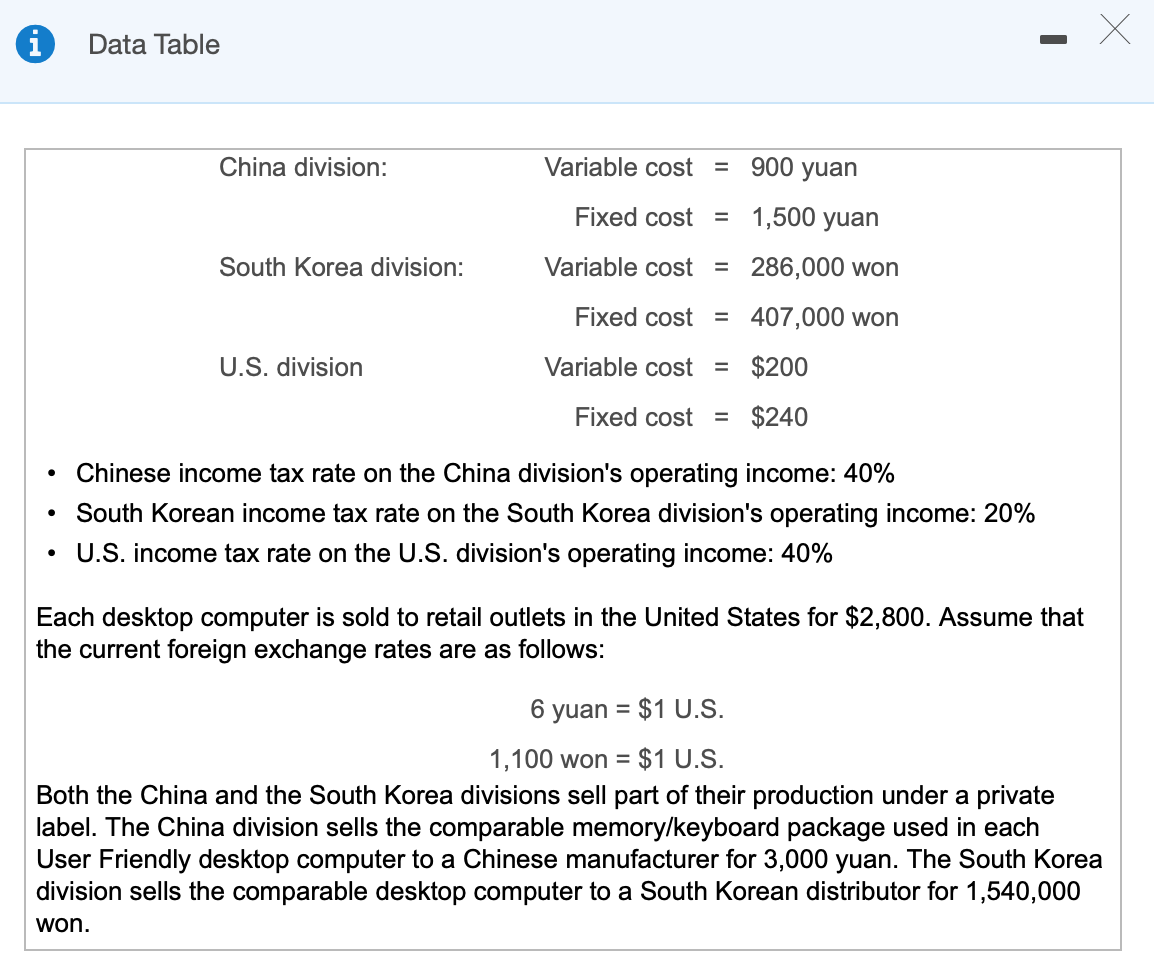

0 E22-20 (similar to) Question Help User Friendly Computer, Inc., with headquarters in San Francisco, manufactures and sells a desktop Requirements computer. User Friendly has three divisions, each of which is located in a different country. Each division is 1. Calculate the after-tax operating income per unit earned by each division under the following run as a profit center, Information on each division follows: transfer pricing methods: (a) market price, (b) 150% of full cost, and (c) 300% of variable cost. (Click the icon to view the data.) (Income taxes are not included in the computation of the cost-based transfer prices.) 2. Which transfer pricing method(s) will maximize the after-tax operating income per unit of User Friendly Computer? Requirement 1. Calculate the after-tax operating income per unit eamed by each division under the following transfer-pricing methods: (a) market price, (b) 150% of full cost, and (c) 300% of variable cost. (Income taxes are not included in the computation of the cost-based transfer prices.) Begin with calculating the after-tax operating income for the China division under each method. Then complete the table for South Korea and the United States. (Convert all foreign currencies to U.S. dollars.) Method A Method B Method C China division Division revenue per unit Cost per unit: Division variable cost per unit Division fixed cost per unit Total division cost per unit Division operating income per unit Income tax at 40% Division net income per unit Enter any number in the edit fields and then click Check Answer. ? Data Table - China division: Variable cost = 900 yuan South Korea division: Fixed cost = 1,500 yuan Variable cost = 286,000 won Fixed cost = 407,000 won U.S. division Variable cost = $200 Fixed cost = $240 . Chinese income tax rate on the China division's operating income: 40% South Korean income tax rate on the South Korea division's operating income: 20% U.S. income tax rate on the U.S. division's operating income: 40% Each desktop computer is sold to retail outlets in the United States for $2,800. Assume that the current foreign exchange rates are as follows: 6 yuan = $1 U.S. 1,100 won = $1 U.S. Both the China and the South Korea divisions sell part of their production under a private label. The China division sells the comparable memory/keyboard package used in each User Friendly desktop computer to a Chinese manufacturer for 3,000 yuan. The South Korea division sells the comparable desktop computer to a South Korean distributor for 1,540,000 won. 0 E22-20 (similar to) Question Help User Friendly Computer, Inc., with headquarters in San Francisco, manufactures and sells a desktop Requirements computer. User Friendly has three divisions, each of which is located in a different country. Each division is 1. Calculate the after-tax operating income per unit earned by each division under the following run as a profit center, Information on each division follows: transfer pricing methods: (a) market price, (b) 150% of full cost, and (c) 300% of variable cost. (Click the icon to view the data.) (Income taxes are not included in the computation of the cost-based transfer prices.) 2. Which transfer pricing method(s) will maximize the after-tax operating income per unit of User Friendly Computer? Requirement 1. Calculate the after-tax operating income per unit eamed by each division under the following transfer-pricing methods: (a) market price, (b) 150% of full cost, and (c) 300% of variable cost. (Income taxes are not included in the computation of the cost-based transfer prices.) Begin with calculating the after-tax operating income for the China division under each method. Then complete the table for South Korea and the United States. (Convert all foreign currencies to U.S. dollars.) Method A Method B Method C China division Division revenue per unit Cost per unit: Division variable cost per unit Division fixed cost per unit Total division cost per unit Division operating income per unit Income tax at 40% Division net income per unit Enter any number in the edit fields and then click Check Answer. ? Data Table - China division: Variable cost = 900 yuan South Korea division: Fixed cost = 1,500 yuan Variable cost = 286,000 won Fixed cost = 407,000 won U.S. division Variable cost = $200 Fixed cost = $240 . Chinese income tax rate on the China division's operating income: 40% South Korean income tax rate on the South Korea division's operating income: 20% U.S. income tax rate on the U.S. division's operating income: 40% Each desktop computer is sold to retail outlets in the United States for $2,800. Assume that the current foreign exchange rates are as follows: 6 yuan = $1 U.S. 1,100 won = $1 U.S. Both the China and the South Korea divisions sell part of their production under a private label. The China division sells the comparable memory/keyboard package used in each User Friendly desktop computer to a Chinese manufacturer for 3,000 yuan. The South Korea division sells the comparable desktop computer to a South Korean distributor for 1,540,000 won