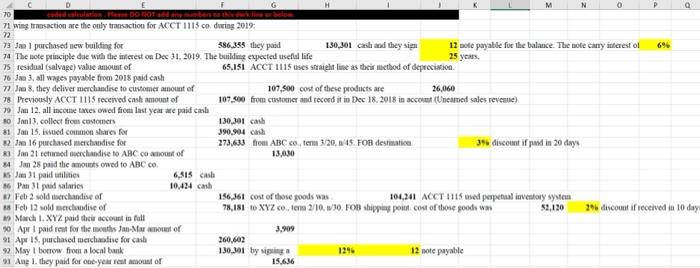

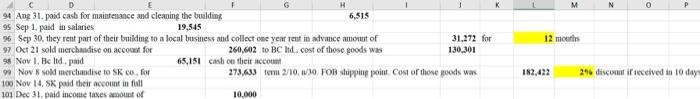

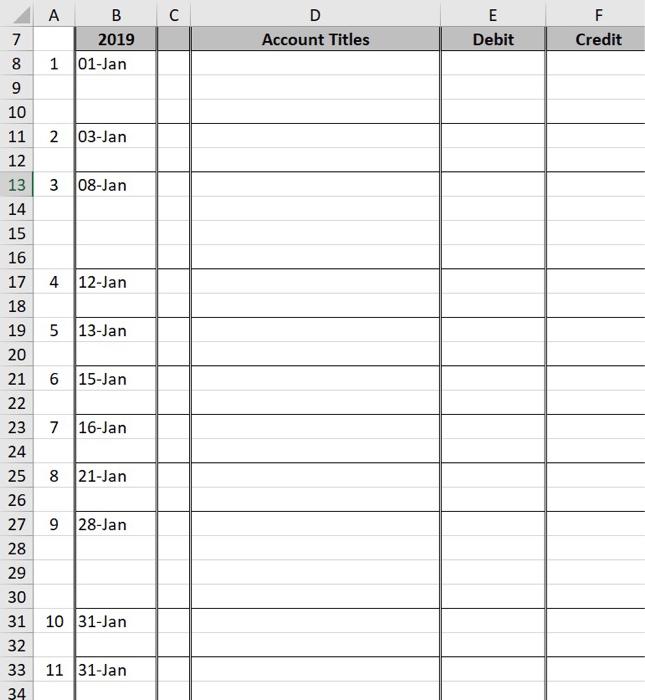

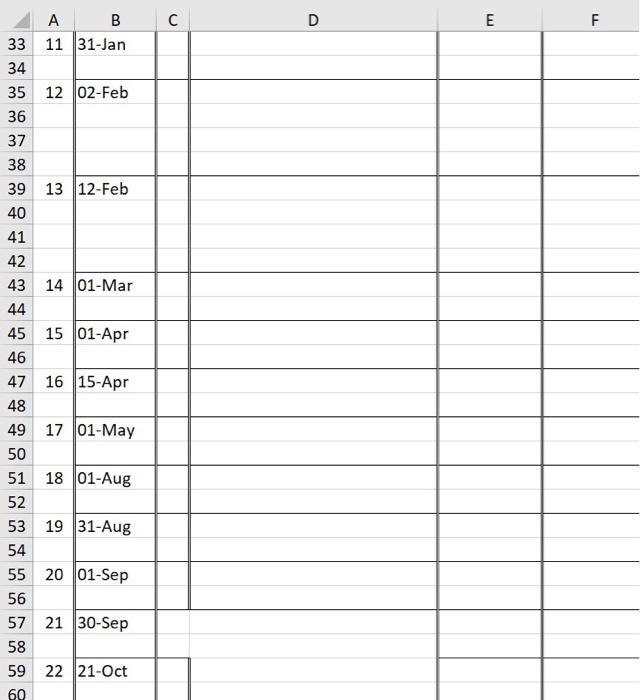

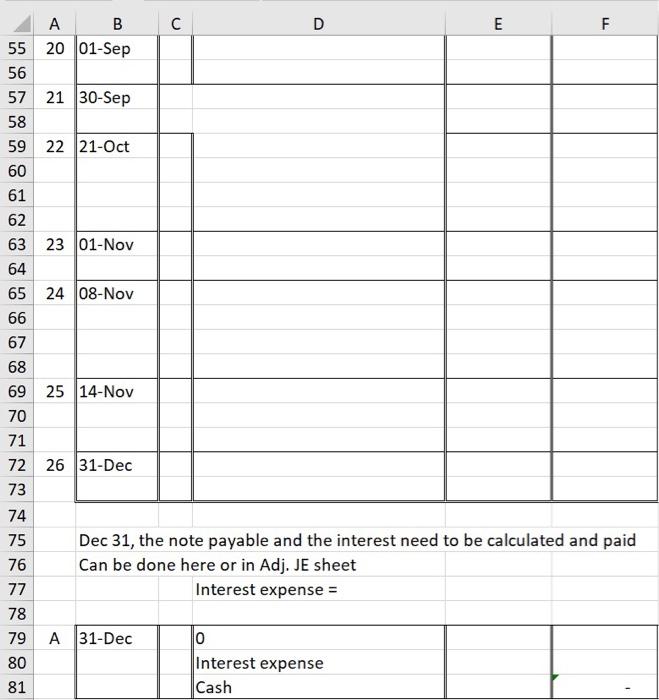

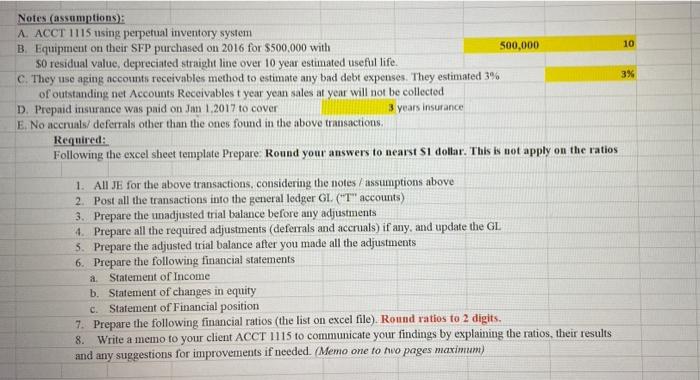

0 P H 70 l wing trinsection are the only transaction for ACCT 1113 co during 2019: 22 73 a 1 purchased new building for 586,355 they paid 1.30.301 cash and they sign 12 note payable for the balance. The more carry interest of 696 74 The note principle dae with the interest on Dec 31, 2019. The building expected useful life 25 yes. 75 residual (salvage) vale amount of 65,151 ACCT 1115 uses strateht line as their method of depreciation 76 3 3. all wages payable from 2018 paid cash 77 Jan 8, they deliver merchandise to customer amount of 107.500 cost of these products are 26,060 78 Previously ACCT III received cash amount of 107.500 from citastomer and record it in Dec 18, 2018 in account (Unenned sales revenue) 99 Jau 12. all income taxes owed from last year we paid cash 10 Jan 13. collect from customers 130,301 cash 31 Jan 15. inued common shares for 390,901 cash 22 Jan 16 purchased merchandise for 273,63 from ABC Co, term 3/20,845. FOB destinatice 34 discouit if paid in 20 day 83 Sa 21 remedorchandise to ABC common of 13,0.30 Jan 28 paid the amounts owed to ABC Co AS J I paid utilities 6,815 cash 36 Pan 31 padalies 10,424 cash *) Feb 2 sold archandise of 156,361 cost of the goods was 104,241 AOCT 1115 used perpetual inventory system * Feb 12 volcndise of 78,181 XYZ Co, tem 2/10, W30 FOB shipping point cost of those goods wa 59,120 256 discount if received in 10 day 19 Mach I.XYZ paid their account in full 90 Apr I paid root for the oth Jan-M Not of 3.909 91 Apr 15 puchased mechanise for cash 260,602 92 May I borrow from a local bank 130.301 by a 1246 12 note payable 1 Aue 1, they paid for one year out of 15,636 M 0 12 months C D 94 Ang 31.pand cash for maintenance and cleaning the building 6,515 95 Sep 1. paid in salaries 19,545 96 Sep 30, they rent part of their building to a local business and collect one year rent in advance amont of 31.272 for 97 Oct 21 sold merchandise on account for 260,602 to BC ltd. cost of those goods was 130,301 > Nov 1, Bled paid 65,151 cash on their account 99 Nov sold merchandise to SK co, for 273,633 em 2/10.10. FOB huipping point Cost of those woods was 100 Nov 14, SK paid their account in full 101 Dec 31. paid income taxes out of 10,000 183,422 29 disconti received in 10 day C A B 2019 1 01-Jan D Account Titles E Debit F Credit 7 oc 7 8 9 10 2 03-Jan 11 12 13 3 08-Jan 14 15 16 17 18 19 4 12-Jan 5 13-Jan 20 21 6 15-Jan 22 23 7 16-Jan 24 25 8 21-Jan 26 27 9 28-Jan 28 29 30 31 10 31-Jan 32 33 11 31-Jan 34 D E F 33 11 31-Jan 34 35 12 02-Feb 36 37 38 39 13 12-Feb 40 41 42 43 14 01-Mar 44 45 15 01-Apr 46 47 16 15-Apr 48 49 17 01-May 50 51 18 01-Aug 52 53 19 31-Aug 54 55 20 01-Sep 56 57 21 30-Sep 58 59 22 21-Oct 60 D E F F A B 55 20 01-Sep 56 57 21 30-Sep 58 59 22 21-Oct 60 61 62 63 23 01-Nov 64 65 24 08-Nov 66 67 68 69 25 14-Nov 70 71 72 26 31-Dec 73 74 75 Dec 31, the note payable and the interest need to be calculated and paid Can be done here or in Adj. JE sheet 77 Interest expense = 78 79 A 31-Dec o Interest expense 81 Cash 76 80 10 Notes (assumptions): A. ACCT 1115 using perpetual inventory system B. Equipment on their SFP purchased on 2016 for $500,000 with 500,000 50 residual value, depreciated straight line over 10 year estimated useful life. C. They use aging accounts receivables method to estimate any bad debt expenses. They estimated 3% 3% of outstanding net Accounts Receivables t year yern sales at year will not be collected D. Prepaid insurance was paid on Jan 1, 2017 to cover 3 years insurance E. No accruals/deferrals other than the ones found in the above transactions Required: Following the excel sheet template Prepare Round your answers to nearst Si dollar. This is not apply on the ratios 1. All JE for the above transactions, considering the notes/ assumptions above 2. Post all the transactions into the general ledger GI. ("T" accounts) 3. Prepare the unadjusted trial balance before any adjustments 4. Prepare all the required adjustments (deferrals and accruals) if any, and update the GL 5. Prepare the adjusted trial balance after you made all the adjustments 6. Prepare the following financial statements Statement of Income b. Statement of changes in equity c. Statement of Financial position 7. Prepare the following financial ratios (the list on excel file). Round ratios to 2 digits. 8. Write a memo to your client ACCT 1115 to communicate your findings by explaining the ratios, their results and any suggestions for improvements if needed. (Memo one to no pages maximum) a