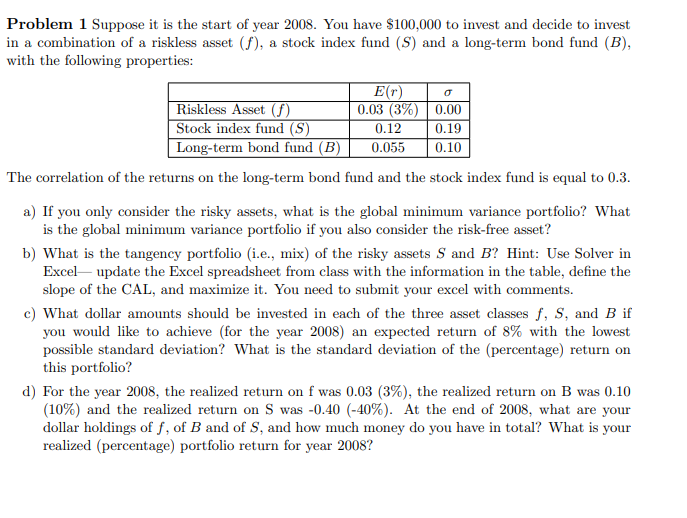

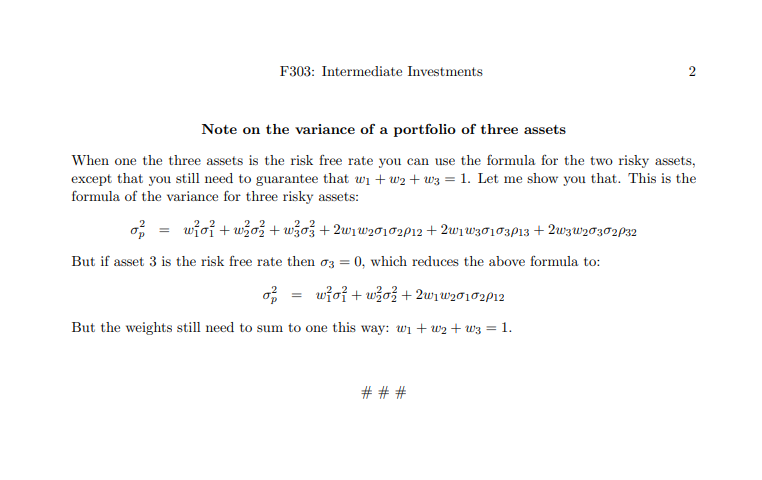

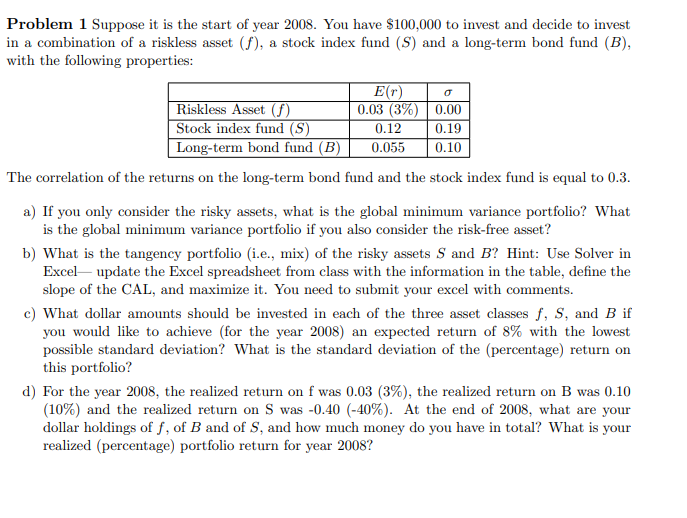

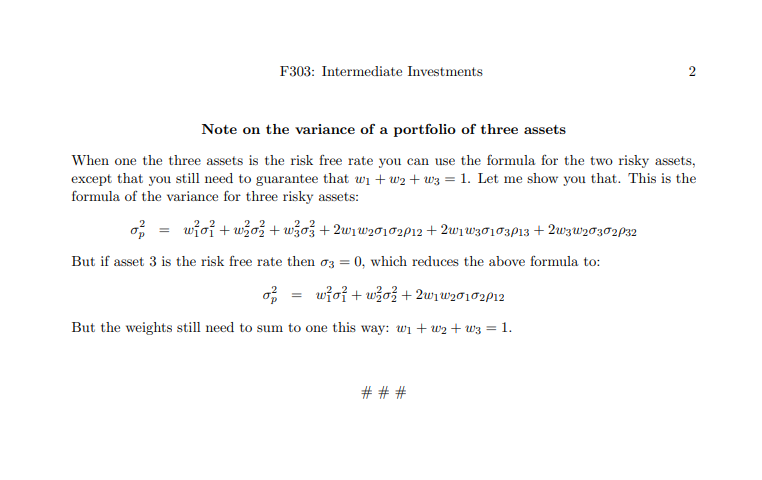

0 Problem 1 Suppose it is the start of year 2008. You have $100,000 to invest and decide to invest in a combination of a riskless asset (f), a stock index fund (S) and a long-term bond fund (B), with the following properties: E(r) Riskless Asset (S) 0.03 (3%) 0.00 Stock index fund (S) 0.12 0.19 Long-term bond fund (B) 0.055 0.10 The correlation of the returns on the long-term bond fund and the stock index fund is equal to 0.3. a) If you only consider the risky assets, what is the global minimum variance portfolio? What is the global minimum variance portfolio if you also consider the risk-free asset? b) What is the tangency portfolio (i.e., mix) of the risky assets S and B? Hint: Use Solver in Excel update the Excel spreadsheet from class with the information in the table, define the slope of the CAL, and maximize it. You need to submit your excel with comments. c) What dollar amounts should be invested in each of the three asset classes f, S, and B if you would like to achieve (for the year 2008) an expected return of 8% with the lowest possible standard deviation? What is the standard deviation of the (percentage) return on this portfolio? d) For the year 2008, the realized return on f was 0.03 (3%), the realized return on B was 0.10 (10%) and the realized return on S was -0.40 (-40%). At the end of 2008, what are your dollar holdings of f, of B and of S, and how much money do you have in total? What is your realized (percentage) portfolio return for year 2008? F303: Intermediate Investments 2 Note on the variance of a portfolio of three assets When one the three assets is the risk free rate you can use the formula for the two risky assets, except that you still need to guarantee that wi+w2 + w3 = 1. Let me show you that. This is the formula of the variance for three risky assets: om wid + wo+wo +2w1W20102012 + 2w1230103P13 + 2w3w20302232 But if asset 3 is the risk free rate then 03 0, which reduces the above formula to: o = wo + wo + 2W1 W120102012 But the weights still need to sum to one this way: wi+w2 + W3 = 1. # # #