Answered step by step

Verified Expert Solution

Question

1 Approved Answer

0 Question 3 Kevin and Janet are the divorced parents of one child, and together they furnish all of her support. The divorce decree,

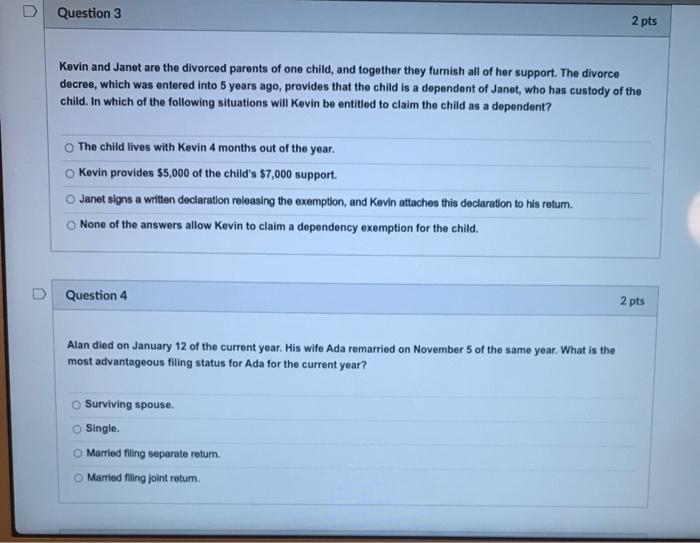

0 Question 3 Kevin and Janet are the divorced parents of one child, and together they furnish all of her support. The divorce decree, which was entered into 5 years ago, provides that the child is a dependent of Janet, who has custody of the child. In which of the following situations will Kevin be entitled to claim the child as a dependent? The child lives with Kevin 4 months out of the year. O Kevin provides $5,000 of the child's $7,000 support. O Janet signs a written declaration releasing the exemption, and Kevin attaches this declaration to his return. None of the answers allow Kevin to claim a dependency exemption for the child. Question 4 Alan died on January 12 of the current year. His wife Ada remarried on November 5 of the same year. What is the most advantageous filing status for Ada for the current year? Surviving spouse. 2 pts O Single. O Married filing separate return. O Married filling joint return. 2 pts

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Q3 Option 3 Janet sings a written declaration releasing the exemption and Kevin attaches this declar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started