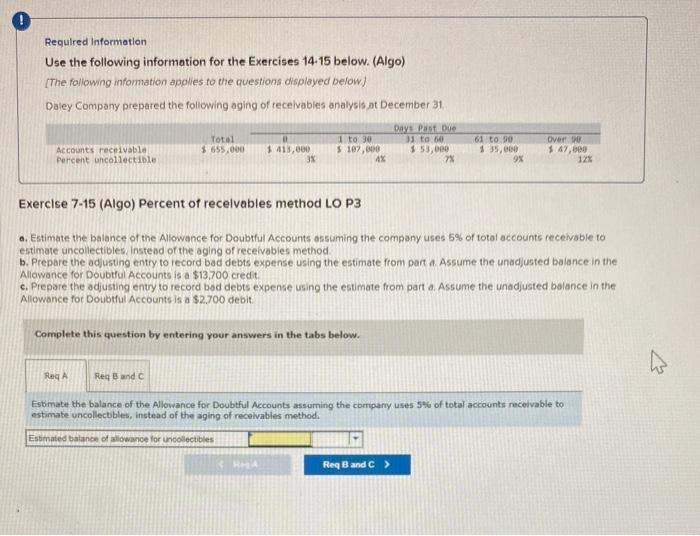

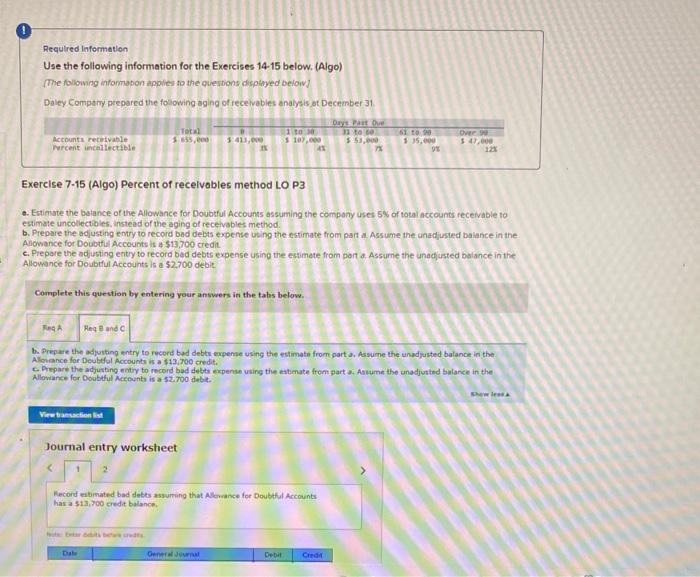

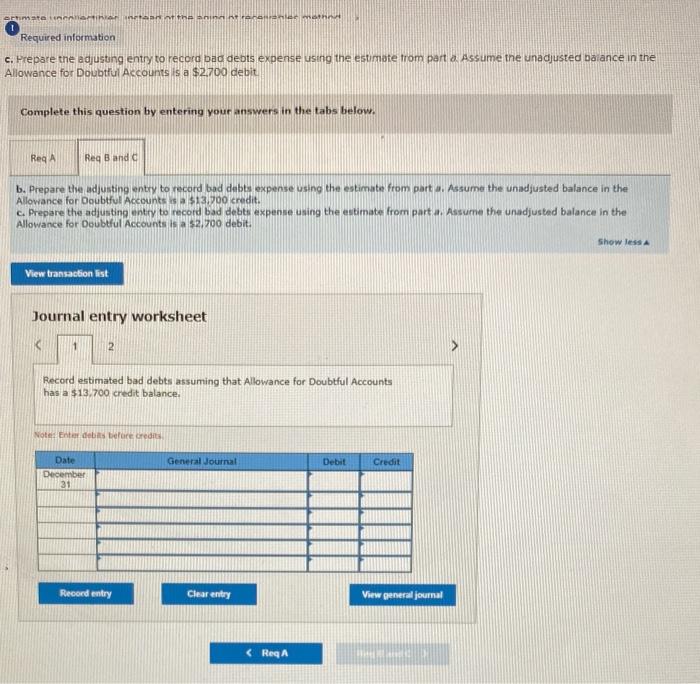

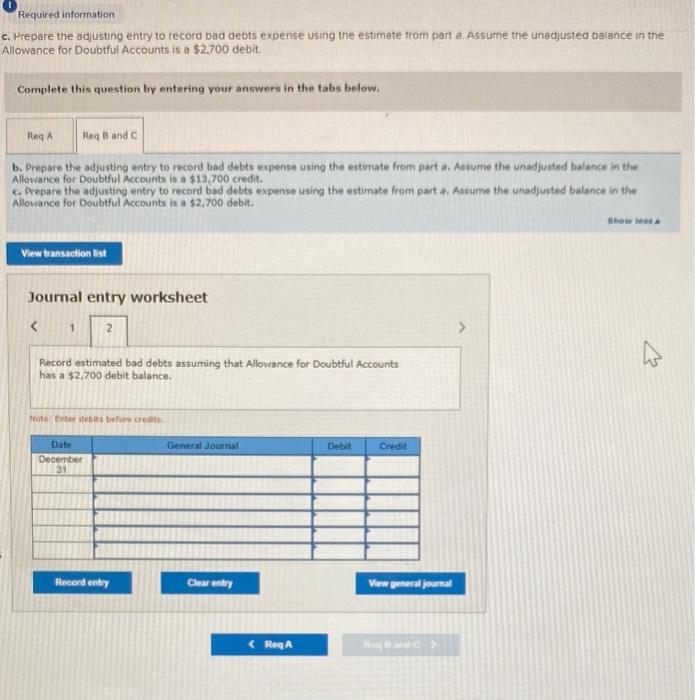

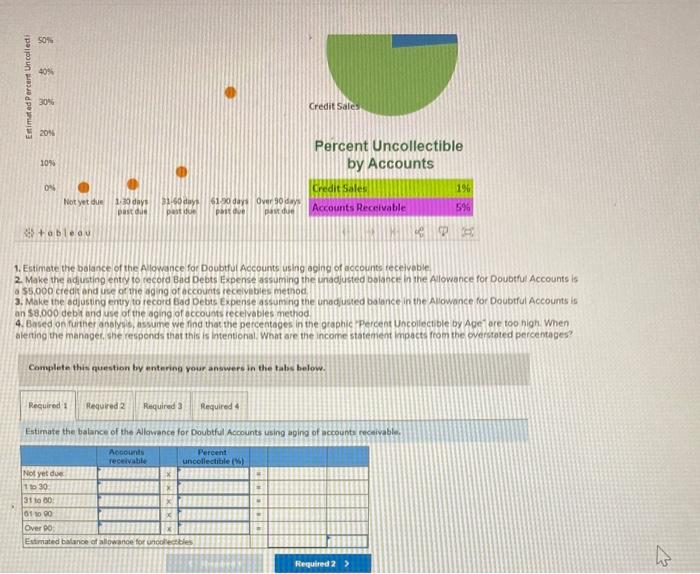

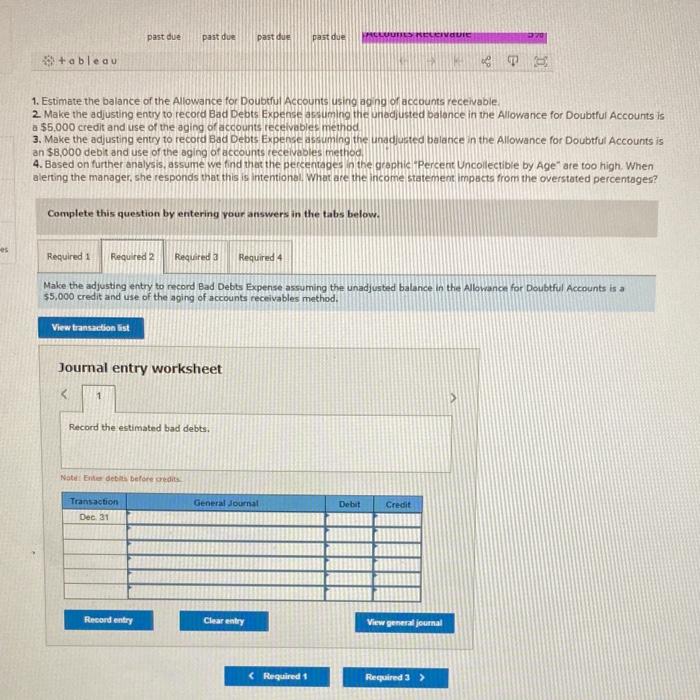

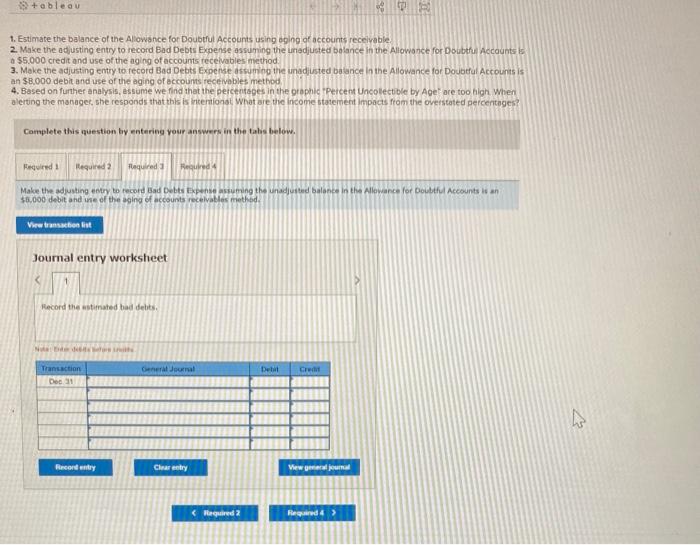

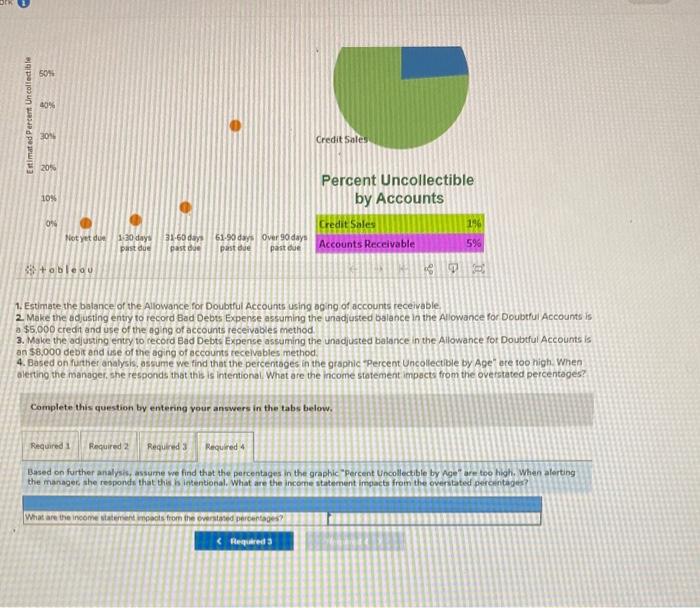

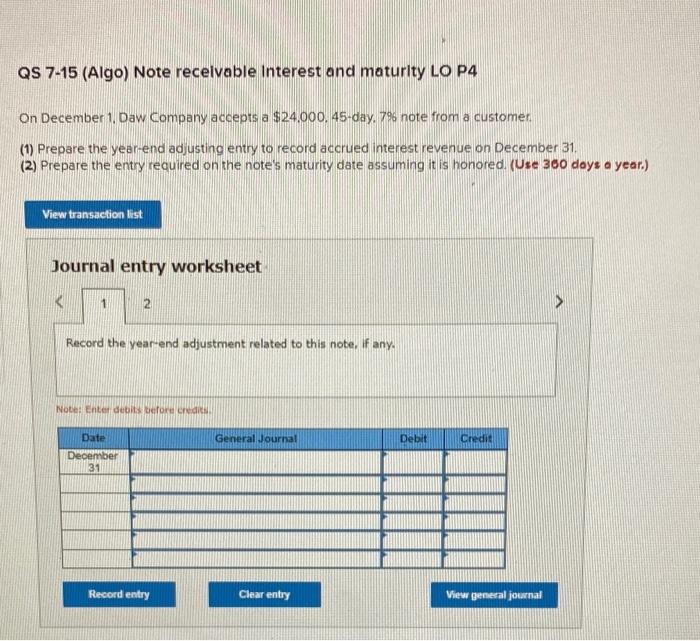

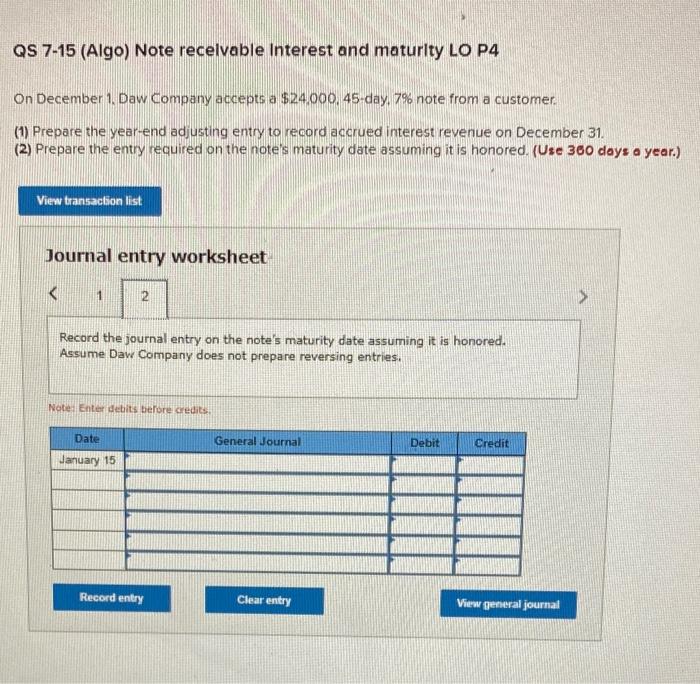

0 Required Information Use the following information for the Exercises 14-15 below. (Algo) [The following information applies to the questions displayed below) Daley Company prepared the following aging of receivables analysis at December 31 Days Past Due Total 1 to 30 3 to 60 Accounts receivable $ 655.000 1413,000 107,000 5.53,000 Percent uncollectible 36 4% 74 61 to 90 $ 35,000 9% Over 90 147,00 12% Exercise 7-15 (Algo) Percent of receivables method LO P3 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method b. Prepare the adjusting entry to record bad debts expense using the estimate from part a Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,700 credit c. Prepare the adjusting entry to record bod debts expense using the estimate from parts. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2.700 debit Complete this question by entering your answers in the tabs below. Raq Reg Band Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. Estimated balance of allowance for collectibles Req Band C > Required Information Use the following information for the Exercises 14-15 below. (Algo) The following information applies to the questions displayed below) Daley Company prepared the following aging of receivables analysis of December 31 Days Part Total 110 31 to Accounts receivable $55,00 3-413,000 $ 107,000 $ 53,000 rcent uncollectible 610 Over 547.000 123 90 Exercise 7-15 (Algo) Percent of receivables method LO P3 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. Prepare the adjusting entry to record bad debts expense using the estimate from paita Assume the unadjusted balance in the Allowance for Doubtful Accounts is $13,700 credit c. Prepare the adjusting entry to record bed debts expense using the estimate from porta. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2.700 debit Complete this question by entering your answers in the tabs below. RA Heqe und C b. Prepare the adjusting entry to record bad debts expense using the estimate from parts. Assume the unadjusted balance in the Allowance for Doubtful Account is a $13.700 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from porta. Anume the unadjusted balance in the Allowance for Doubtful Accounts is a $2.700 debit Journal entry worksheet Hacord estimated bad debts assuring that Allowance for Doubtful Accounts has a $13,700 credit balance Generator Debi Cred ernmateriaattheanintienen leimath Required information c. Prepare the adjusting entry to record bad debts expense using the estmte from part a Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2.700 debit Complete this question by entering your answers in the tabs below. ReqA Req Banda b. Prepare the adjusting entry to record bad debts expense using the estimate from parts. Assume the unadjusted balance in the Allowance for Doubtful Accounts a $13.700 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from parts. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2.700 debit. Show less View transaction list Journal entry worksheet 1 2 Record estimated bad debts assuming that Allowance for Doubtful Accounts has a $13.700 credit balance. Note Enti debore redit General Journal Debit Credit Date December 31 Record entry Clear entry View general journal G past due past due past du past due PRELUUTSELIVUI +ableau 1. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable 2. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is a 55.000 credit and use of the aging of accounts receivables method 3. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is an $8,000 debit and use of the aging of accounts receivables method 4. Based on further analysis, assume we find that the percentages in the graphic "Percent Uncollectible by Age are too high. When alerting the manager, she responds that this is intentional. What are the income statement impacts from the overstated percentages? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required 4 Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is a $5,000 credit and use of the aging of accounts receivables method. View transaction list Journal entry worksheet 1 Record the estimated bad debts. Note Edet before credits General Journal Transaction Dec 31 Debit Credit Record entry Clear entry View general journal $+ableau 1. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable 2. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts 55.000 credit and use of the aging of accounts receivables method 3. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is an $8.000 debit and use of the aging of accounts receivables method 4. Based on further analysis, assume we find that the percentages in the graphic "Percent Uncolectible by Age are too high When alerting the manager, she responds that this is intentionat What are the income statement impacts from the overstated percentages? Complete this question by entering your answers in the tabs below. Required Required 2 Tequired Required Malce the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is an $3.000 debit and ine of the aging of accounts receivables method. View transaction lit Journal entry worksheet Record the estimated bad debits Nu General Journal Det Cr Transaction Dec Record Charly View all 505 10% Estimated Percent Un collectible 309 Credit Sales 20% 10% Percent Uncollectible by Accounts Credit Sales 190 09 Not yet de 10 days 31-60 days 61.93 days Over 90 days past due past due past de past due obledo 596 Accounts Receivable 0 1. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable 2. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is a $5,000 credit and use of the aging of accounts receivables method 3. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is an $8,000 debt and ise of the aging of accounts receivables method 4. Based on further analysis, assume we find that the percentages in the graphic "Percent Uncollectible by Age" are too high. When alerting the manager, she responds that this is intentional. What are the income statement impacts from the overstated percentages? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required 4 Based on further analysis, assume we find that the percentages in the graphic Percent Uncollectible by Age are too high. When alerting the manager she responds that this intentional. What are the income statement impacts from the overstated percentages? What are the income talemate meets from the overstored centage Required QS 7-15 (Algo) Note receivable Interest and maturity LO P4 On December 1, Daw Company accepts a $24.000.45-day, 796 note from a customer (1) Prepare the year-end adjusting entry to record accrued Interest revenue on December 31 (2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 300 days a year.) View transaction list Journal entry worksheet 1 2 Record the year and adjustment related to this note. If any. Note: Enter debit before CRNI Date General Journal Debit Credit December 31 Record entry Clear entry View general journal QS 7-15 (Algo) Note recelvable Interest and maturity LO P4 On December 1, Daw Company accepts a $24.000,45 day. 7% note from a customer (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31, (2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 300 days a year.) View transaction list Journal entry worksheet