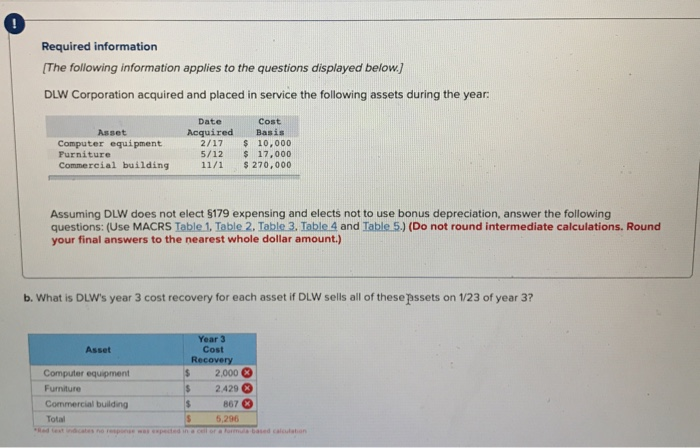

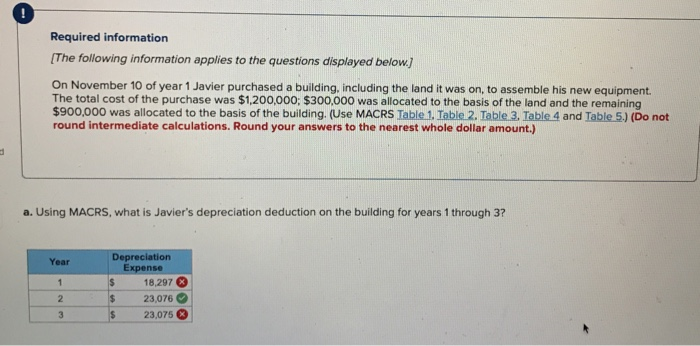

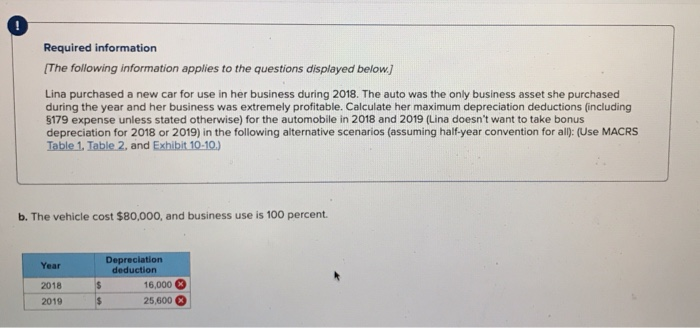

0 Required informatiorn The following information applies to the questions displayed below DLW Corporation acquired and placed in service the following assets during the year Date Cost Basis Asset Acquired Computer equipment Furniture Commercial building 2/17 10,000 5/12 17,000 11/1 $270,000 Assuming DLW does not elect $179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2. Table 3. Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) b. What is DLW's year 3 cost recovery for each asset if DLW sells all of thesepssets on 1/23 of year 3? Asset Cost $ 2,000 2.429 3 Computer equipment Furniture Commercial building Total S867 5,296 n a cell or a rla based calculation 0 Required information The following information applies to the questions displayed below.] On November 10 of year 1 Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,200,000: $300.000 was allocated to the basis of the land and the remaining $900,000 was allocated to the basis of the building. (Use MACRS Table 1. Table 2. Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) a. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3? Depreciation Expense Year 18,297 23,076 23,075 Required information The following information applies to the questions displayed below] Lina purchased a new car for use in her business during 2018. The auto was the only business asset she purchased during the year and her business was extremely profitable. Calculate her maximum depreciation deductions (including 5179 expense unless stated otherwise) for the automobile in 2018 and 2019 (Lina doesn't want to take bonus depreciation for 2018 or 2019) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1, Table 2, and Exhibit 10-10.) b. The vehicle cost $80,000, and business use is 100 percent Depreciation deduction Year 2018 2019 16,000 25,600 0 Required informatiorn The following information applies to the questions displayed below DLW Corporation acquired and placed in service the following assets during the year Date Cost Basis Asset Acquired Computer equipment Furniture Commercial building 2/17 10,000 5/12 17,000 11/1 $270,000 Assuming DLW does not elect $179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2. Table 3. Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) b. What is DLW's year 3 cost recovery for each asset if DLW sells all of thesepssets on 1/23 of year 3? Asset Cost $ 2,000 2.429 3 Computer equipment Furniture Commercial building Total S867 5,296 n a cell or a rla based calculation 0 Required information The following information applies to the questions displayed below.] On November 10 of year 1 Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,200,000: $300.000 was allocated to the basis of the land and the remaining $900,000 was allocated to the basis of the building. (Use MACRS Table 1. Table 2. Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) a. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3? Depreciation Expense Year 18,297 23,076 23,075 Required information The following information applies to the questions displayed below] Lina purchased a new car for use in her business during 2018. The auto was the only business asset she purchased during the year and her business was extremely profitable. Calculate her maximum depreciation deductions (including 5179 expense unless stated otherwise) for the automobile in 2018 and 2019 (Lina doesn't want to take bonus depreciation for 2018 or 2019) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1, Table 2, and Exhibit 10-10.) b. The vehicle cost $80,000, and business use is 100 percent Depreciation deduction Year 2018 2019 16,000 25,600