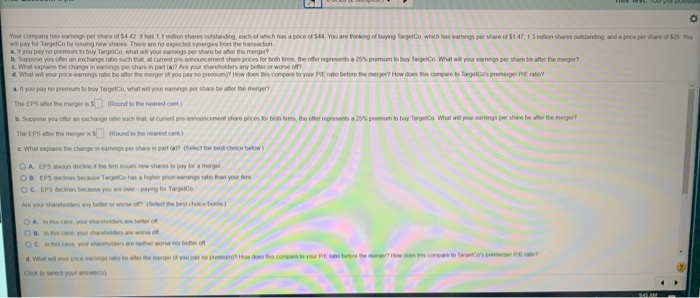

0 Your company has earnings pet share of 5442 ha 11 million shares outstanding, each of which has a price of 544. You are thinking of buying TargetCo which has earnings per share of $147,13 million shares outstanding and price pershare of 525 You wipay for TargetCo byssung now she There are no expected synergestion the transaction 2. If you pay no premium to buy Target what will your camnings per Share beater the merger? b. Suppose you offer an exchange ratio such that of current pre-announcement share prices for both firms, the offer represents a 25 premium to buy Tapetco What will your earnings per share better the merger? What explains the change in eangs per share in parla Are your shareholders anber or worse a. What we your price canings ratio te after the merger (f you pay no premun? How does this compare to your PE ratio before the merger How does this compare to lagetCo's perge Pattato? a. If you pay no premium to buy Target what will your earnings per share be after the merger? The EPS her the meer as Round to the nearest cont) b. Suppose you on exchange with a current prenoncement Share prices for botims, the other represents a promumtowy Targets What will your earnings per share bear the merger? The EPS ahe theme is sound to the nearest cent) What expans the change in earnings per share in partlap Select the best choice below OA EPS always decline the more to pay for a manger OD EPS Geces because Targot has a higher cestoran youtum OC EPS Geches because you are a lot og Are your shower or worse? Select the best choice O Athos arbete Od web Click to your we M 0 Your company has earnings pet share of 5442 ha 11 million shares outstanding, each of which has a price of 544. You are thinking of buying TargetCo which has earnings per share of $147,13 million shares outstanding and price pershare of 525 You wipay for TargetCo byssung now she There are no expected synergestion the transaction 2. If you pay no premium to buy Target what will your camnings per Share beater the merger? b. Suppose you offer an exchange ratio such that of current pre-announcement share prices for both firms, the offer represents a 25 premium to buy Tapetco What will your earnings per share better the merger? What explains the change in eangs per share in parla Are your shareholders anber or worse a. What we your price canings ratio te after the merger (f you pay no premun? How does this compare to your PE ratio before the merger How does this compare to lagetCo's perge Pattato? a. If you pay no premium to buy Target what will your earnings per share be after the merger? The EPS her the meer as Round to the nearest cont) b. Suppose you on exchange with a current prenoncement Share prices for botims, the other represents a promumtowy Targets What will your earnings per share bear the merger? The EPS ahe theme is sound to the nearest cent) What expans the change in earnings per share in partlap Select the best choice below OA EPS always decline the more to pay for a manger OD EPS Geces because Targot has a higher cestoran youtum OC EPS Geches because you are a lot og Are your shower or worse? Select the best choice O Athos arbete Od web Click to your we M