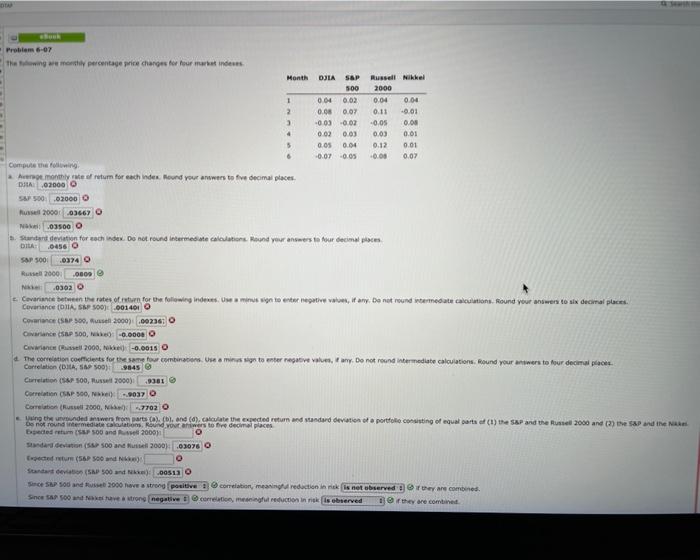

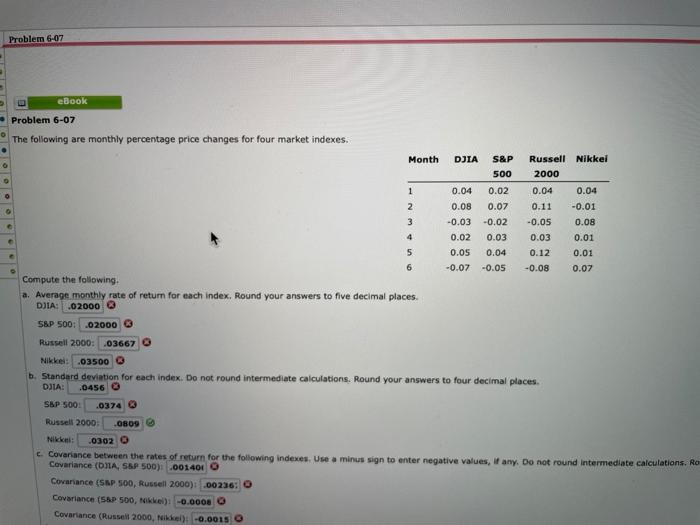

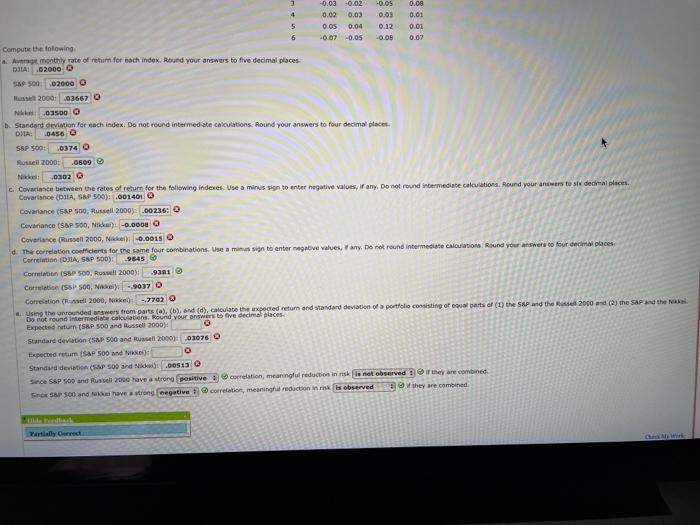

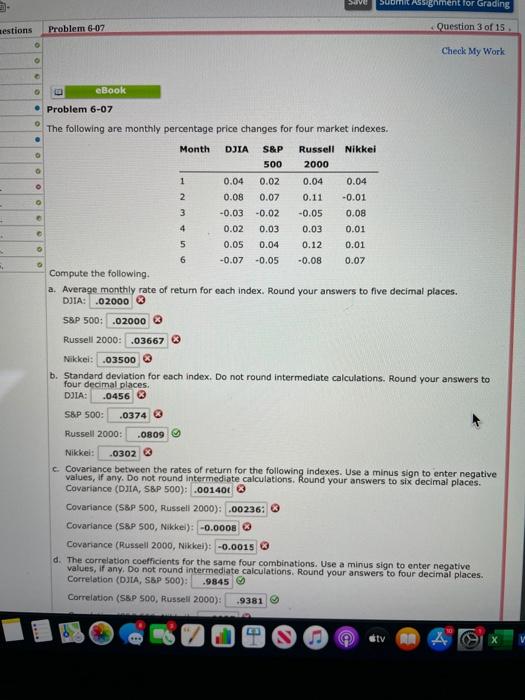

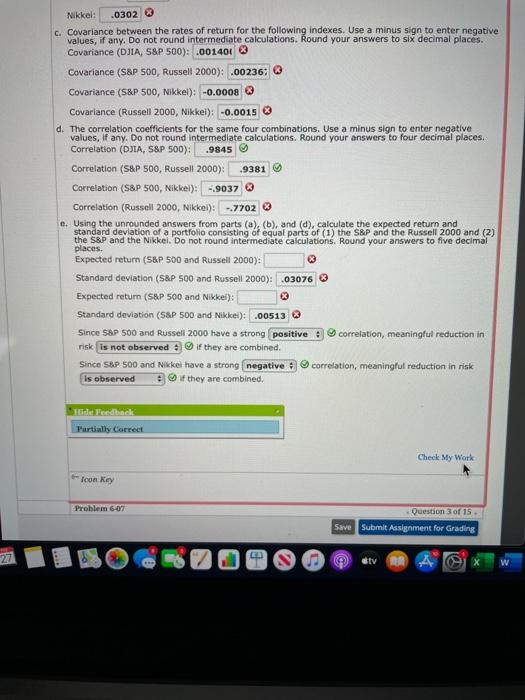

0.0 0324 0 Problem 6-07 the percentage price charges for our art idees Month DJIA SAP Russel Nikkel 500 2000 1 0.04 0.02 0.04 0.04 2 0.00 0.07 0.11 0.01 3 -0.0302 -0.05 0.00 4 000 003 003 0.01 5 003 0.04 0.12 0.01 -0.02 -0.05 Compute the following no momentum for each inder. Hound your answers to five decimal places DA 020000 S 500 020000 Mussel 20001 03667 O NO 03500 O Sturture deviation for each index Do not round intermediate calculator Round your answers to four decima 0456 S&P 500 Russell 2000 0809 0302 Caveriante between the rate of stor for the following indexes. Uw minus vign to enter reptive www.it any. Do not round intermediate calculations. Round your answers to six decimal places Covenance (DIA, SEPS00).001401 Covariance sa 500. Musel 20001.002361 O Cance SAP 500, 0.0000 O Cell 2000, -0.0015 O The correction concerts for the same for combinators. Use a minu sign to enter reparive Vau, Pawy. Do not round intermediate calculations. Round your answers to four decimal Correlation (DA, SAP 500) Carrelation (S&P 500, 2000) Correlation (SAP 500, -9037 O Correlation (2000, N7702 O ung the down from parts coland().we tegeed retum and standard deviation of a portfolio conting of equal parts of (1) the Sap and the Russell 2000 and the Pad the and to five dem places Dededen (SSP 500 and 2000) O dard deviation (500 and 2000).03076 O wete (56P ON Standart (SAP 500 and 00513 O Since SAP SD and R 2000 have strong positive correlation, meaning reduction in se observed they are combined. Since Sadron negative correlatie met reduction in risk observed they are combined Problem 6-07 eBook Problem 6-07 The following are monthly percentage price changes for four market indexes. Month DJIA S&P Russell Nikkel 500 2000 1 0.04 0.02 0.04 0.04 2 0.08 0.07 0.11 -0.01 3 -0.03 -0.02 -0.05 0.08 0.02 0.03 0.03 0.01 5 0.05 0.04 0.12 0.01 6 -0.07 -0.05 -0.08 0.07 Compute the following a. Average monthly rate of return for each index, Round your answers to five decimal places. DIA:.02000 S&P 5001 02060 Russell 2000: .03667 Nikkel: .03500 b. Standard deviation for each index. Do not round intermediate calculations, Round your answers to four decimal places. DJIA: .0456 S&P 500: .0374 Russell 2000 0809 Nick: 0302 c. Covariance between the rates of return for the following indexes. Use a minus sign to enter negative values, Wany. Do not round Intermediate calculations. Ro Covariance (DNA, SSP 500).0014010 Covariance (S&P 500, Russell 2000) .00236 Covariance (56P 500, Nikkel) -0.0004 0 Covariance (Russell 2000, Nikkel): -0.0015 3 -0.03 -0.02 -0.05 0.06 4 0.02 0.03 0.03 0.01 5 0.05 0.04 0.12 0.01 6 -0.07 -0.05 -0.05 0.07 Compute the following Ang monthly rate of return for each index. Round your answers to five decimal places DIA! .02000 O SMP 500 .02000 Hus 20001 .03667 0 Bi 0390 b. Standard deviation for each index. Do not round intermediate calculations. Round your answers to four decimal places DIA 0456 0 55P 500: 0374 0 Russell 2000: 0509 Nike 0302 O c. Covariance between the rates of return for the following indexes: Use a minus sign to enter negative values, if any, Do not roundermediate calculations. Round your answers to si decimal places Covariance (OLA, SM 500.001401 O Covariance (SAP 500, Russell 2000): .002363 Covariance (S&P 500, NIE): -0.0000 0 Covariance (Russell 2000, N -0.0015 O d. The correlation coefficients for the same four combinations. Use to enter negative values, any. Do not round Intermediate calculations. Round your answers to four decimal places Correlation (DA, S&P 500) Correlation (SSP 500, Russell 2000) 9303 Cortion (55P 500, Nadiy -9037 0 Correlation (sell 2000, -.7702 using the unrounded answers from parts (a), (b), and (d), calculate the expected return and standard deviation of portfolio consisting of coul parts of (1) the SP and the Red 2000 and (2) the SAP and the Do round intermediate calculations, Round your answers to five decimal places Expected return (SAP 500 and Russell 2000): 0 Standard deviation (SAP 500 and Russell 2000): 03076 O Expected return (SAP 500 and Standard deviation SAP SD and Nick .00513 Since S&P 500 and Russell 2000 have a strong positive correlation, meaningful reduction in riskenet observed in they are combined SS500 and have a strong negative correlation, meaningful reduction is observed w they we came Partially Cered SVE Suomi Assignment for Grading aestions Problem 6-02 Question 3 of 15 Check My Work o eBook @ o O O . Problem 6-07 The following are monthly percentage price changes for four market indexes. Month DJIA S&P Russell Nikkel 500 2000 1 0.04 0.02 0.04 0.04 2 0.08 0.07 0.11 -0.01 3 -0.03 -0.02 -0.05 0.08 4 0.02 0.03 0.03 0.01 5 0.05 0.04 0.12 0.01 6 -0.07 -0.05 -0.08 0.07 Compute the following a. Average monthly rate of return for each index. Round your answers to five decimal places. DJIA: .02000 3 S&P 500: .02000 3 Russell 2000: .03667 Nikkel: .03500 b. Standard deviation for each index. Do not round intermediate calculations. Round your answers to four decimal places. DIA: .0456 3 S&P 500: .0374 Russell 2000: .0809 Nikkel: .0302 3 Covariance between the rates of return for the following indexes. Use a minus sign to enter negative values, if any. Do not round Intermediate calculations. Round your answers to six decimal places Covariance (DJIA, S&P 500): .001401 Covariance (S&P 500, Russell 2000): .00236: Covariance (S&P SOO, Nikkel): -0.0008 Covariance (Russell 2000, Nikkel): -0.0015 d. The correlation coefficients for the same four combinations. Use a minus sign to enter negative values, if any, Do not round intermediate calculations. Round your answers to four decimal places. Correlation (DJIA, S&P 500): .9845 Correlation (S&P 500, Russell 2000): .9381 sty .9381 Nikkel: .0302 c. Covariance between the rates of return for the following indexes. Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers to six decimal places. Covariance (DJIA, S&P 500): .001400 Covariance (S&P 500, Russell 2000): .00236; Covariance (S&P 500, Nikkel): -0.0008 * Covariance (Russell 2000, Nikkel): -0.0015 d. The correlation coefficients for the same four combinations. Use a minus sign to enter negative values, If any. Do not round Intermediate calculations. Round your answers to four decimal places. Correlation (DIA, S&P 500): .9845 Correlation (S&P 500, Russell 2000): Correlation (S&P 500, Nikkel): -9037 @ Correlation (Russell 2000, Nikkel): -7702 e. Using the unrounded answers from parts (a), (b), and (d), calculate the expected return and standard deviation of a portfolio consisting of equal parts of (1) the S&P and the Russell 2000 and (2) the S&P and the Nikkei. Do not round intermediate calculations. Round your answers to five decimal places. Expected return (S&P 500 and Russell 2000) Standard deviation (S&P 500 and Russell 2000): .03076 Expected return (S&P 500 and Nikkel): Standard deviation (S&P 500 and Nikkel): .00513 Since S&P 500 and Russell 2000 have a strong positive correlation, meaningful reduction in risk is not observed if they are combined. Since S&P 500 and Nikkel have a strong negative correlation, meaningful reduction in risk is observed if they are combined. Slide Feedback Partially Correct Check My Work -- Icon Key Problem 6-07 Question 3 of 15 Save Submit Assignment for Grading 27 sty W 0.0 0324 0 Problem 6-07 the percentage price charges for our art idees Month DJIA SAP Russel Nikkel 500 2000 1 0.04 0.02 0.04 0.04 2 0.00 0.07 0.11 0.01 3 -0.0302 -0.05 0.00 4 000 003 003 0.01 5 003 0.04 0.12 0.01 -0.02 -0.05 Compute the following no momentum for each inder. Hound your answers to five decimal places DA 020000 S 500 020000 Mussel 20001 03667 O NO 03500 O Sturture deviation for each index Do not round intermediate calculator Round your answers to four decima 0456 S&P 500 Russell 2000 0809 0302 Caveriante between the rate of stor for the following indexes. Uw minus vign to enter reptive www.it any. Do not round intermediate calculations. Round your answers to six decimal places Covenance (DIA, SEPS00).001401 Covariance sa 500. Musel 20001.002361 O Cance SAP 500, 0.0000 O Cell 2000, -0.0015 O The correction concerts for the same for combinators. Use a minu sign to enter reparive Vau, Pawy. Do not round intermediate calculations. Round your answers to four decimal Correlation (DA, SAP 500) Carrelation (S&P 500, 2000) Correlation (SAP 500, -9037 O Correlation (2000, N7702 O ung the down from parts coland().we tegeed retum and standard deviation of a portfolio conting of equal parts of (1) the Sap and the Russell 2000 and the Pad the and to five dem places Dededen (SSP 500 and 2000) O dard deviation (500 and 2000).03076 O wete (56P ON Standart (SAP 500 and 00513 O Since SAP SD and R 2000 have strong positive correlation, meaning reduction in se observed they are combined. Since Sadron negative correlatie met reduction in risk observed they are combined Problem 6-07 eBook Problem 6-07 The following are monthly percentage price changes for four market indexes. Month DJIA S&P Russell Nikkel 500 2000 1 0.04 0.02 0.04 0.04 2 0.08 0.07 0.11 -0.01 3 -0.03 -0.02 -0.05 0.08 0.02 0.03 0.03 0.01 5 0.05 0.04 0.12 0.01 6 -0.07 -0.05 -0.08 0.07 Compute the following a. Average monthly rate of return for each index, Round your answers to five decimal places. DIA:.02000 S&P 5001 02060 Russell 2000: .03667 Nikkel: .03500 b. Standard deviation for each index. Do not round intermediate calculations, Round your answers to four decimal places. DJIA: .0456 S&P 500: .0374 Russell 2000 0809 Nick: 0302 c. Covariance between the rates of return for the following indexes. Use a minus sign to enter negative values, Wany. Do not round Intermediate calculations. Ro Covariance (DNA, SSP 500).0014010 Covariance (S&P 500, Russell 2000) .00236 Covariance (56P 500, Nikkel) -0.0004 0 Covariance (Russell 2000, Nikkel): -0.0015 3 -0.03 -0.02 -0.05 0.06 4 0.02 0.03 0.03 0.01 5 0.05 0.04 0.12 0.01 6 -0.07 -0.05 -0.05 0.07 Compute the following Ang monthly rate of return for each index. Round your answers to five decimal places DIA! .02000 O SMP 500 .02000 Hus 20001 .03667 0 Bi 0390 b. Standard deviation for each index. Do not round intermediate calculations. Round your answers to four decimal places DIA 0456 0 55P 500: 0374 0 Russell 2000: 0509 Nike 0302 O c. Covariance between the rates of return for the following indexes: Use a minus sign to enter negative values, if any, Do not roundermediate calculations. Round your answers to si decimal places Covariance (OLA, SM 500.001401 O Covariance (SAP 500, Russell 2000): .002363 Covariance (S&P 500, NIE): -0.0000 0 Covariance (Russell 2000, N -0.0015 O d. The correlation coefficients for the same four combinations. Use to enter negative values, any. Do not round Intermediate calculations. Round your answers to four decimal places Correlation (DA, S&P 500) Correlation (SSP 500, Russell 2000) 9303 Cortion (55P 500, Nadiy -9037 0 Correlation (sell 2000, -.7702 using the unrounded answers from parts (a), (b), and (d), calculate the expected return and standard deviation of portfolio consisting of coul parts of (1) the SP and the Red 2000 and (2) the SAP and the Do round intermediate calculations, Round your answers to five decimal places Expected return (SAP 500 and Russell 2000): 0 Standard deviation (SAP 500 and Russell 2000): 03076 O Expected return (SAP 500 and Standard deviation SAP SD and Nick .00513 Since S&P 500 and Russell 2000 have a strong positive correlation, meaningful reduction in riskenet observed in they are combined SS500 and have a strong negative correlation, meaningful reduction is observed w they we came Partially Cered SVE Suomi Assignment for Grading aestions Problem 6-02 Question 3 of 15 Check My Work o eBook @ o O O . Problem 6-07 The following are monthly percentage price changes for four market indexes. Month DJIA S&P Russell Nikkel 500 2000 1 0.04 0.02 0.04 0.04 2 0.08 0.07 0.11 -0.01 3 -0.03 -0.02 -0.05 0.08 4 0.02 0.03 0.03 0.01 5 0.05 0.04 0.12 0.01 6 -0.07 -0.05 -0.08 0.07 Compute the following a. Average monthly rate of return for each index. Round your answers to five decimal places. DJIA: .02000 3 S&P 500: .02000 3 Russell 2000: .03667 Nikkel: .03500 b. Standard deviation for each index. Do not round intermediate calculations. Round your answers to four decimal places. DIA: .0456 3 S&P 500: .0374 Russell 2000: .0809 Nikkel: .0302 3 Covariance between the rates of return for the following indexes. Use a minus sign to enter negative values, if any. Do not round Intermediate calculations. Round your answers to six decimal places Covariance (DJIA, S&P 500): .001401 Covariance (S&P 500, Russell 2000): .00236: Covariance (S&P SOO, Nikkel): -0.0008 Covariance (Russell 2000, Nikkel): -0.0015 d. The correlation coefficients for the same four combinations. Use a minus sign to enter negative values, if any, Do not round intermediate calculations. Round your answers to four decimal places. Correlation (DJIA, S&P 500): .9845 Correlation (S&P 500, Russell 2000): .9381 sty .9381 Nikkel: .0302 c. Covariance between the rates of return for the following indexes. Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers to six decimal places. Covariance (DJIA, S&P 500): .001400 Covariance (S&P 500, Russell 2000): .00236; Covariance (S&P 500, Nikkel): -0.0008 * Covariance (Russell 2000, Nikkel): -0.0015 d. The correlation coefficients for the same four combinations. Use a minus sign to enter negative values, If any. Do not round Intermediate calculations. Round your answers to four decimal places. Correlation (DIA, S&P 500): .9845 Correlation (S&P 500, Russell 2000): Correlation (S&P 500, Nikkel): -9037 @ Correlation (Russell 2000, Nikkel): -7702 e. Using the unrounded answers from parts (a), (b), and (d), calculate the expected return and standard deviation of a portfolio consisting of equal parts of (1) the S&P and the Russell 2000 and (2) the S&P and the Nikkei. Do not round intermediate calculations. Round your answers to five decimal places. Expected return (S&P 500 and Russell 2000) Standard deviation (S&P 500 and Russell 2000): .03076 Expected return (S&P 500 and Nikkel): Standard deviation (S&P 500 and Nikkel): .00513 Since S&P 500 and Russell 2000 have a strong positive correlation, meaningful reduction in risk is not observed if they are combined. Since S&P 500 and Nikkel have a strong negative correlation, meaningful reduction in risk is observed if they are combined. Slide Feedback Partially Correct Check My Work -- Icon Key Problem 6-07 Question 3 of 15 Save Submit Assignment for Grading 27 sty W