Answered step by step

Verified Expert Solution

Question

1 Approved Answer

00 On October 31, 2024, the bank statement for the cash account of Bellevue Incorporated shows a balance of $12,694, while the company's records

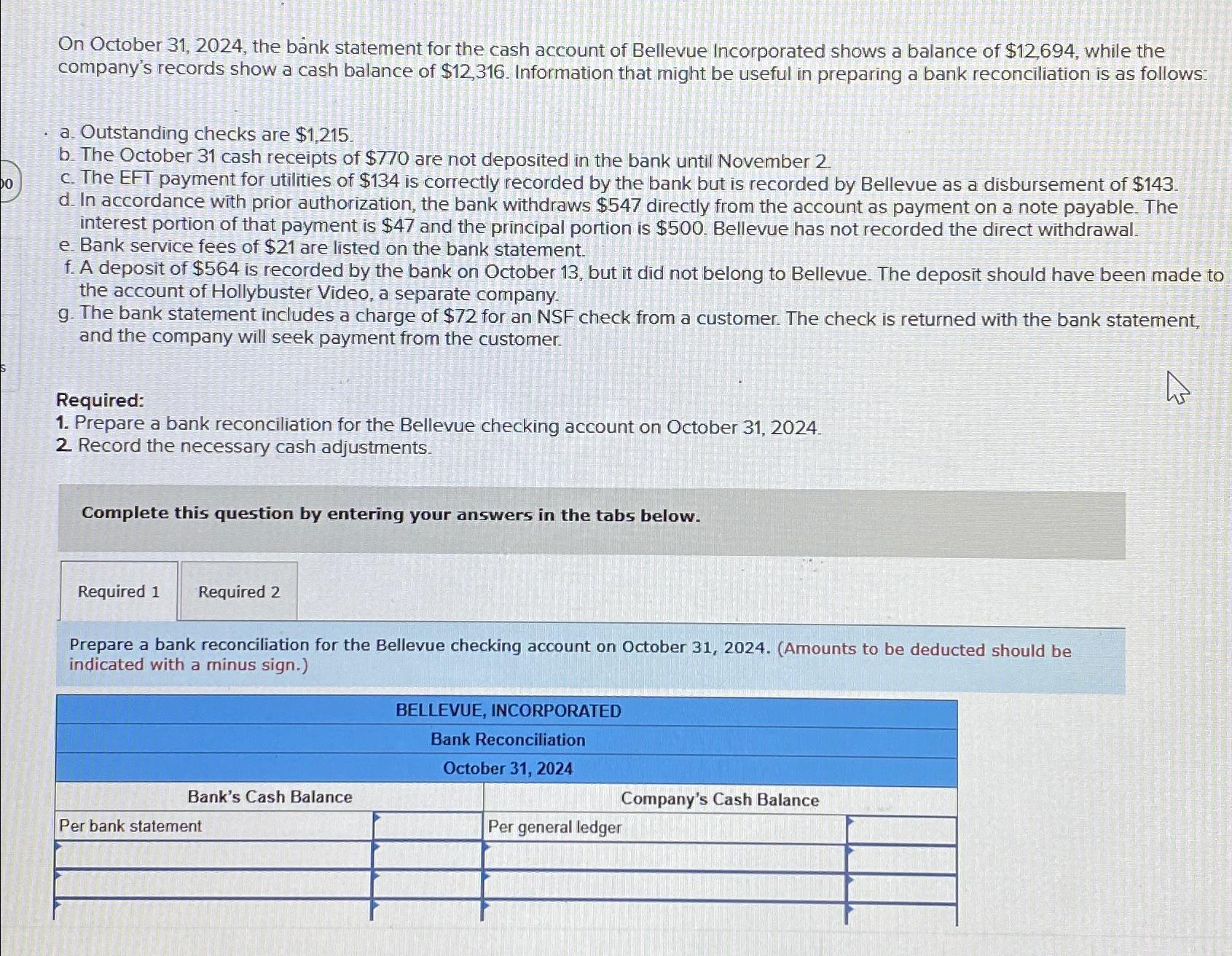

00 On October 31, 2024, the bank statement for the cash account of Bellevue Incorporated shows a balance of $12,694, while the company's records show a cash balance of $12,316. Information that might be useful in preparing a bank reconciliation is as follows: a. Outstanding checks are $1,215. b. The October 31 cash receipts of $770 are not deposited in the bank until November 2 c. The EFT payment for utilities of $134 is correctly recorded by the bank but is recorded by Bellevue as a disbursement of $143. d. In accordance with prior authorization, the bank withdraws $547 directly from the account as payment on a note payable. The interest portion of that payment is $47 and the principal portion is $500. Bellevue has not recorded the direct withdrawal. e. Bank service fees of $21 are listed on the bank statement. f. A deposit of $564 is recorded by the bank on October 13, but it did not belong to Bellevue. The deposit should have been made to the account of Hollybuster Video, a separate company. g. The bank statement includes a charge of $72 for an NSF check from a customer. The check is returned with the bank statement, and the company will seek payment from the customer. Required: 1. Prepare a bank reconciliation for the Bellevue checking account on October 31, 2024. 2. Record the necessary cash adjustments. Complete this question by entering your answers in the tabs below. W Required 1 Required 2 Prepare a bank reconciliation for the Bellevue checking account on October 31, 2024. (Amounts to be deducted should be indicated with a minus sign.) Bank's Cash Balance Per bank statement BELLEVUE, INCORPORATED Bank Reconciliation October 31, 2024 Per general ledger Company's Cash Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started