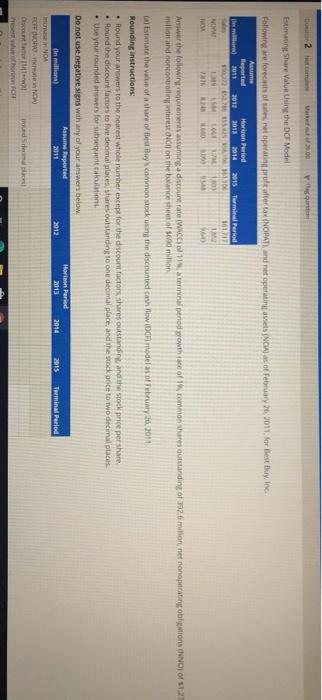

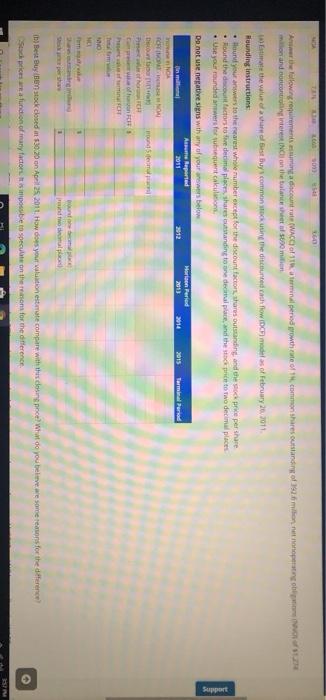

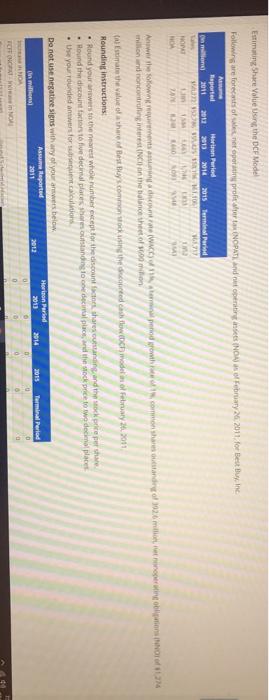

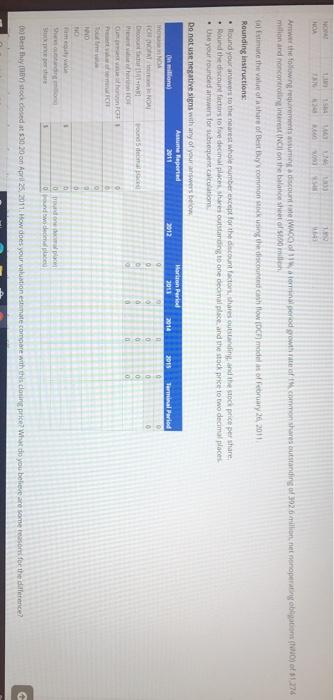

000 Estimating Share Value Using the DCF Model Following forecasts are operater tax (NOPATI et operatives Ns of Feb, 2011. for Best Buy Anime leported Horton Period 2011 2012 2013 2014 2015 Terminal Period 500 16121 MA 16 Awww the following requires adscorra ACC terperiod wowth of tomontanding of 1926 milion net nonopen obligations (NNOT of 1127 million and noncontrolling is on the sheet of sodio Estimate the value of the common stock using the discounted cavillow and softebrany 26 2011 Rounding instructions: . Found your answers to the nearest whole ruher except for the discount factors shares outstanding and the stock pricepershare Round the discount factors to five decimal places, share outstanding to one dental place and the stock ode to two decimal places Use your rounded answers for subsections Harian Period 2013 2012 2014 2015 Terminal Period Do not use negative signs with any of your answers below. Asume Reported in million 2011 non NOA FCFF OF NON Discount frorden who con Aeollowing requirements contrat (WACC) na pred growth rate of common shares outstanding of 20 milion tongo milion and concorsi on the balance of milion Estimate the valur cest buy common to using the discounted how (as of February 20,2011 Rounding instructions Hourul your answers to the rest whole number except for the discount factors are outstanding and there pershare Round the coulit factors to five decimal places, shares outstanding to a decimal place and the stock price to two decimal places Use your rounded wwers for sequent cake Support Horien Feried 2013 2014 Terminal Punto Do not use negative signs with any of your rowers below Are Reported mi 2011 CA CON dem CHE 0 b) Best Buy on stock closed in 53020 on April 25, 2011. How do you toestate compare with this casino What do you believe are some reasons for the deference Stapic weatunction of many factoribe to speculate on the tons for the difference Estimating Share Value Using the DCF Model Following are forecasts of the operating profiter (NOPAT) and het operating Is February 24, 2011. for Best Buy Inc Reports Hari Period 2011 2011 2013 2014 2015 terminal Puri WWW.10 NO Awe fotowing companied growth common shares of 1926 mengering milion and controlling interest on the balance sheet of 60 milion Estimate the value of the Best Buys.com cored a low och models of February 21, 2011 Rounding instructions Round your awers to the nearest whole aber eccept for the discount for the cutting and the stock pricepers . Hound the discount factors to five decimal places shoutstanding one place and the Mock price to two decimal place Use your rounded answers for sunt calculations Do not use negative signs with any of your answers below Assume Reported Horizon Period on mins 2011 2012 2013 2014 2015 Terminal Period NOA CONNOR Anwer the town of contemporodowhite of common shares outstanding of 3026 million operating on 1276 milion and controlling in on the balance sheet of me Estimate the value of the of Best Buy common stock using the discounted how model of February 26 2011 Rounding instructions: Round your answer to the nearest whole number except for the count factor shares outstanding and the stock price per share Round the discount factors to five decimal place shares og tone deal place and the stock price to two decimal places Use your rounded awwers for subsequent calculations Do not use negative signs with any of your answers Am Reported On millons) 2011 mon RATNO Dr! und den Marisan Period 2011 2012 2014 2015 Terminal Period 0 0 0 horn PERCHE 2 NO HO um Shando STED Donde Dund decide Co Besty stock closed at $30 20 on April 25, 2011. How does your valuation estimate compare with this dos price? Wat do you believe are some reason for the difference? 000 Estimating Share Value Using the DCF Model Following forecasts are operater tax (NOPATI et operatives Ns of Feb, 2011. for Best Buy Anime leported Horton Period 2011 2012 2013 2014 2015 Terminal Period 500 16121 MA 16 Awww the following requires adscorra ACC terperiod wowth of tomontanding of 1926 milion net nonopen obligations (NNOT of 1127 million and noncontrolling is on the sheet of sodio Estimate the value of the common stock using the discounted cavillow and softebrany 26 2011 Rounding instructions: . Found your answers to the nearest whole ruher except for the discount factors shares outstanding and the stock pricepershare Round the discount factors to five decimal places, share outstanding to one dental place and the stock ode to two decimal places Use your rounded answers for subsections Harian Period 2013 2012 2014 2015 Terminal Period Do not use negative signs with any of your answers below. Asume Reported in million 2011 non NOA FCFF OF NON Discount frorden who con Aeollowing requirements contrat (WACC) na pred growth rate of common shares outstanding of 20 milion tongo milion and concorsi on the balance of milion Estimate the valur cest buy common to using the discounted how (as of February 20,2011 Rounding instructions Hourul your answers to the rest whole number except for the discount factors are outstanding and there pershare Round the coulit factors to five decimal places, shares outstanding to a decimal place and the stock price to two decimal places Use your rounded wwers for sequent cake Support Horien Feried 2013 2014 Terminal Punto Do not use negative signs with any of your rowers below Are Reported mi 2011 CA CON dem CHE 0 b) Best Buy on stock closed in 53020 on April 25, 2011. How do you toestate compare with this casino What do you believe are some reasons for the deference Stapic weatunction of many factoribe to speculate on the tons for the difference Estimating Share Value Using the DCF Model Following are forecasts of the operating profiter (NOPAT) and het operating Is February 24, 2011. for Best Buy Inc Reports Hari Period 2011 2011 2013 2014 2015 terminal Puri WWW.10 NO Awe fotowing companied growth common shares of 1926 mengering milion and controlling interest on the balance sheet of 60 milion Estimate the value of the Best Buys.com cored a low och models of February 21, 2011 Rounding instructions Round your awers to the nearest whole aber eccept for the discount for the cutting and the stock pricepers . Hound the discount factors to five decimal places shoutstanding one place and the Mock price to two decimal place Use your rounded answers for sunt calculations Do not use negative signs with any of your answers below Assume Reported Horizon Period on mins 2011 2012 2013 2014 2015 Terminal Period NOA CONNOR Anwer the town of contemporodowhite of common shares outstanding of 3026 million operating on 1276 milion and controlling in on the balance sheet of me Estimate the value of the of Best Buy common stock using the discounted how model of February 26 2011 Rounding instructions: Round your answer to the nearest whole number except for the count factor shares outstanding and the stock price per share Round the discount factors to five decimal place shares og tone deal place and the stock price to two decimal places Use your rounded awwers for subsequent calculations Do not use negative signs with any of your answers Am Reported On millons) 2011 mon RATNO Dr! und den Marisan Period 2011 2012 2014 2015 Terminal Period 0 0 0 horn PERCHE 2 NO HO um Shando STED Donde Dund decide Co Besty stock closed at $30 20 on April 25, 2011. How does your valuation estimate compare with this dos price? Wat do you believe are some reason for the difference