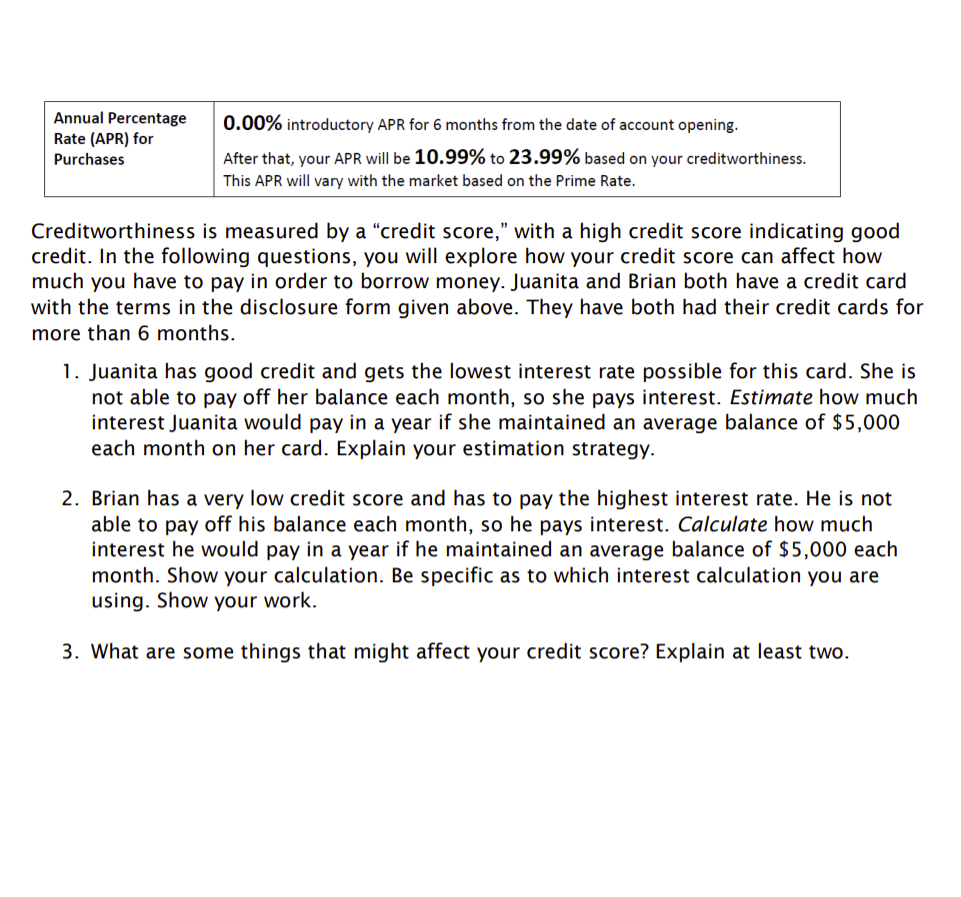

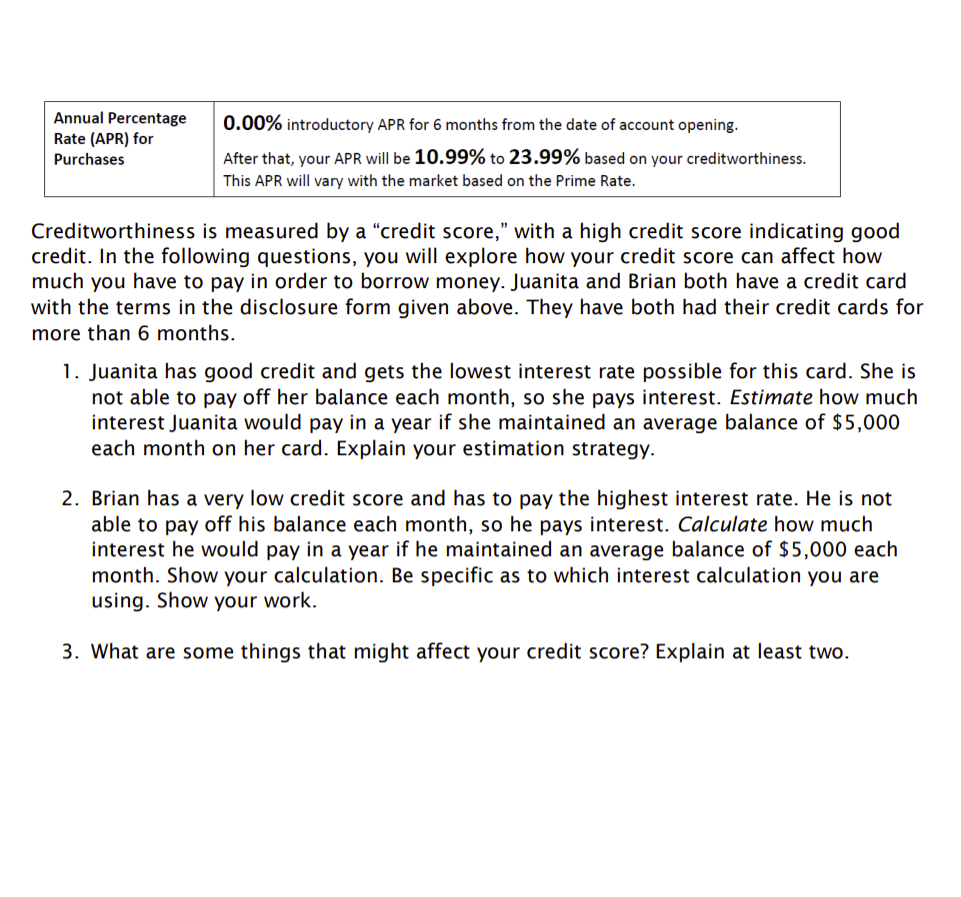

0.00% introductory APR for 6 months from the date of account opening. Annual Percentage Rate (APR) for Purchases After that, your APR will be 10.99% to 23.99% based on your creditworthiness. This APR will vary with the market based on the Prime Rate. Creditworthiness is measured by a "credit score," with a high credit score indicating good credit. In the following questions, you will explore how your credit score can affect how much you have to pay in order to borrow money. Juanita and Brian both have a credit card with the terms in the disclosure form given above. They have both had their credit cards for more than 6 months. 1. Juanita has good credit and gets the lowest interest rate possible for this card. She is not able to pay off her balance each month, so she pays interest. Estimate how much interest Juanita would pay in a year if she maintained an average balance of $5,000 each month on her card. Explain your estimation strategy. 2. Brian has a very low credit score and has to pay the highest interest rate. He is not able to pay off his balance each month, so he pays interest. Calculate how much interest he would pay in a year if he maintained an average balance of $5,000 each month. Show your calculation. Be specific as to which interest calculation you are using. Show your work. 3. What are some things that might affect your credit score? Explain at least two. 0.00% introductory APR for 6 months from the date of account opening. Annual Percentage Rate (APR) for Purchases After that, your APR will be 10.99% to 23.99% based on your creditworthiness. This APR will vary with the market based on the Prime Rate. Creditworthiness is measured by a "credit score," with a high credit score indicating good credit. In the following questions, you will explore how your credit score can affect how much you have to pay in order to borrow money. Juanita and Brian both have a credit card with the terms in the disclosure form given above. They have both had their credit cards for more than 6 months. 1. Juanita has good credit and gets the lowest interest rate possible for this card. She is not able to pay off her balance each month, so she pays interest. Estimate how much interest Juanita would pay in a year if she maintained an average balance of $5,000 each month on her card. Explain your estimation strategy. 2. Brian has a very low credit score and has to pay the highest interest rate. He is not able to pay off his balance each month, so he pays interest. Calculate how much interest he would pay in a year if he maintained an average balance of $5,000 each month. Show your calculation. Be specific as to which interest calculation you are using. Show your work. 3. What are some things that might affect your credit score? Explain at least two