Answered step by step

Verified Expert Solution

Question

1 Approved Answer

0.00% Problem 8-17 (Value of Operations) Save Submit Assignment for Grading Question 11 of 13 Check My Work eBook Problem Walk-Through Value of Operations Kendra

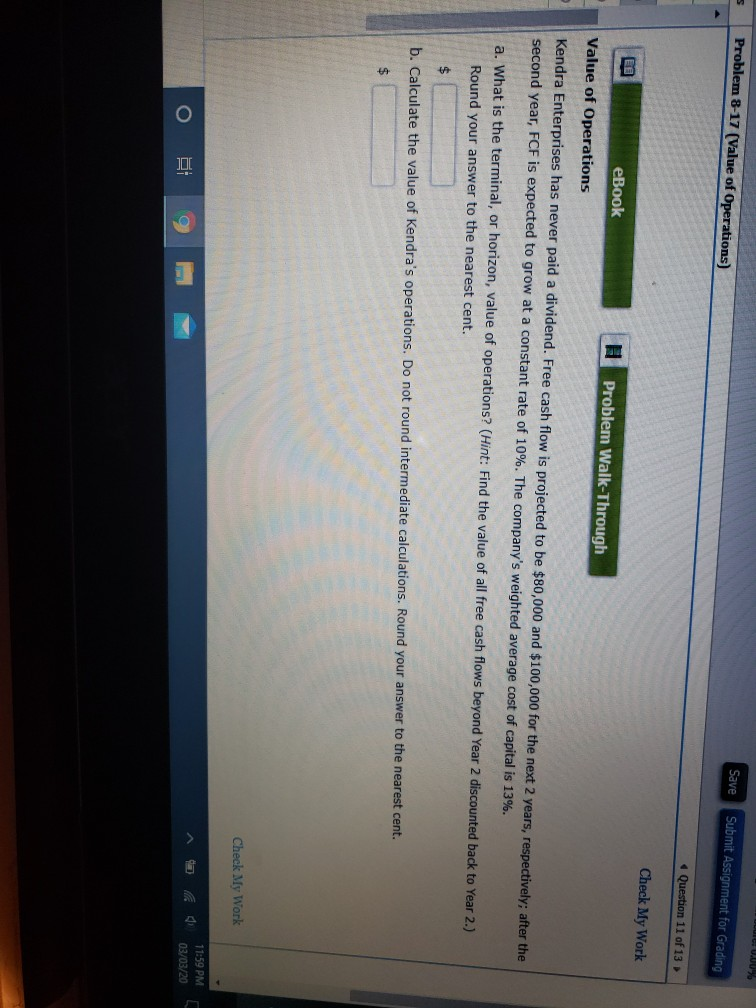

0.00% Problem 8-17 (Value of Operations) Save Submit Assignment for Grading Question 11 of 13 Check My Work eBook Problem Walk-Through Value of Operations Kendra Enterprises has never paid a dividend. Free cash flow is projected to be $80,000 and $100,000 for the next 2 years, respectively; after the second year, FCF is expected to grow at a constant rate of 10%. The company's weighted average cost of capital is 13%. a. What is the terminal, or horizon, value of operations? (Hint: Find the value of all free cash flows beyond Year 2 discounted back to Year 2.) Round your answer to the nearest cent. b. Calculate the value of Kendra's operations. Do not round intermediate calculations. Round your answer to the nearest cent. Check My Work 11:59 PM 03/03/20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started