Answered step by step

Verified Expert Solution

Question

1 Approved Answer

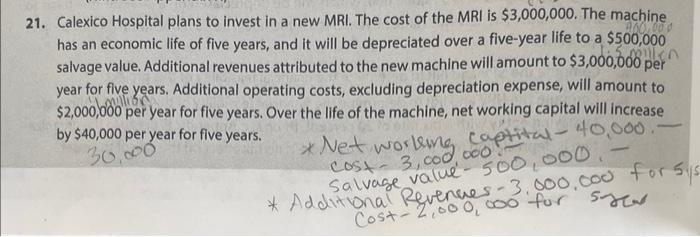

00,000 21. Calexico Hospital plans to invest in a new MRI. The cost of the MRI is $3,000,000. The machine. has an economic life

00,000 21. Calexico Hospital plans to invest in a new MRI. The cost of the MRI is $3,000,000. The machine. has an economic life of five years, and it will be depreciated over a five-year life to a $500,000 Len salvage value. Additional revenues attributed to the new machine will amount to $3,000,000 per year for five years. Additional operating costs, excluding depreciation expense, will amount to bhavillion $2,000,000 per year for five years. Over the life of the machine, net working capital will increase by $40,000 per year for five years. 30,000 * Net working captital - 40,000.- * Additional Rev3.000.cod for sys Salvage value- 500,000.- Cost-2,000,000 for sy net present value REVIEW QUESTIONS AND PROBLEMS 333 a. Assuming that the hospital is a non-taxpaying entity, what is the project's NPV at a discount rate of 8 percent, and what is the project's IRR? Is the decision to accept or reject the same under either capital budgeting method, or does it differ? b. Assuming that the hospital is a taxpaying entity and its tax rate is 30 percent, what is the project's NPV at a cost of capital of 8 percent, and what is the project's IRR? Is the decision to accept or reject the same under either capital budgeting method, or does it differ? (Hint: see Appendices C, D, and E.) itor decided

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV and internal rate of return IRR of the project we need to analyze the cash flows associated with the investment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started