Question

(01) The new CEO of your company asks for 2 million dollars as annual income. Your company considers 3 alternatives; A (fixed salary of 2

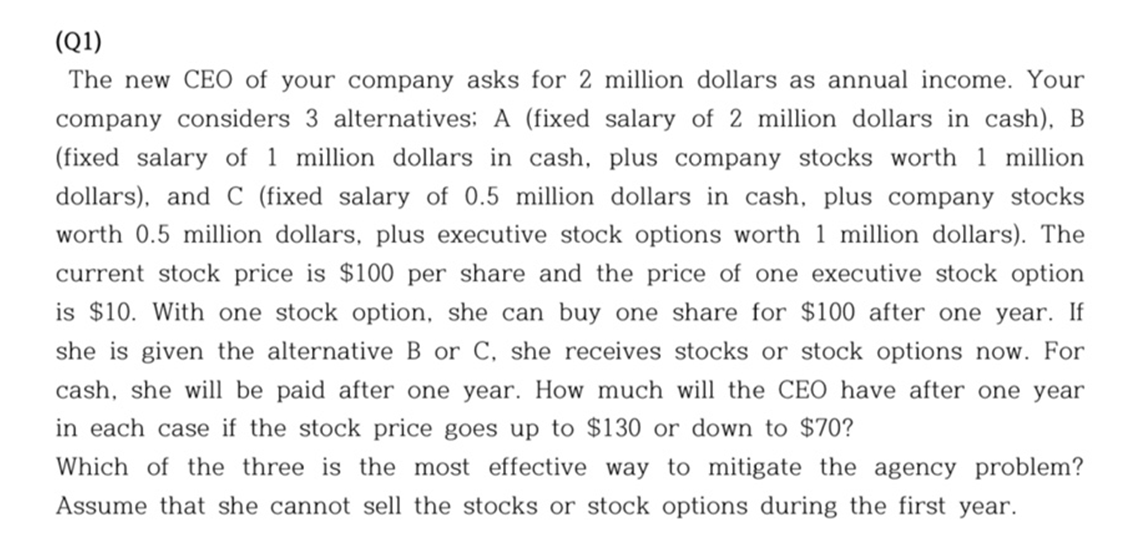

(01) The new CEO of your company asks for 2 million dollars as annual income. Your company considers 3 alternatives; A (fixed salary of 2 million dollars in cash), B (fixed salary of 1 million dollars in cash, plus company stocks worth 1 million dollars), and C (fixed salary of 0.5 million dollars in cash, plus company stocks worth 0.5 million dollars, plus executive stock options worth 1 million dollars). The current stock price is $100 per share and the price of one executive stock option is $10. With one stock option, she can buy one share for $100 after one year. If she is given the alternative B or C, she receives stocks or stock options now. For cash, she will be paid after one year. How much will the CEO have after one year in each case if the stock price goes up to $130 or down to $70? Which of the three is the most effective way to mitigate the agency problem? Assume that she cannot sell the stocks or stock options during the first year.

The new CEO of your company asks for 2 million dollars as annual income. Your company considers 3 alternatives; A (fixed salary of 2 million dollars in cash), B (fixed salary of 1 million dollars in cash, plus company stocks worth 1 million dollars), and C (fixed salary of 0.5 million dollars in cash, plus company stocks worth 0.5 million dollars, plus executive stock options worth 1 million dollars). The current stock price is $100 per share and the price of one executive stock option is $10. With one stock option, she can buy one share for $100 after one year. If she is given the alternative B or C, she receives stocks or stock options now. For cash, she will be paid after one year. How much will the CEO have after one year in each case if the stock price goes up to $130 or down to $70 ? Which of the three is the most effective way to mitigate the agency problem? Assume that she cannot sell the stocks or stock options during the first yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started