Answered step by step

Verified Expert Solution

Question

1 Approved Answer

01 to 9t61 Isunns as to noitsiosiqob ot tosidua zi inslg od 005.214 On the 1st of July 2022, Savannah Inc. underwent an acquisition process

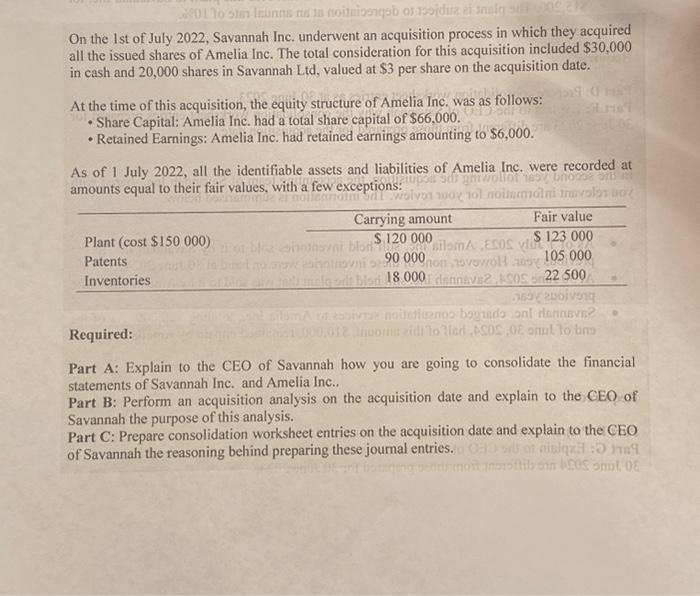

01 to 9t61 Isunns as to noitsiosiqob ot tosidua zi inslg od 005.214 On the 1st of July 2022, Savannah Inc. underwent an acquisition process in which they acquired all the issued shares of Amelia Inc. The total consideration for this acquisition included $30,000 in cash and 20,000 shares in Savannah Ltd, valued at $3 per share on the acquisition date. At the time of this acquisition, the equity structure of Amelia Inc. was as follows: rij of Share Capital: Amelia Inc. had a total share capital of $66,000. Retained Earnings: Amelia Inc. had retained earnings amounting to $6,000. Morni STA :0 As of 1 July 2022, all the identifiable assets and liabilities of Amelia Inc. were recorded at amounts equal to their fair values, with a a few exceptions: upon se smwolle 1997 brocorded minue al noisemoim onl weive1 100 101 noilsmotni involo1 DOY Plant (cost $150 000) Patents Inventories Carrying amount Fair value #101 blog esinomnevni blant $120 000 silsmA ESOS vlit 10 is beter no onow eononovni sa90 000non 19vowol asoy $ 123 000 105.000 22 500 e bloc es ferli malgodt blod 18 0001 dennevs2.ASOS on 2 1 2 gadino! ont sitomA of essiv192 noitetluanoo bogdood dennevB2 temen 000,012 anvors aid to 1sd ASOS 08 onul to bas Required: Part A: Explain to the CEO of Savannah how you are going to consolidate the financial statements of Savannah Inc. and Amelia Inc.. Part B: Perform an acquisition analysis on the acquisition date and explain to the CEO of Savannah the purpose of this analysis. Part C: Prepare consolidation worksheet entries on the acquisition date and explain to the CEO of Savannah the reasoning behind preparing these journal entries. 030 tot nisiqx: moit moisflib o PSOS onut OE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started