Answered step by step

Verified Expert Solution

Question

1 Approved Answer

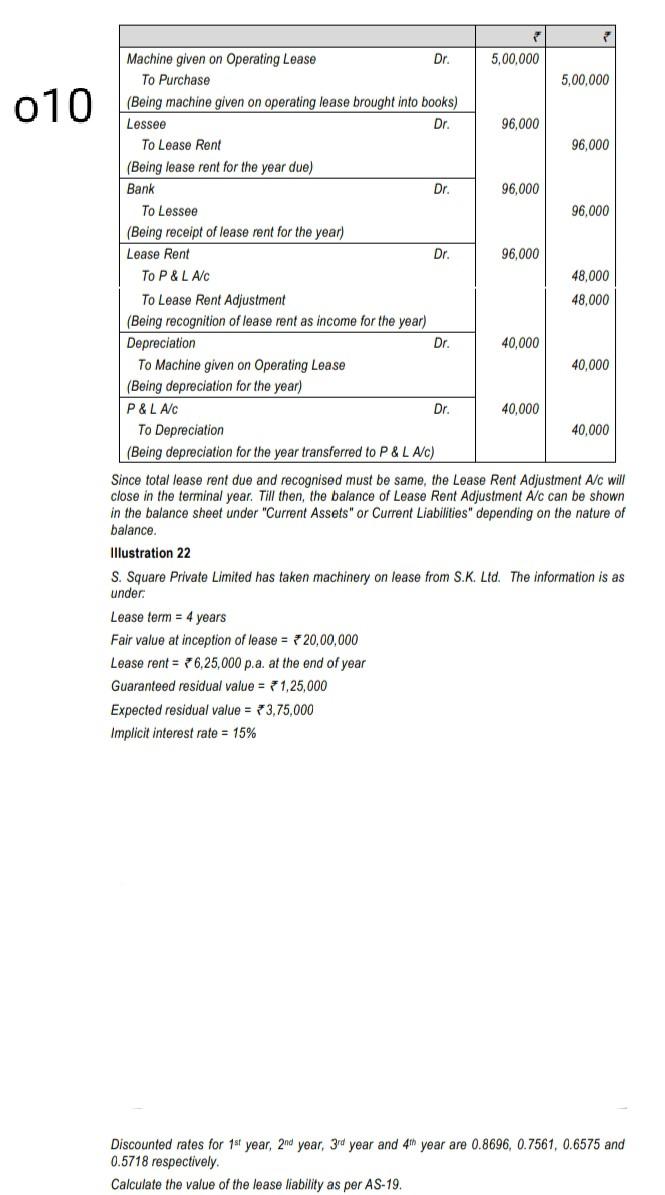

010 Dr. Machine given on Operating Lease Dr. 5,00,000 To Purchase 5,00,000 (Being machine given on operating lease brought into books) Lessee Dr. 96,000 To

010 Dr. Machine given on Operating Lease Dr. 5,00,000 To Purchase 5,00,000 (Being machine given on operating lease brought into books) Lessee Dr. 96,000 To Lease Rent 96,000 (Being lease rent for the year due) Bank Dr. 96,000 To Lessee 96,000 (Being receipt of lease rent for the year) Lease Rent 96,000 To P & L A/C 48,000 To Lease Rent Adjustment 48,000 (Being recognition of lease rent as income for the year) Depreciation Dr. 40,000 To Machine given on Operating Lease 40,000 (Being depreciation for the year) P&L A/C Dr. 40,000 To Depreciation 40,000 (Being depreciation for the year transferred to P & L A/C) Since total lease rent due and recognised must be same, the Lease Rent Adjustment A/c will close in the terminal year. Till then, the balance of Lease Rent Adjustment A/c can be shown in the balance sheet under "Current Assets" or Current Liabilities" depending on the nature of balance. Illustration 22 S. Square Private Limited has taken machinery on lease from S.K. Ltd. The information is as under Lease term = 4 years Fair value at inception of lease = 720,00,000 Lease rent = 76,25,000 p.a. at the end of year Guaranteed residual value = 1,25,000 Expected residual value = 73.75,000 Implicit interest rate = 15% Discounted rates for 1st year, 2nd year, 3rd year and 4th year are 0.8696, 0.7561, 0.6575 and 0.5718 respectively. Calculate the value of the lease liability as per AS-19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started