Question

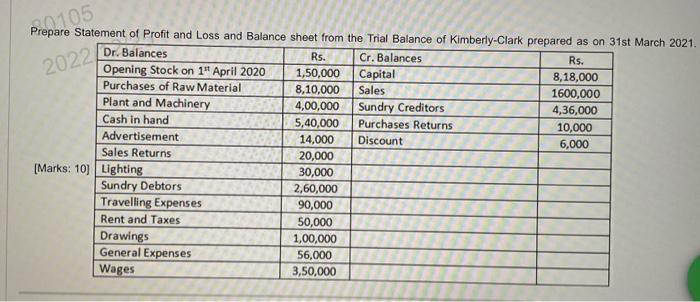

0105 Prepare Statement of Profit and Loss and Balance sheet from the Trial Balance of Kimberly-Clark prepared as on 31st March 2021. Dr. Balances

0105 Prepare Statement of Profit and Loss and Balance sheet from the Trial Balance of Kimberly-Clark prepared as on 31st March 2021. Dr. Balances 2022 Rs. 8,18,000 1600,000 4,36,000 10,000 6,000 Opening Stock on 1 April 2020 Purchases of Raw Material Plant and Machinery Cash in hand Advertisement Sales Returns [Marks: 10] Lighting Sundry Debtors Travelling Expenses Rent and Taxes Drawings General Expenses Wages Rs. 1,50,000 8,10,000 4,00,000 Sundry Creditors 5,40,000 Purchases Returns 14,000 Discount 20,000 30,000 2,60,000 Cr. Balances Capital Sales 90,000 50,000 1,00,000 56,000 3,50,000

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

31 Dr Particulare KimberlyClark Profit Lowe Alc 31st March 2021 31st March 2021 Amount ope...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Practical Approach

Authors: Jeffrey Slater

12th edition

978-0132772068, 133468100, 013277206X, 9780133468106, 978-0133133233

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App