Answered step by step

Verified Expert Solution

Question

1 Approved Answer

01/24/2019 Answered I adjusted trial balance of S.. 22 minutes later MacBook Pro 1. John (who is single) had the following transactions in stock on

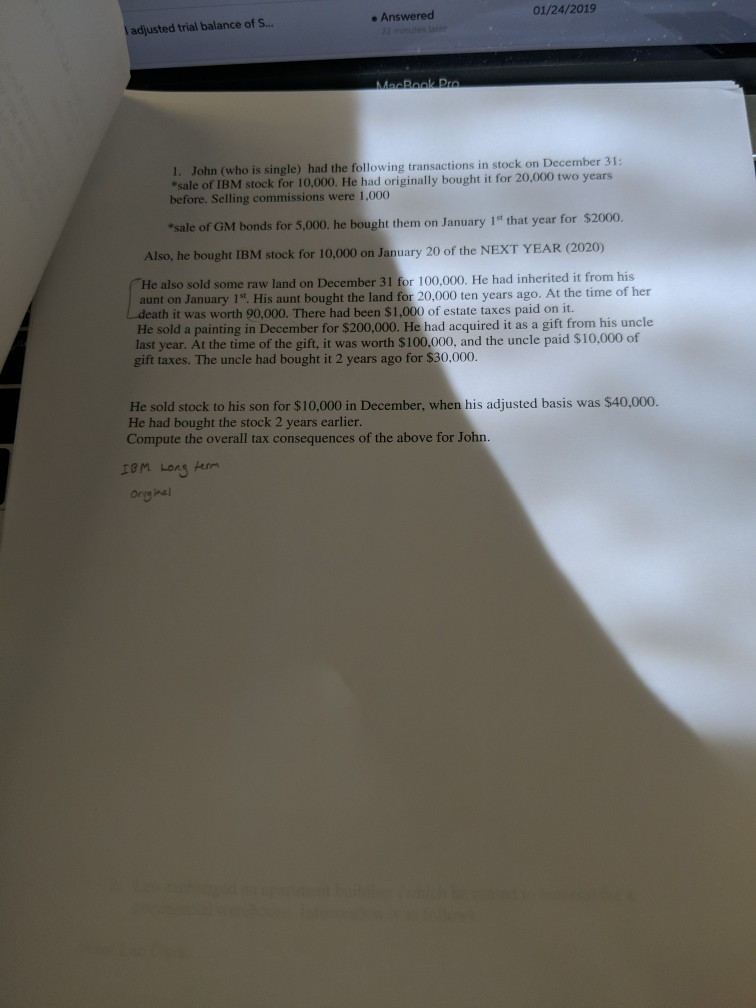

01/24/2019 Answered I adjusted trial balance of S.. 22 minutes later MacBook Pro 1. John (who is single) had the following transactions in stock on December 31: "sale of IBM stock for 10,000. He had originally bought it for 20,000 two years before. Selling commissions were 1,000 sale of GM bonds for 5,000. he bought them on January 1st that year for $2000. Also, he bought IBM stock for 10,000 on January 20 of the NEXT YEAR (2020) He also sold some raw land on December 31 for 100,000. He had inherited it from his aunt on January 1st. His aunt bought the land for 20,000 ten years ago. At the time of her death it was worth 90,000. There had been $1,000 of estate taxes paid on it. He sold a painting in December for $200,000. He had acquired it as a gift from his uncle last year. At the time of the gift, it was worth $100,000, and the uncle paid $10,000 of gift taxes. The uncle had bought it 2 years ago for $30,000. He sold stock to his son for $10,000 in December, when his adjusted basis was $40,000. He had bought the stock 2 years earlier. Compute the overall tax consequences of the above for John. Orginal 01/24/2019 Answered I adjusted trial balance of S.. 22 minutes later MacBook Pro 1. John (who is single) had the following transactions in stock on December 31: "sale of IBM stock for 10,000. He had originally bought it for 20,000 two years before. Selling commissions were 1,000 sale of GM bonds for 5,000. he bought them on January 1st that year for $2000. Also, he bought IBM stock for 10,000 on January 20 of the NEXT YEAR (2020) He also sold some raw land on December 31 for 100,000. He had inherited it from his aunt on January 1st. His aunt bought the land for 20,000 ten years ago. At the time of her death it was worth 90,000. There had been $1,000 of estate taxes paid on it. He sold a painting in December for $200,000. He had acquired it as a gift from his uncle last year. At the time of the gift, it was worth $100,000, and the uncle paid $10,000 of gift taxes. The uncle had bought it 2 years ago for $30,000. He sold stock to his son for $10,000 in December, when his adjusted basis was $40,000. He had bought the stock 2 years earlier. Compute the overall tax consequences of the above for John. Orginal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started