Question

0)/(15 3.41 9013 11, 19 7,900 8 I Below are summary cash flow statement for three roughly equal-sized companies. (#25) A B C Operating

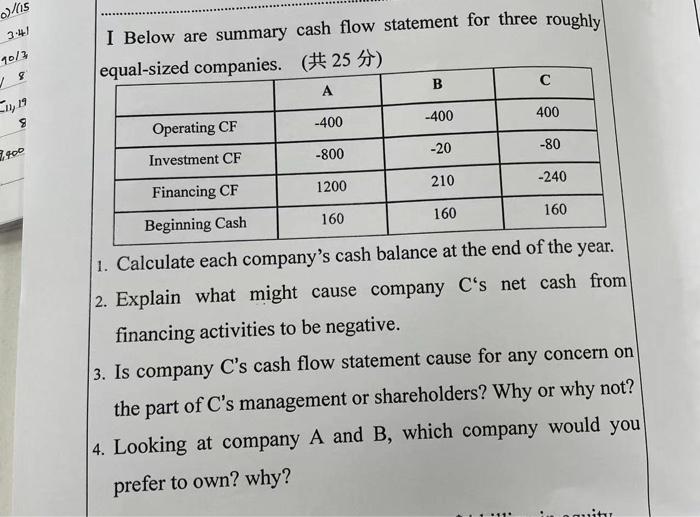

0)/(15 3.41 9013 11, 19 7,900 8 I Below are summary cash flow statement for three roughly equal-sized companies. (#25) A B C Operating CF -400 -400 400 Investment CF -800 -20 -80 Financing CF 1200 210 -240 Beginning Cash 160 160 160 1. Calculate each company's cash balance at the end of the year. 2. Explain what might cause company C's net cash from financing activities to be negative. 3. Is company C's cash flow statement cause for any concern on the part of C's management or shareholders? Why or why not? 4. Looking at company A and B, which company would you prefer to own? why?

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate each companys cash balance at the end of the year Company A Beginning Cash Operating CF ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Analysis for Financial Management

Authors: Robert Higgins

11th edition

77861787, 978-0077861780

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App