Answered step by step

Verified Expert Solution

Question

1 Approved Answer

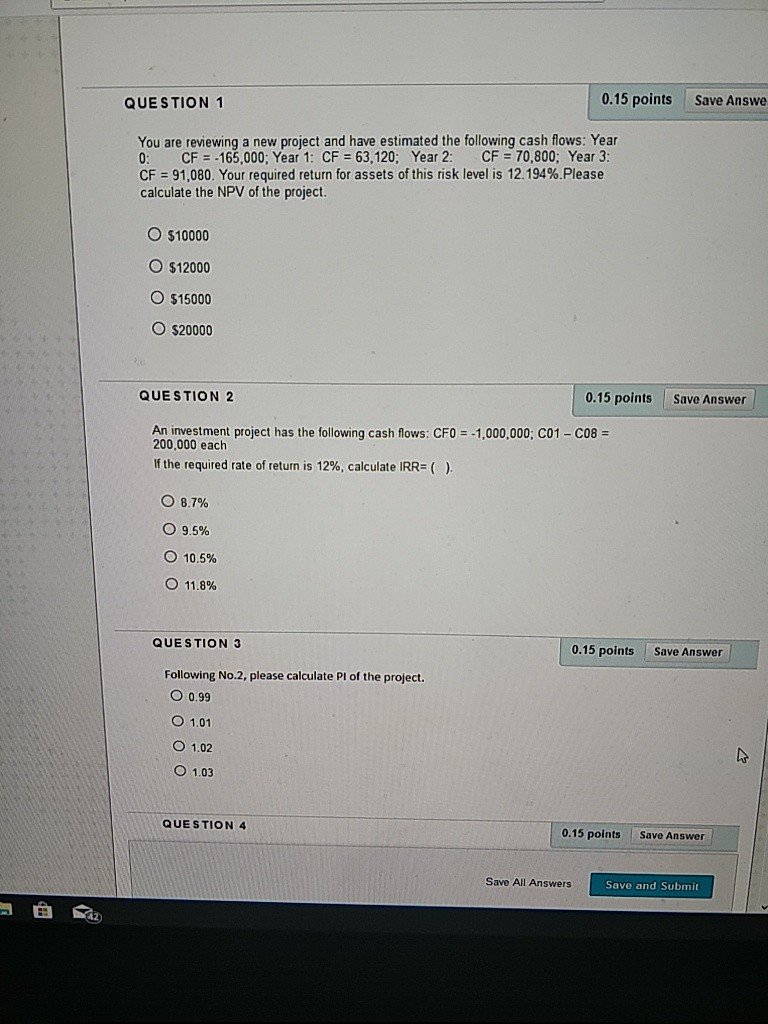

0.15 points Save Answe QUESTION 1 You are reviewing a new project and have estimated the following cash flows: Year 0: CF =-165,000, Year 1:

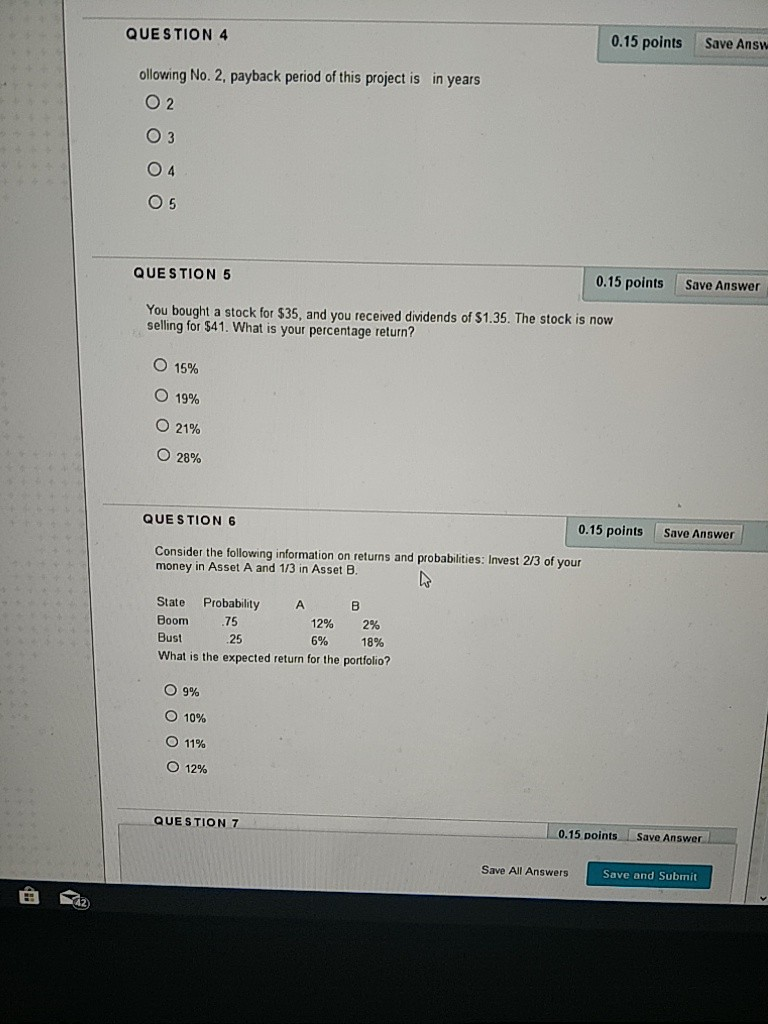

0.15 points Save Answe QUESTION 1 You are reviewing a new project and have estimated the following cash flows: Year 0: CF =-165,000, Year 1: CF-63120, Year 2: CF : 70,800, Year 3: CF = 91,080. Your required return for assets of this risk level is 12.19496. Please calculate the NPV of the project O $10000 O $12000 O $15000 o $20000 0.15 points Save Answer QUESTION 2 An investment project has the following cash flows: CF0 =-1,000,000: C01-C08 200,000 each lf the required rate of return is 12%, calculate IRRs ( ). 8.7% o 9.5% 10.5% o 11.8% QUESTION 3 0.15 points Save Answer Following No.2, please calculate PI of the project. O 0.99 O 1.01 O 1.02 103 QUES TION 4 0.15 points Save Answer Save All Answers Save and Submit 0.15 points Save Answ QUESTION 4 in years ollowing No. 2, payback period of this project is O 2 03 O 4 O 5 0.15 points Save Answer QUESTION 5 You bought a stock for $35, and you received dividends of $1.35. The stock is now selling for $41. What is your percentage return? O 15% O 19% O 21% o 28% 0.15 points Save Answer QUES TION 6 Consider the following information on returns and probabilities: Invest 2/3 of your money in Asset A and 1/3 in Asset B. State Probability A Boom 75 Bust What is the expected return for the portfolio? 12% 6% 2% 18% .25 996 O 10% O 11% 12% QUE S TION 7 0.15 points Save Answer Save All Answers Save and Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started